EV Growth Drives Shares

- 18th February 2025

Aaj Ka Bazaar

The US bourses were closed on Monday on account of President’s Day. The Asian market exhibited a positive bias, with Nikkei posting gains, tracking the optimism from the European markets, improved geopolitical outlook and upbeat GDP front. Hang Seng continues its upward trend buoyed by its tech boom. Domestically, the markets are expected to make a weak start, as per the cue from GIFT Nifty. We expect a bounce back in sentiments as the day progresses, which would largely be on the back of a positive peer outlook and easing global sentiments.

Markets Around Us

BSE Sensex –75,966.07 (-0.04%)

Nifty 50 – 22,921.80 (-0.16%)

Bank Nifty – 49,071.25 (-0.38%)

Dow Jones – 44,577.47 (0.07%)

Nasdaq – 20,037.25 (0.46%)

FTSE – 8,768.01 (0.41%)

Nikkei 225 –39,437.49 (0.67%)

Hang Seng – 23,080.23 (-2.05%)

Sector: Auto Components & Equipments

Uno Minda Expands into EV Powertrains

Uno Minda’s shares rose 2% to ₹909 on February 18 after announcing a joint venture with Suzhou Inovance Automotive and its subsidiary to develop high-voltage EV powertrain products for passenger and commercial vehicles. As part of the deal, Inovance Automotive (HK) will acquire a 30% stake in Uno Minda Auto Innovations, which will now operate as a joint venture with Uno Minda holding 70%. The partnership will manufacture key EV components like charging units, E-axles, inverters, and motors, with operations based in India under both brands. Governance includes an eight-member board, with Uno Minda appointing five directors, including the chairman. This expands their existing collaboration after a technical license agreement in June 2024. Uno Minda recently reported a 20% increase in net profit and revenue. Despite today’s gain, the stock fell over 8% last week and 17% last month. As of 9:40 AM, shares were at ₹900, up 1.2% from the last close.

Why it Matters:

This joint venture strengthens Uno Minda’s position in the growing EV market by expanding its product portfolio with high-voltage powertrain components. Partnering with Inovance Automotive brings advanced technology and expertise, enhancing competitiveness. Despite recent stock declines, the move signals long-term growth potential in India’s evolving EV sector.

NIFTY 50 GAINERS

TECHM– 1690.15 (1.51%)

WIPRO – 309.8 (1.46%)

APOLLOHSOP – 6359.55 (0.94%)

NIFTY 50 LOSERS

GRASIM – 2424.35 (-1.60%)

TATASTEEL – 132.14 (-1.60%)

BEL – 244.65 (-1.55%)

Secto: Electrical Equipment

ABB India Surges 4% on Strong Earnings

ABB India’s shares jumped nearly 4% to ₹5,440 on February 18 after reporting strong Q3 results, breaking a three-day losing streak. The company’s net profit surged 56% to ₹528.41 crore, up from ₹338.68 crore last year, driven by a 22% revenue increase to ₹3,364.93 crore—its highest December-quarter revenue in five years. Sequentially, net profit grew 20% and revenue 16%. For the full year, ABB India recorded its highest-ever order book at ₹13,079 crore and revenue of ₹12,188 crore. However, new orders for the quarter fell 14% due to large one-time orders in 2023. Growth came from strong demand across metals, mining, energy, chemicals, and renewables, with the Process Automation and Robotics segments performing well. The board proposed a ₹33.50 per share final dividend. By 9:20 AM, shares were at ₹5,230, up 3.6% from the last close, though the stock is down 25% year-to-date.

Why it Matters:

ABB India’s strong earnings and record-high order book highlight its resilience and growth potential despite a 25% stock decline this year. The company’s expansion across key industries like energy, mining, and renewables signals long-term demand. Its dividend announcement further boosts investor confidence in future performance.

Around the World

Most Asian markets rose on Tuesday, with Chinese tech stocks leading the gains ahead of key earnings reports. Hong Kong’s Hang Seng jumped 2% as Alibaba surged nearly 5% and Baidu gained 0.4%, driven by confidence in China’s AI sector. Broader Chinese stocks also saw gains, supported by optimism over AI adoption and economic growth. Meanwhile, Australia’s ASX 200 dropped 0.5% after the Reserve Bank of Australia cut interest rates by 25 basis points but took a cautious stance on further easing due to inflation concerns. Major Australian banks declined, while mining giant BHP rose 0.5% despite reporting its weakest six-month profit in six years. Japan’s Nikkei 225 and TOPIX gained 0.6%, South Korea’s KOSPI rose 0.4%, and Singapore’s Straits Times inched up 0.1%. India’s Nifty 50 futures pointed to a weak open amid concerns over slowing growth and U.S. trade tariffs. U.S. markets were closed Monday, limiting global cues.

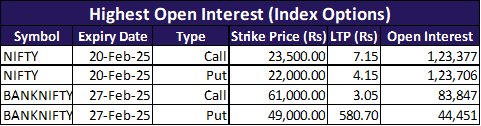

Option Traders Corner

Max Pain

Nifty 50 – 22846.70

Bank Nifty – 48922.10

Nifty 50 – 22886.38 (Pivot)

Support – 22,798, 22,637, 22,549

Resistance – 23,047, 23,135, 23,296

Bank Nifty – 49034.5 (Pivot)

Support – 48,750, 48,241, 47,956

Resistance – 49,543, 49,827, 50,336

Have you checked our latest YouTube Video

Did you know?

India's Mutual Fund Industry Sees 40% Growth

The total equity assets under management of India’s domestic mutual fund industry reached ₹33.4 trillion in 2024, marking a 40% increase compared to the previous year, according to Motilal Oswal’s Fund Folio Report.