Here's What You Get

- StoxCalls is free for our KYC customers

- F&O strategies

- Precision Entry and Exit Strategies

- Top Stock Picks

- Seamless Trading at the click of a Button

- Expert Analysis and Reports

- Real-Time Updates to Make Informed Decisions

Screeners

Screeners IPO

IPO Mutual funds

Mutual funds Unlimited trading

Unlimited trading Zero Brokerage*

Zero Brokerage*

Please Note: There will be no brokerage charged for equity & derivatives upto 1 cr turnover in a month. Upon exceeding 1 cr turnover limit, Rs 10 per executed order will be charged from the next day of exhaustion. In case the customer renews the plan, zero brokerage will be applicable again for 30 days from the date of fresh subscription.

A Zero Brokerage Trading Account has revolutionized the trading industry by offering an option to trade without paying traditional brokerage fees. These accounts have gained immense popularity for reducing trading costs, enabling greater accessibility for small-scale investors, and making frequent trading a more viable option.

What is a Zero Brokerage Trading Account?

As the name suggests, a zero brokerage trading account allows you to buy and sell stocks without incurring brokerage fees charged by the trading platform. This translates to significant cost savings, particularly for active traders who frequently execute trades. However, it’s important to understand that while brokerage fees might be eliminated, other charges like account maintenance fees, stamp duty, and GST may still apply.

How Does it Differ from Traditional Brokerage Trading Accounts?

Zero brokerage trading accounts differ from traditional ones primarily in their fee structure. Traditional trading accounts charge brokerage fees based on the volume or value of trades, offering a structured approach that aligns the cost with the level of service and personalized support provided. In contrast, zero brokerage accounts eliminate or significantly reduce these charges, often operating on subscription or flat-fee models. While traditional accounts might provide extensive personal advisory services, zero brokerage accounts focus on cost efficiency and cater to tech-savvy traders using advanced online platforms.

Traditional Brokerage Model: A Foundation for Modern Trading

The Traditional Brokerage Model in India has long been a staple in the financial markets, primarily catering to investors who value a full-service approach. In this model, brokerage firms charge clients fees based on the volume and size of their trades. The fee structure typically includes:

- Percentage-Based Fees: Brokers charge a specific percentage of the transaction value. For example, a fee of 0.5% on a trade worth ₹1,00,000 results in a direct cost of ₹500.

- Tiered Pricing: To attract high-volume traders, some traditional brokers use a tiered pricing structure, reducing the fee percentage as the volume of trades increases.

- Other Charges: These include account maintenance charges, platform usage fees, and even inactivity fees in some cases.

Traditional brokerage models also offer several other advantages which includes:

- Comprehensive Services: These brokers provide investment advice, portfolio management services, and access to in-depth research reports.

- Personalized Service: Investors benefit from one-on-one relationships with brokers who understand their financial goals and provide tailored advice.

The fees associated with traditional brokerage accounts reflect the value of comprehensive services, making them a suitable choice for investors seeking expert guidance and tailored investment strategies. The rise of digital platforms and discount brokers has challenged the traditional model’s dominance, especially among cost-conscious investors.

How Brokerage Models Have Evolved?

The way brokerage services are offered has evolved significantly over the years. Initially, the Traditional Brokerage Model was the dominant option for investors who required full-service support, including investment advisory and portfolio management. However, this approach provides access to premium services, including personalized guidance, detailed research, and robust platforms, with fees structured to reflect the value of these comprehensive offerings.

With technological advancements, the Discount Brokerage Model emerged, offering reduced transaction costs and online platforms. This model catered to self-directed investors but was still involved in per-trade fees. The latest is the Zero Brokerage Model.

Zero Brokerage vs Traditional Brokerage Model

To understand the advantages of a zero brokerage trading account, it’s important to compare it with the traditional model. Here’s how they differ:

In traditional trading scenarios, brokerage firms typically charge a percentage of the trade volume as fees for every transaction executed on their platform. For example, a fee of 0.5% on a trade worth ₹1,00,000 results in a direct cost of ₹500.

The Zero Brokerage Model, however, eliminates these per-trade charges entirely. Instead of worrying about escalating fees, traders can focus on executing as many transactions as desired without incurring additional costs per trade. This makes the zero brokerage model particularly attractive for frequent traders, as it significantly boosts cost efficiency and preserves profitability. However, traders who do not want to pay an upfront fee, will find value in the traditional brokerage model which works on the principle of pay as you go.

How Do Zero Brokerage Trading Accounts Work?

Understanding the Zero Brokerage Model

The zero brokerage model eliminates per-transaction fees, allowing traders to execute trades without incurring direct brokerage costs. This model is particularly advantageous for frequent traders or high-volume investors, as it significantly reduces trading expenses. However, the absence of brokerage fees doesn’t mean these platforms operate for free. Instead, they leverage alternative revenue streams to maintain profitability and sustainability.

Revenue Streams for Brokers Offering Zero Brokerage Accounts

Zero brokerage firms utilize diverse revenue models to compensate for the lack of traditional brokerage fees. Common strategies include:

- Premium Services: While basic trading services are free, these platforms often charge for advanced features. These include access to superior analytical tools, real-time data feeds, enhanced charting capabilities, and more in-depth research reports.

- Interest on Margin Funds: Many zero brokerage platforms provide margin trading facilities, where traders can borrow money to trade larger amounts than they have in their accounts. The interest charged on these borrowed funds is a significant revenue source for these platforms.

- Revenue Sharing with Exchanges: Some zero brokerage firms have arrangements with stock exchanges or other financial trading platforms where they receive a share of the revenue generated from trade execution or other related services.

- Account Maintenance Fees: Although trade execution might come free of charge, traders may still be required to pay annual or monthly account maintenance fees, which contribute to the platform’s earnings.

Types of Charges That May Still Apply

Even though zero brokerage accounts eliminate traditional brokerage fees, traders should be aware of additional charges that may still apply:

- Platform Fees: Some platforms charge a subscription or usage fee for accessing their trading software or apps.

- Regulatory Charges: Fees mandated by regulators, such as Securities Transaction Tax (STT), GST, or SEBI turnover fees, are applicable on all trades, regardless of the brokerage model.

- Depository Participant (DP) Charges: These fees apply when shares are transferred in or out of a Demat account.

- Other Miscellaneous Fees: Charges for services like fund withdrawals, offline trading, or specific research reports may still be levied.

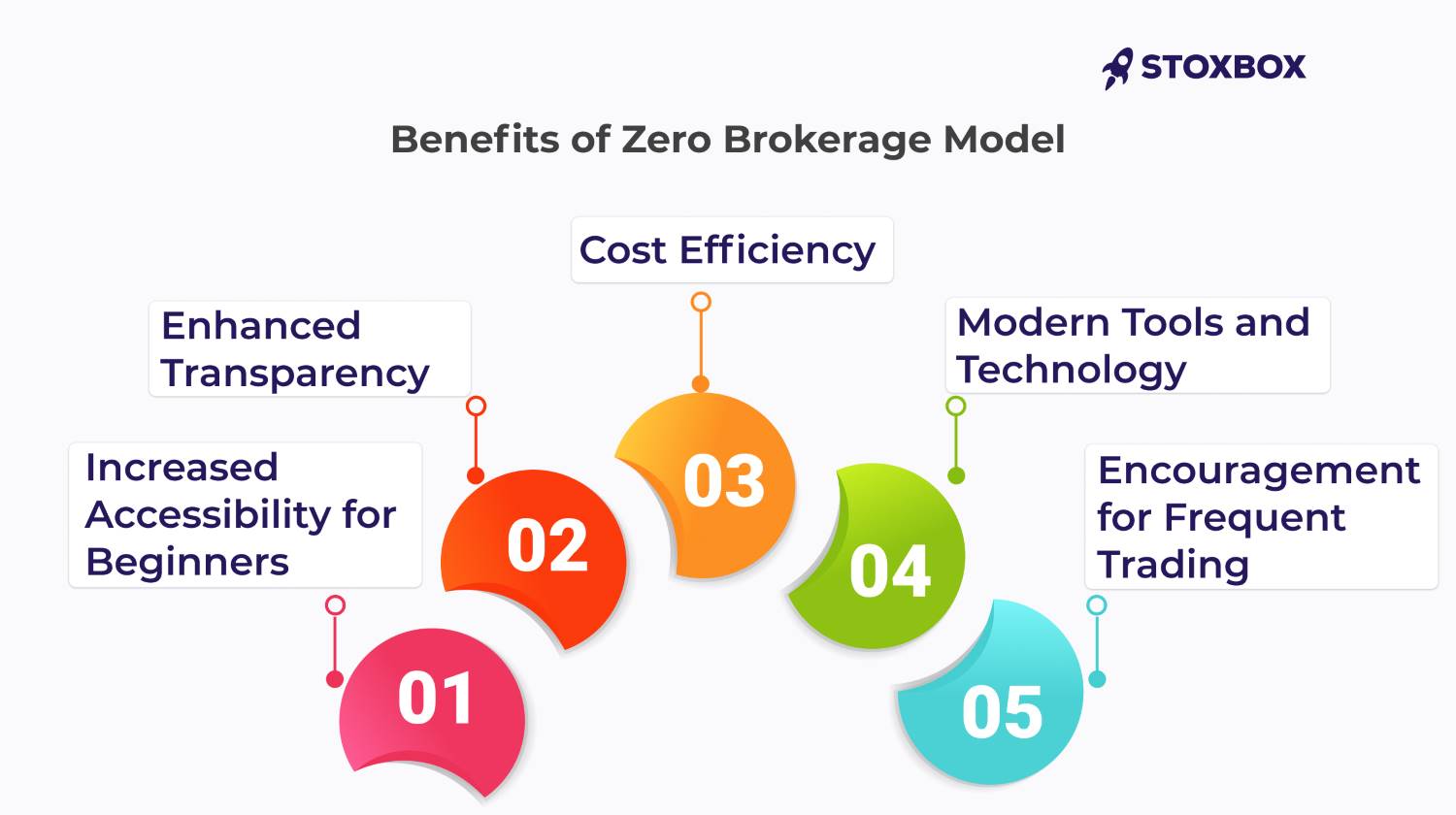

Benefits of Zero Brokerage Model

The zero brokerage model has revolutionized the trading experience for investors, offering a range of benefits that make it an attractive choice for modern traders and investors:

1. Cost Efficiency:

The most significant advantage is the reduction or elimination of brokerage fees. This is particularly beneficial for active traders, such as day traders and those dealing in high volumes, as it minimizes costs that could otherwise eat into their profits.

2. Encouragement for Frequent Trading:

Without the burden of incremental transaction costs, traders can execute as many trades as needed without worrying about the cumulative impact of fees. This fosters a trading environment conducive to strategies like swing trading and intraday trading, where frequent transactions are crucial. It also encourages portfolio diversification by allowing investors to explore and trade in multiple asset classes without additional financial strain.

3. Enhanced Transparency:

Zero brokerage platforms typically offer straightforward and transparent pricing structures with no hidden charges. This clarity helps investors better understand their actual costs and returns, fostering trust and making financial planning more predictable. Transparent fee structures also prevent unpleasant surprises, which are common in traditional trading models with multiple hidden fees.

4. Modern Tools and Technology:

Most zero brokerage accounts are built on technologically advanced platforms that offer features like real-time market data, advanced charting tools, and user-friendly interfaces. These modern tools empower investors to make informed decisions, whether they are seasoned traders or beginners just starting out.

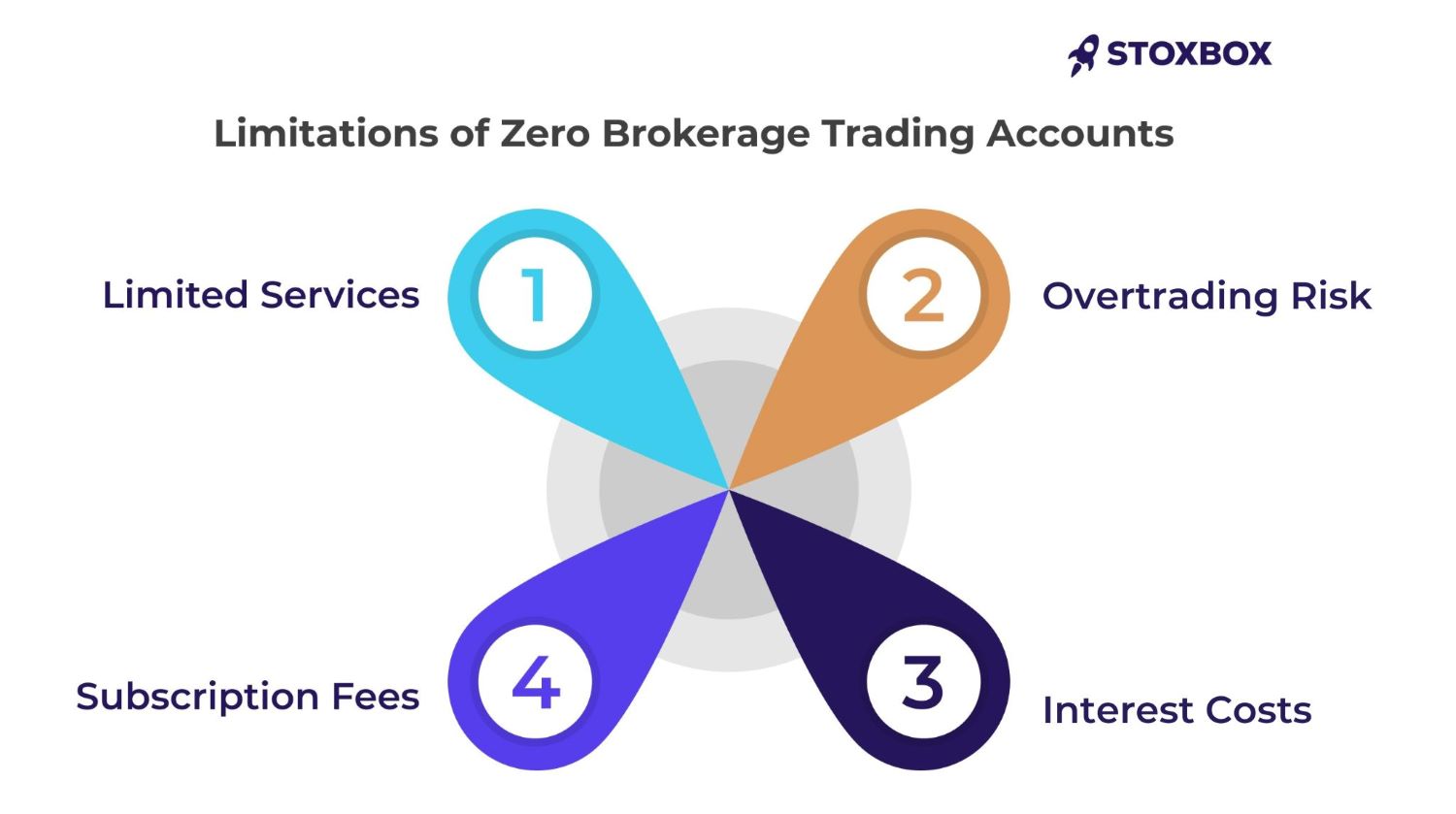

Limitations of Zero Brokerage Trading Accounts

While the benefits are significant, there are some considerations that traders should be aware of:

- Limited Services: The basic free services may not include all the tools and support a trader might need. Additionally, premium services can incur extra costs, potentially offsetting the savings from zero brokerage fees.

- Subscription Fees: Many zero brokerage platforms rely on subscription-based models. For occasional traders, these fixed costs could outweigh the savings on brokerage fees.

- Overtrading Risk: The absence of trading costs might encourage excessive trading, which can be risky, especially for inexperienced traders.

- Interest Costs: For traders utilizing margin trading, interest costs can become a significant expense. Careful management of these costs is crucial to avoid eroding profits.

Who Should Consider a Zero Brokerage Trading Account?

Zero brokerage trading accounts cater to a wide range of investors, each with unique trading styles and financial objectives. Here’s a breakdown of who can benefit most from these accounts:

1. Active Traders and Day Traders:

For individuals who execute multiple trades daily, traditional brokerage fees can quickly add up, significantly impacting profitability. Zero brokerage accounts eliminate per-trade fees, allowing active traders and day traders to maximize their gains without worrying about the costs associated with frequent transactions. This is particularly advantageous for those employing high-frequency strategies like intraday trading or scalping. However, for individuals who execute multiple trades daily, traditional brokerage accounts offer the advantage of comprehensive services, including expert insights and premium tools, which can enhance decision-making and support more informed trading strategies.

2. Small-Scale or Beginner Investors:

New investors or those starting with smaller capital often benefit from the comprehensive support offered by traditional brokerage accounts. These accounts provide personalized guidance, research tools, and one-on-one advice, helping beginners navigate the complexities of the market with confidence. On the other hand zero brokerage accounts that may lack advisory services, traditional brokers ensure that small-scale or beginner investors receive the insights and assistance needed to learn and grow effectively, making their trading journey well-informed and strategically sound.

3. Cost-Conscious Traders with Tight Budgets:

Investors who prioritize minimizing expenses will find zero brokerage accounts to be an excellent fit. These accounts are designed for individuals who want to focus on growing their portfolio without the added pressure of recurring transaction fees. By cutting unnecessary costs, traders can allocate more resources toward their investment strategies.

4. Investors Focused on Long-Term Goals Without Frequent Trading:

While zero brokerage accounts are often associated with frequent trading, they can also be valuable for long-term investors. For those who make occasional trades to rebalance their portfolio or invest in long-term opportunities, the absence of per-trade fees ensures that every rupee goes directly toward building wealth rather than paying brokerage charges.

Best Practices for Using Zero Brokerage Trading Accounts

While zero brokerage accounts offer significant cost benefits, using them effectively requires careful consideration and strategic planning. Here are some best practices to get the most out of your trading experience:

How Can You Avoid Hidden Costs?

Even with zero brokerage accounts, some charges can sneak in, such as platform fees, regulatory charges, or fees for premium services. To avoid surprises, always review the platform’s pricing structure carefully. Ask yourself: “Am I using any optional services that might incur additional fees?” Stay vigilant and stick to the features you need.

What Tools Should You Leverage for Smarter Trading?

Modern zero brokerage platforms offer a range of tools like advanced analytics, live market tracking, and AI-driven insights. Are you making full use of these? Familiarize yourself with features like stock screeners, portfolio analysis, and customizable dashboards. These tools aren’t just bells and whistles—they’re your allies in making informed decisions.

Should You Trade Frequently or Think Long-Term?

Zero brokerage accounts make frequent trading tempting, but is that the right move for you? Strike a balance. Dedicate part of your portfolio to long-term growth while experimenting with short-term trading strategies. Set clear goals for both approaches to stay focused.

How Can You Protect Yourself From Risks?

Risk is inevitable in trading, but how you manage it makes all the difference. Diversify your portfolio to spread exposure, use stop-loss orders to limit potential losses, and always have a risk-management plan. Are you borrowing funds for margin trading? Monitor interest costs closely to ensure they don’t eat into your gains.

Benefits of Opening a Trading Account with StoxBox

To open a free trading account with Stoxbox, you’ll need the following documents:

- PAN Card

- Aadhaar Card (for address proof)

- Recent Photograph

- Bank Account Details

- Income Proof (for trading in derivatives)

These documents help us ensure compliance with regulatory requirements and establish your investment profile.

StoxBox stands out in the crowded market of trading apps by combining advanced tools, cost efficiency, and a user-friendly interface. Key benefits include:

- Advanced Charting Tools: Essential for technical analysis, these tools provide multiple indicators and chart patterns, enabling traders to analyze market trends and make informed decisions.

- In-Depth Research Reports: Detailed company and sector analyses by experienced analysts offer valuable insights, helping investors make better-informed choices.

- Intuitive Interface: A user-friendly platform ensures seamless navigation and efficient trade execution, catering to both beginners and experienced traders.

- Secure Transactions: Robust encryption and multi-factor authentication safeguard user data and trading activities, ensuring a safe trading environment.

- Personalized Support: StoxBox provides access to a dedicated team of experts who offer tailored advice and assistance, ensuring investors can confidently make decisions aligned with their financial goals.

- Pay-As-You-Go Model: Unlike rigid plans, StoxBox allows you to pay only for the services you use, offering flexibility and cost efficiency to traders of all types.

With its comprehensive features, StoxBox caters to the diverse needs of modern investors, making it an ideal platform for both seasoned traders and beginners.

How to Get Started with the StoxBox App

Getting started with StoxBox is a breeze! Here’s a quick guide:

- Download the StoxBox app from the App Store or Google Play Store.

- Open an account by providing your basic details and completing the KYC (Know Your Customer) process. Check out the video here.

- Fund your account using a secure online payment method.

- Explore the app, familiarise yourself with the features, and start trading!

StoxBox App Performance:

- 3.9 Star Rating: On both the App Store and Google Play Store, StoxBox boasts a near-perfect user rating, reflecting its positive user experience.

- 100,000+ Downloads: The app has been downloaded over 100,000 times, highlighting its growing popularity among Indian investors.

- 95% User Retention Rate: StoxBox enjoys a high user retention rate, indicating user satisfaction and continued engagement with the platform.

Conclusion

The Indian stock market presents a wealth of opportunities for potential investors. StoxBox, with its user-friendly mobile app, aims to empower a new generation of investors by providing a cost-effective and convenient way to participate in the market. By embracing technology and prioritizing user experience, StoxBox strives to make trading in India a more accessible and rewarding experience for all.

Frequently Asked Questions

Does StoxBox offer Zero Brokerage Trading?

No, StoxBox does not offer zero brokerage trading, but it provides competitive brokerage rates designed to suit different investor needs. Instead of adopting a zero-brokerage model, StoxBox focuses on delivering value-added services like research-backed stock recommendations, advanced trading tools, and seamless platform navigation, personalised support to enhance your trading experience.

Are there any hidden charges in zero brokerage accounts?

While zero brokerage accounts eliminate transaction fees, traders may still incur other costs such as account maintenance fees, regulatory charges (e.g., STT, GST), or charges for premium services. It’s important to review the fee structure before signing up.

Can I trade without a broker?

No, trading stocks without a broker is not possible for retail investors in India. Brokers act as intermediaries to provide access to stock exchanges like NSE and BSE. For institutional investors, direct market access (DMA) may be an option, but this is not available for individual traders.

What is meant by zero brokerage?

Zero brokerage refers to a pricing model where traders are not charged any brokerage fees for executing transactions. This approach significantly reduces trading costs.

What is a no fee brokerage?

A no fee brokerage refers to an account where the broker waives fees for basic trading services, such as buying and selling stocks. However, additional charges may still apply for premium tools, advanced features, or specific services.

Who should consider using a zero brokerage trading account?

Zero brokerage accounts are ideal for frequent traders, cost-conscious investors, and those preferring tech-driven platforms with essential tools. However, they may not suit investors seeking personalized advisory services.

For users who value expert guidance along with cost efficiency, StoxBox bridges this gap. Offering free institutional-grade research recommendations, actionable trading calls, and one of the lowest brokerage rates in the industry, StoxBox ensures traders benefit from both premium services and cost-effectiveness. Explore our brokerage plans here.

What documents are required to open a trading account with StoxBox?

Performance Of Our ProTips

Performance Summary 7th Nov - 11th Nov 2022

| Products | No Of Call | Success | Fail | Exit | Open |

|---|---|---|---|---|---|

| BTST/STBT | 0 | 0 | 0 | 0 | 0 |

| Expiry Strategy | 1 | 1 | 0 | 0 | 0 |

| Intraday Futures | 1 | 1 | 0 | 0 | 0 |

| Intraday Options | 5 | 5 | 1 | 0 | 0 |

| Intraday Calls | 3 | 1 | 2 | 0 | 0 |

| Options Strategy | 1 | 1 | 0 | 0 | 0 |

| Smallcap Movers | 2 | 1 | 0 | 0 | 1 |

| Rapid Movers | 0 | 0 | 0 | 0 | 0 |

| Swing Trades | 2 | 0 | 0 | 0 | 2 |

| Positional | 2 | 0 | 0 | 0 | 0 |

| Calls | 15 | 9 | 3 | 0 | 3 |