Tata Motors’ Big Upside

- 19th February 2025

Aaj Ka Bazaar

After an extended weekend, the US indices highlighted a rather mixed trend, wobbling between red and green before ending their day on a flat, albeit positive note. The mixed sentiment comes after the market prepares to wrap up its quarterly earnings, with Fed minutes coming up in the week and geopolitical uncertainty. On the Asian front, Nikkei exhibited a mixed debut as well, with sell-off amidst automaker shares offset the buying in banks amidst the rising yields in Japan. Meanwhile, Hang Seng made a weak start, however, the index is on its way to make a recovery. Domestically, the D-street are expected to make a flattish start accompanying a positive bias, as indicated by GIFT Nifty. We believe that markets could be under pressure today as US tariffs expectations continue to scare the overall global sentiments.

Markets Around Us

BSE Sensex –75,956.62 (-0.01%)

Nifty 50 – 22,928.95 (-0.07%)

Bank Nifty – 49,383.95 (0.60%)

Dow Jones – 44,595.73 (0.09%)

Nasdaq – 20,032.62 (0.03%)

FTSE – 8,766.73 (0.01%)

Nikkei 225 –39,098.17 (0.44%)

Hang Seng – 22,911.68 (-0.38%

Sector: Passenger Cars & Utility Vehicles

Stock Surge on CLSA Rating Upgrade

Tata Motors’ stock rose 1% to ₹688 on February 19 after CLSA upgraded its rating to “high-conviction outperform” with a target price of ₹930, signaling a potential 36.3% upside. Despite a 12% decline in the past month and being 50% below its all-time high, CLSA sees this as a strong buying opportunity. Jaguar Land Rover (JLR) is trading at a low valuation of 1.2x FY27 EV/EBITDA versus its usual 2.5x, offering a cushion against risks like US tariffs and weak demand. A cyclical recovery in the commercial vehicle segment from FY27 could boost valuations soon. In Q3 FY25, Tata Motors’ net profit fell 22% to ₹5,451 crore, missing estimates, while revenue rose 2.7% to ₹1,13,575 crore. EBITDA margin improved to 7.8% due to cost-cutting. EV sales grew 19%, but fleet demand dropped post-FAME II subsidy expiry. The company expects gradual demand recovery, backed by infrastructure growth and stable interest rates.

Why it Matters:

Tata Motors’ upgrade by CLSA signals strong growth potential, with a 36.3% upside despite recent stock declines. JLR’s low valuation provides a safety net against market risks, while a commercial vehicle recovery could boost future earnings. Improving margins and stable interest rates support long-term confidence in the company’s growth.

NIFTY 50 GAINERS

BEL– 250.15 (2.27%)

TATASTEEL – 136.42 (1.40%)

NTPC – 315.3 (1.32%)

NIFTY 50 LOSERS

DRREDDY – 1151.4 (-3.84%)

SUNPHARMA – 1672.6 (-1.70%)

TCS – 3809.55 (-1.64%)

Secto: Cellular & Fixed line services

Airtel Stake Sale to Refinance Loans

Bharti Airtel conducted a block deal worth ₹8,475 crore on February 18, with promoter entity Indian Continent Investment selling a 0.9% stake. The company will use the proceeds to refinance loans taken for its investment in British Telecom (BT). Bharti Telecom, another promoter, bought 1.2 crore shares, while global and domestic investors, including Goldman Sachs, GQG Partners, SBI Life, and Vanguard, also participated. Airtel’s Q3 FY25 net profit surged 505% to ₹14,781 crore, driven by a one-time gain from Indus Towers’ consolidation, while revenue grew 19% YoY to ₹45,129 crore. The company added 0.6 million postpaid customers, expanding its base to 25.3 million. Despite a nearly 1% drop in stock price to ₹1,656 at 10:30 am, Airtel shares have gained 45% in the last year, reflecting strong market confidence. The block deal saw major institutional investors acquiring significant stakes, reinforcing positive sentiment around the company’s financial health.

Why it Matters:

Bharti Airtel’s stake sale helps refinance loans tied to its British Telecom investment, strengthening its financial position. The participation of major global investors signals strong confidence in the company’s growth. Despite a slight stock dip, Airtel’s 45% yearly gain and rising market share highlight its long-term potential.

Around the World

Most Asian stocks fell on Wednesday after U.S. President Trump threatened new 25% tariffs on cars, pharmaceuticals, and semiconductors, but South Korea’s KOSPI surged 1.8% to a five-month high on strong tech stocks. Japan’s Nikkei and TOPIX dropped 0.4% and 0.3%, while Hong Kong’s Hang Seng was the worst performer, down 0.7%. Despite the tariff concerns, markets showed resilience, as past threats have sometimes been used as negotiation tactics. China’s markets gained 0.7%, driven by optimism in AI and government support for private businesses. Samsung and SK Hynix jumped 2-4%, helping KOSPI recover losses from political turmoil. Singapore’s Straits Times rose 0.4%, supported by strong bank earnings, though United Overseas Bank dipped. U.S. stock futures stayed steady, with the S&P 500 hitting a record high. Traders are now watching for Federal Reserve signals and key economic data, while India’s Nifty 50 faces pressure from potential U.S. trade tariffs.

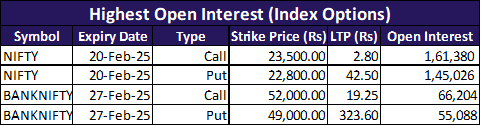

Option Traders Corner

Max Pain

Nifty 50 – 22928.50

Bank Nifty – 49414.85

Nifty 50 – 22913.1 (Pivot)

Support – 22,833, 22,722, 22,642

Resistance – 23,024, 23,104, 23,215

Bank Nifty – 49076.93 (Pivot)

Support – 48,825, 48,563, 48,311

Resistance – 49,338, 49,590, 49,852

Have you checked our latest YouTube Video

Did you know?

India's Mutual Fund Industry Sees 40% Growth

The total equity assets under management of India’s domestic mutual fund industry reached ₹33.4 trillion in 2024, marking a 40% increase compared to the previous year, according to Motilal Oswal’s Fund Folio Report.