Zomato Set for Growth

- 25th February 2025

Aaj Ka Bazaar

The US market experienced fluctuations before closing mixed overnight. The S&P 500 declined by 0.5%, and the tech-heavy Nasdaq Composite fell by 1.2%, as significant technology stocks lost ground amid concerns regarding narratives driven by artificial intelligence. Increased trade tensions also kept investors on edge, particularly after President Trump’s announcement that the tariffs planned for Canada and Mexico would move forward as scheduled once the month-long delay concludes next week. The absence of significant US economic data may have contributed to the choppy trading ahead of the Federal Reserve’s preferred inflation readings released on Friday. This morning, Asian markets opened significantly lower, with benchmark indexes in New Zealand, Japan, and Hong Kong experiencing drops of 1-2%. The Indian market is expected to open flat on Tuesday in light of the global weakness. The Gift Nifty suggests a marginal decline at the opening. Weak sentiment may continue due to concerns over tariffs and anticipation of results from tech giant Nvidia, along with the forthcoming inflation data from the Federal Reserve.

Markets Around Us

BSE Sensex – 74,729.36 (0.37%)

Nifty 50 – 22,601.25 (0.21%)

Bank Nifty – 48,786.25 (0.30%)

Dow Jones – 43,581.94 (0.28%)

Nasdaq – 19,287.27 (-1.21%)

FTSE – 8,658.98 (0.00%)

Nikkei 225 – 38,370.36 (-1.05%)

Hang Seng – 23,196.33 (-0.62%)

Sector: E-Retail/ E-Commerce

Bernstein Predicts Zomato Rally to ₹310

Global brokerage firm Bernstein remains positive on Zomato, maintaining an ‘outperform’ rating with a target price of ₹310, indicating a potential 39% upside. While competition in quick commerce is rising with aggressive expansion by Zomato, Swiggy, and Zepto, Bernstein believes the focus is now on both growth and profitability. Even with intensifying competition, price wars are expected to remain limited due to Swiggy’s lower margins. Bernstein sees Zomato strengthening its leadership in quick commerce, which it predicts will outpace other retail channels, especially with expansion into Tier 2 cities. Initially seen as a niche for high-end urban customers, quick commerce is now appealing to a broader consumer base. Zomato’s stock has gained attention as it will soon be included in the Nifty 50 index. Additionally, Zomato has rebranded itself as Eternal, signaling its ambition to expand beyond food delivery. At 9:16 AM, its shares were trading at ₹226.15 on the NSE.

Why it Matters:

Zomato’s strong position in quick commerce and its inclusion in the Nifty 50 index make it a key stock to watch. Bernstein’s bullish stance suggests significant growth potential despite rising competition. The company’s rebranding to Eternal signals broader ambitions beyond food delivery, making it a long-term investment consideration.

NIFTY 50 GAINERS

M&M– 2769.75 (2.33%)

BAJAJFINSV – 1891.65 (1.82%)

BAJFINANCE– 8465 (1.32%)

NIFTY 50 LOSERS

HINDALCO – 624.8 (-2.66%)

COALINDIA – 360.15 (-1.27%)

LT – 3222.1 (-1.09%)

Secto: Paints

Akzo Nobel Sells Business to Parent

Akzo Nobel India’s stock is in focus after it agreed to sell its powder coatings business and R&D center to its Netherlands-based parent for ₹2,073 crore and ₹70 crore, respectively. The parent will also acquire intellectual property rights for the decorative paints business in India, Bangladesh, Bhutan, and Nepal for ₹1,152 crore. This move will make Akzo Nobel India more independent, eliminating ongoing royalty payments and improving margins and cash flow. The company aims to focus on liquid paints and coatings while reducing reliance on its parent. Akzo Nobel, Europe’s largest paintmaker, began reviewing its India business last year and plans to retain its industrial coatings division for now. However, a complete exit could push the total deal value to $2.2 billion. Selling the industrial coatings business may be complex due to intellectual property protections and long-term contracts, including those with the Indian Navy. Akzo Nobel India’s market cap currently stands at $1.75 billion.

Why it Matters:

Akzo Nobel India’s sale of key businesses to its parent enhances financial independence by eliminating royalty payments and improving margins. The move streamlines its focus on liquid paints and coatings while securing its long-term growth. A potential full exit could significantly impact the company’s valuation and future strategy.

Around the World

Asian stocks mostly fell on Tuesday as technology shares declined ahead of Nvidia’s earnings report. A Bloomberg report about the U.S. tightening chip export restrictions to China added to concerns, especially after Trump called for stricter scrutiny of Chinese investments. Wall Street’s tech sell-off also weighed on Asian markets, with Hong Kong’s Hang Seng dropping 2%, Japan’s Nikkei 225 down 0.9%, and Taiwan’s TSMC slipping 1.4%. Investors are cautious about Nvidia’s earnings, which could provide insights into AI demand. China’s stock rally cooled, with the CSI 300 and Shanghai Composite falling 0.9% and 0.5%, respectively. South Korea’s KOSPI dropped 0.4%, but losses were limited after the central bank cut interest rates. Japan’s TOPIX fell 0.2%, though gains in major trading houses—boosted by Warren Buffett’s investment—helped offset losses. Australia’s ASX 200 declined 0.6%, Singapore’s market remained flat, and Indian markets faced continued selling pressure.

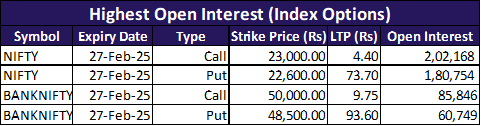

Option Traders Corner

Max Pain

Nifty 50 – 22590.35

Bank Nifty – 48768.60

Nifty 50 – 22580.07 (Pivot)

Support – 22,492, 22,430, 22,342

Resistance – 22,641, 22,729, 22,790

Bank Nifty – 48560.75 (Pivot)

Support – 48,373, 48,094, 47,906

Resistance – 48,839, 49,027, 49,306

Have you checked our latest YouTube Video

Did you know?

India's Mutual Fund Industry Sees 40% Growth

The total equity assets under management of India’s domestic mutual fund industry reached ₹33.4 trillion in 2024, marking a 40% increase compared to the previous year, according to Motilal Oswal’s Fund Folio Report.