Prestige Estates Breaks Sales Record

- 07th May 2025

Aaj Ka Bazaar

The U.S. markets closed lower on Tuesday after President Donald Trump stated that he would set tariff levels and concessions for trade partners seeking to avoid higher duties, signaling a shift away from reciprocal negotiations. Meanwhile, major Asian markets traded higher in early hours as investors responded positively to news of an upcoming meeting between top U.S. and Chinese trade officials. Back home, Gift Nifty traded at 24,370, indicating a mild gap-down opening of around 50 to 100 points for Indian benchmark indices. This shows a limited impact from rising geopolitical tensions following Operation Sindoor, where India strike on terror camps in Pakistan and POK in retaliation for the April 22 Pahalgam terrorist attack. In a significant development, India finalized a trade deal with the United Kingdom on Tuesday, spurred by recent tariff disruptions linked to Trump’s policies. The agreement is expected to boost bilateral trade in sectors such as whisky, automobiles, and food products. In the stock-specific front, Paytm will remain in focus after the company reported a wider sequential loss for the March quarter, attributed to a one-time employee stock option expense. However, the company expressed confidence in achieving profitability from the April–June quarter onward. Investors are also closely watching for a potential India–U.S. trade agreement, with Trump stating that his administration will review possible deals in the coming two weeks. Additionally, market participants await Coal India’s quarterly results for further cues.

Markets Around Us

BSE Sensex – 80,758.53 (0.15%)

Nifty 50 – 24,431.30 (0.21%)

Bank Nifty – 54,651.75 (0.70%)

Dow Jones – 40,829.00 (-0.95%)

Nasdaq – 17,689.66 (-0.87%)

FTSE – 8,597.42 (0.01%)

Nikkei 225 – 36,839.52 (0.02%)

Hang Seng – 22,775.98 (0.48%)

Sector: Real Estate

Prestige Estates' NCR debut earn big

Real estate firm Prestige Estates Projects Ltd on Tuesday (May 6) said it has recorded over ₹3,000 crore in sales within a week of launching its first residential project in the National Capital Region (NCR). The project, The Prestige City, located in Indirapuram, sold 1,200 units during the initial launch phase. This is the Bengaluru-based real estate group’s maiden foray into NCR’s residential segment. The company attributed the swift sales to a combination of brand trust, strategic location, and demand for premium, well-planned residential communities in urban centres. Spread across 62.5 acres in Indirapuram Extension on National Highway 24, the current launch covered two residential phases,Oakwood and Mulberry, featuring a total of 3,421 homes across 19 towers.

Why it Matters:

Prestige Estates’ record-breaking launch marks its successful entry into the highly competitive NCR real estate market. The swift ₹3,000 crore sales highlight the rising demand for premium, well-planned residential communities in urban hubs. It also reflects growing buyer confidence in established, trusted real estate brands venturing into new regions.

NIFTY 50 GAINERS

TATAMOTORS – 669.75 (3.32%)

BAJFINANCE – 8868.00 (0.80%)

JIOFIN– 252.80 (0.64%)

NIFTY 50 LOSERS

ASIANPAINT – 2380.50 (-1.55%)

LT – 3293.70 (-1.21%)

NTPC – 338.10 (-1.08)

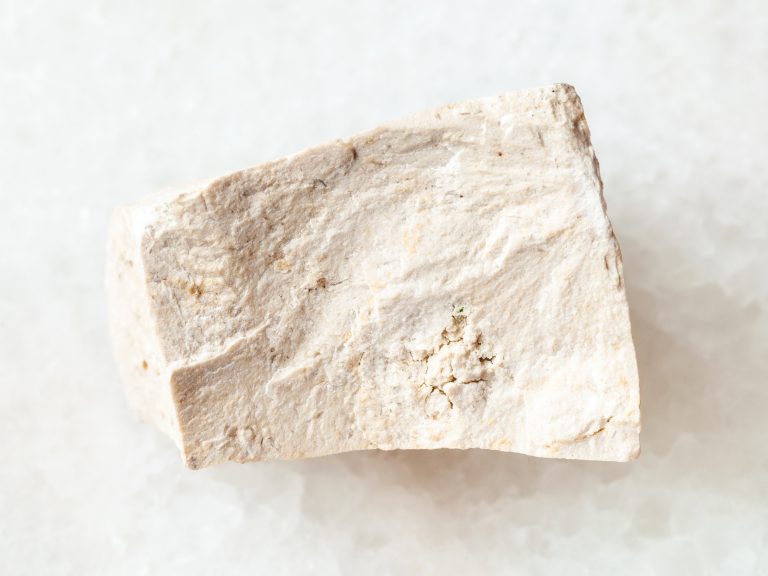

Sector : Minerals

Gujrat Minerals Signs Deal With City Gold Pipes

For supply of 150 MT of limestone from its upcoming Lakhpat Punrajpur Mine Gujarat Mineral Development Corporation (GMDC) has signed a Long-Term Supply Agreement (LSA) with City Gold Pipes (A consortium of Goldcrest Cement and Kailash Darshan Housing Development (Gujarat)) for the supply of 150 million tons of limestone over a period of 40 years from its upcoming Lakhpat Punrajpur Mine in Lakhpat Taluka of Kutch District in Gujarat.

Why it Matters:

The long-term agreement secures consistent limestone supply for City Gold Pipes, supporting their cement and infrastructure projects. It ensures steady revenue visibility for GMDC from its upcoming Lakhpat Punrajpur Mine. The deal also highlights Kutch’s growing importance as a mineral resource hub for industrial demand.

Around the World

Asian stock markets mostly moved higher on Wednesday, led by gains in Chinese stocks after news of upcoming trade talks with the U.S. lifted investor hopes of easing trade tensions. Hong Kong’s Hang Seng surged 1.5%, while China’s markets rose about 0.5%, helped by expectations of more economic support from the central bank. U.S. futures also climbed in Asian trading after a weak Wall Street session. However, not all markets were upbeat — Indian stocks faced pressure as military tensions with Pakistan escalated, although futures pointed to a positive open. The conflict follows a recent deadly attack in Kashmir, raising concerns over further instability. Broader Asian markets traded cautiously ahead of a U.S. Federal Reserve meeting, with Australia, Japan, and South Korea posting modest gains. Singapore’s market dipped, pulled down by weaker bank earnings. Overall, sentiment remained mixed, driven by geopolitics, trade talks, and monetary policy expectations.

Option Traders Corner

Nifty 50 – 24400

Bank Nifty – 54500

Nifty 50 – 24407 (Pivot)

Support – 24,304, 24,229, 24,126

Resistance – 24,482, 24,584, 24,660

Bank Nifty – 54493 (Pivot)

Support – 53,950, 53,629, 53,086

Resistance – 54,814, 55,357, 55,678

Have you checked our latest YouTube Video

Did you know?

India’s Retail Investor Surge: Market Participation Hits Record Highs in 2024

India’s stock market has seen a 36% rise in retail participation, with over 50 million investors active by 2024. This surge is driven by increased financial literacy, digital trading platforms, and government initiatives. Systematic Investment Plans (SIPs) have also gained popularity, with monthly contributions hitting ₹14,000 crore in early 2025. These trends reflect growing confidence in India’s equity markets.