₹13,500 Crore Jet Deal

- 13th December 2024

Aaj Ka Bazaar

Wall Street indices closed mostly higher, with the S&P 500 gaining 0.82% and the Nasdaq Composite surging 1.77% to hit the 20,000 mark for the first time. The rally in tech stocks, driven by hopes of looser regulations under Donald Trump’s presidency and optimism around AI-driven earnings growth in the coming quarters, showed no signs of slowing. However, the Dow Jones edged down by 0.22%. These movements were supported by the US inflation report, which solidified expectations of a Federal Reserve rate cut next week. Asian markets largely tracked the gains from the US markets, closing in positive territory. Japan’s Nikkei rose by 1.5%, while Hong Kong’s Hang Seng and China’s CSI 300 added 0.12% and 0.14%, respectively. Indian benchmark indices are expected to open on a muted note but may gain momentum and turn positive, reflecting the global cues. In stock-specific news, ACME Solar Holdings secured the 250 MW FDRE Project W Firm and Dispatchable Renewable Energy in an e-reverse auction conducted by NHPC at a Rs. 4.56 per unit tariff. Additionally, a greenshoe option could potentially double the project’s capacity to 500 MW, increasing ACME Solar’s total capacity to 6,970 MW.

Markets Around Us

BSE Sensex –80,966.46 (-0.40%)

Nifty 50 – 24,495.10 (-0.22%)

Bank Nifty – 53,139.60 (-0.14%)

Dow Jones – 43,871.29 (-0.10%)

Nasdaq – 19,915.98 (-0.59%)

FTSE – 8,311.76 (0.12%)

Nikkei 225 – 39,394.86 (-1.14%)

Hang Seng – 20,079.46 (-1.54%)

Sector: Aerospace & Defence

HAL Signs Deal for Sukhoi Jets

Hindustan Aeronautics Ltd. (HAL) shares are in focus after signing a ₹13,500 crore deal with the Ministry of Defence to deliver 12 advanced Su-30MKI jets. These jets will include 62.6% locally sourced components, bolstering India’s self-reliance in defense. The aircraft, to be built at HAL’s Nasik division, will enhance the Indian Air Force’s operational capability. HAL has already secured ₹40,000 crore in manufacturing orders this year, and analysts expect further defense contracts in Q4FY25, making it a key player in India’s defense sector.

Why it Matters:

This deal emphasizes India’s push for self-reliance in defense through indigenous manufacturing. It strengthens the Indian Air Force’s capabilities while showcasing HAL’s growing role in securing major defense contracts. Analysts predict more orders, solidifying HAL’s importance in the sector.

NIFTY 50 GAINERS

HINDUNILVR – 2353.65 (0.37%)

NESTLEIND – 2231.60 (0.34%)

ADANIENT – 2512.55 (0.34%)

NIFTY 50 LOSERS

JSWSTEEL – 981.55 (-2.41%)

TATASTEEL – 147.34 (-2.28%)

SHRIRAMFIN – 3187.85 (-1.85%)

Sector: Financial Services

CRISIL Gains on Strategic Investments

CRISIL shares are likely to rise further on December 14 after its board approved a ₹33.25 crore investment to acquire a 4.08% stake in Online PSB Loans. This deal aims to enhance CRISIL’s market presence by supporting fintech-driven loan platforms. The acquisition, pending standard conditions and final agreements, is expected to close within 45 days. CRISIL recently reported a 12.8% YoY rise in Q2FY25 net profit to ₹171.55 crore, and its stock remains near its 52-week high, showing strong investor interest.

Why it Matters:

CRISIL’s acquisition of a stake in Online PSB Loans strengthens its foothold in the fintech lending sector, aligning with growth opportunities in digital financial solutions. This strategic move is set to diversify CRISIL’s offerings and boost market confidence.

Around the World

Asian stocks fell sharply on Friday, mirroring Wall Street losses amid caution before the Federal Reserve meeting next week. Chinese markets declined as updates from a key legislative meeting disappointed investors, failing to announce aggressive economic stimulus. The Shanghai Composite dropped 1.8%, while Hong Kong’s Hang Seng lost 1.9%. Japan’s Nikkei 225 fell 1.3%, and other Asian indices also struggled. Meanwhile, South Korea’s KOSPI rose 0.3% amid political developments, while India’s Nifty 50 and Malaysia’s FTSE KLCI showed mixed trends. Global investors remained cautious on central bank policy signals.

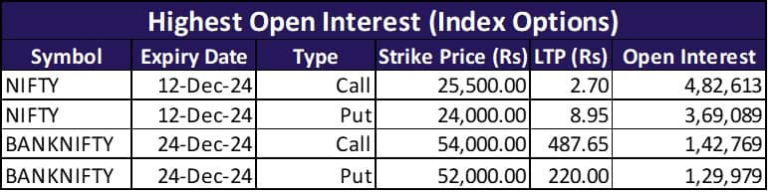

Option Traders Corner

Max Pain

Nifty 50 – 24,500

Bank Nifty – 53,300

Nifty 50 – 24,583 (Pivot)

Support – 24,492, 24,436, 24,345

Resistance – 24,639, 24,731, 24,787

Bank Nifty – 53,309 (Pivot)

Support – 53,081, 52,946, 52,718

Resistance – 53,444, 53,672, 53,807

Did you know?

Indian Digital Milestone Achieved

India has generated over 138 crore Aadhaar numbers, transforming digital identity verification. DigiLocker now serves 37 crore users, securely storing 776 crore documents. The DIKSHA platform has facilitated 556 crore learning sessions and achieved nearly 18 crore course enrollments.