In the stock market, blue chip companies are the titans. They speak about the company’s performance, they are popular, and have a high market value. As a result, investors seek exposure to blue chip funds to build a strong portfolio that outmatches inflation.

But, it is important to consider all the variables of a blue chip fund. This blog highlights the blue chip funds, how it works, and their features.

Table of Contents

What are Blue Chip Funds?

A Blue Chip Fund is an equity scheme that offers its investors a portfolio of stocks that generate solid and stable yields for a long time. These stocks are high-market cap companies, meaning the risk factor is relatively low. One can also consider blue chip funds as a sound financial scheme with decent returns.

How Does it Work?

Blue chip mutual funds invest in companies, which have a strong track record in terms of numbers, enabling the investors to generate return from them. Blue chip funds’ mostly hold stocks in the top 100 as per market capitalization. To diversify their portfolio these funds’ also invest in bonds and also keep cash components free in the funds in order to diversify the portfolio. Blue chip companies have a longer spectrum for investment. Thus, the cost of the blue chip funds is relatively higher.

Why Are Investors Interested In Blue Chips?

There are many reasons why investors want those blue chip stocks. Here are some popular reasons why investors like these blue chip stocks.

- Most of the blue chips have established brand names, and this leads to better corporate governance standards and loyalty to the business.

- Blue chips may not be as big profit generators as small and medium manufacturing models, but they are lower on the risk scale compared to small and medium enterprises.

- These blue chips help diversify the portfolio and reduce the risk in the portfolio through stability.

- Most of the blue chips have an official track record, as have many Tata companies for over 100 years.

- Most blue chips have a stable dividend policy, so they are more likely to meet shareholder expectations.

- Blue chips are very liquid in the market, so these blue chips can be bought and sold in large quantities, which makes MFs and FIIs like them.

- Since many of these blue chips are closely watched by auditors and fund managers, there is much more purpose and work involved.

- Most blue chips are also available in futures and options, so these positions can be closed using futures or options to reduce the right chance.

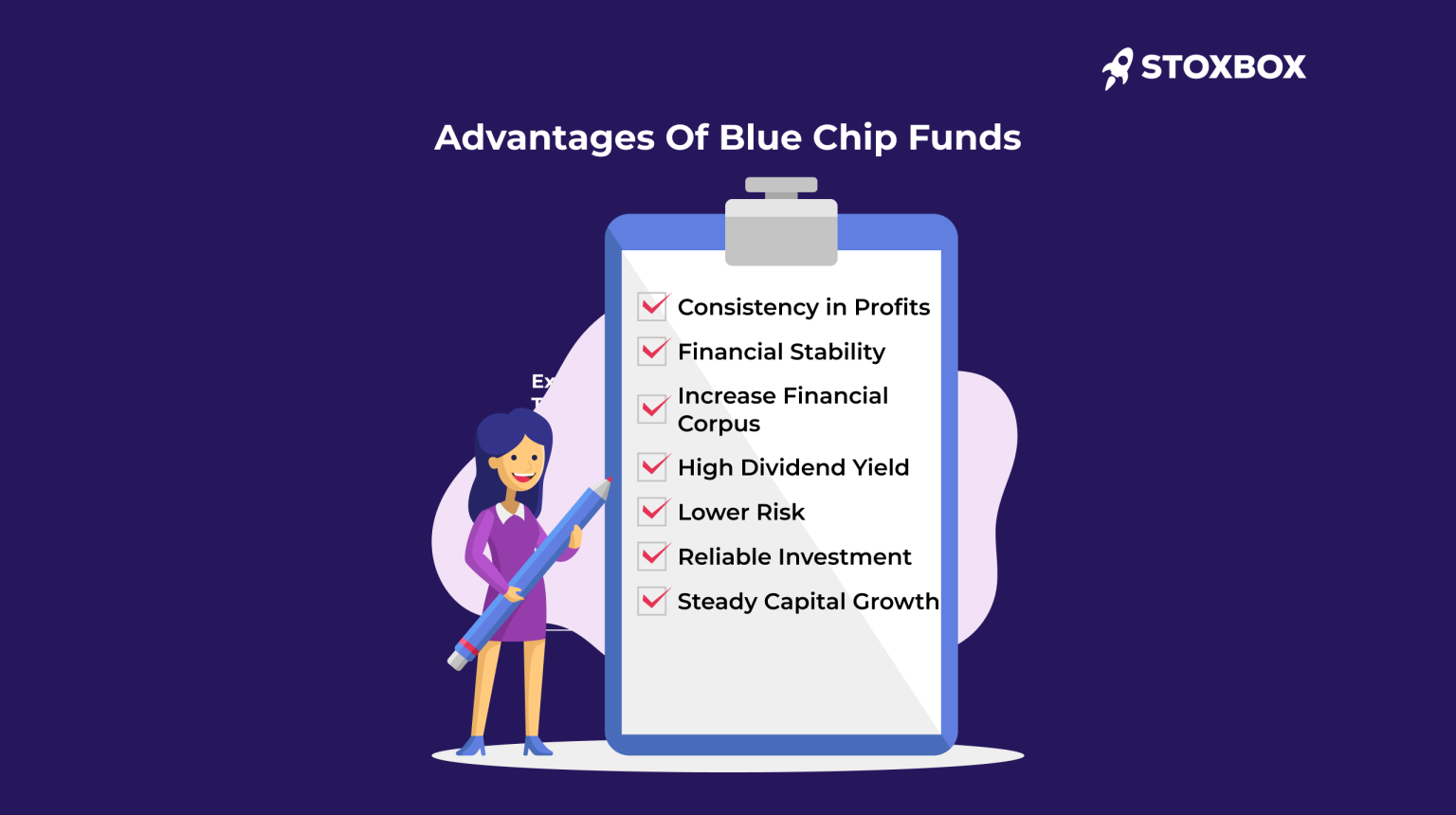

Advantages Of Blue Chip Funds

Consistency in Profits:

- Blue chip funds are known for delivering consistent profits, which is highly valued by investors.

- These funds help stabilise an investor’s finances by providing steady returns.

Financial Stability:

- Investing in blue chip funds enhances financial stability by delivering returns slightly higher than the market index (alpha).

- These funds offer lower risk and greater stability compared to other types of investments.

Increase Financial Corpus:

- Blue chip funds help investors grow their financial corpus by providing steady profits.

- They are an effective way to enhance capital over time.

High Dividend Yield:

- Many blue chip stocks are known for paying high and consistent dividends.

- This consistent dividend payment benefits the fund and, ultimately, the investors.

Lower Risk:

- Blue chip funds typically involve lower risk compared to mid-cap and small-cap funds.

- The stability and financial strength of blue chip companies contribute to the lower risk profile.

Reliable Investment:

- Blue chip funds are considered reliable investments due to their strong track record and financial health.

- They provide a sense of security and trust for investors.

Steady Capital Growth:

- These funds offer a steady timeline of growth, which is beneficial for long-term investment goals.

- The compounding effect over time further enhances the value of the investment.

Types Of Blue Chip Funds In India

Large Cap funds

A large cap fund is basically a diversifier of risk and creates a portfolio that optimises returns for a given level of risk. Large cap funds need to create alpha by beating the Nifty by a large enough margin to justify the higher Total expense ratio (TER) in active large cap funds.

Index Funds

An index fund, as the name suggests, is a passive fund that does not try to beat the market, but tries to earn as much as the index does. So if the Nifty earned 23.8% returns in 2021, then the index fund would give you similar returns because they create a portfolio that is exactly the same as the index and even the weights are similar to the index. Hence the only concern for an index fund manager is to minimise tracking error. Index funds have the advantage of being lower on the cost scale, compared to active funds.

Blue chip funds would fit perfectly into your long term life goals like a child’s education, your own retirement corpus etc. Financing such goals can be best done with the help of blue-chip funds. The returns are attractive, the risk is relatively lower and the compounding is consistent over time.

Top 10 Blue-Chip Funds In India

Here is a quick look at some of the top performing large cap funds in India. We have considered returns over a five year period so have only considered funds that have been in existence for more than 5 years as a shorter time period will not give a proper picture of such funds. We have considered Direct Plans for simplicity.

| Scheme | 5-Year Returns | |

|---|---|---|

| Regular | Benchmark | |

| Nippon India Large Cap | 21.91 | 19.84 |

| ICICI Prudential Bluechip | 21.25 | 19.23 |

| Baroda BNP Paribas Large Cap | 20.28 | 19.23 |

| Kotak Bluechip | 20.13 | 19.23 |

| Canara Robeco Bluechip Equity | 20.11 | 19.84 |

| JM Large Cap | 19.74 | 19.84 |

| Invesco India Large Cap | 19.49 | 19.23 |

| HDFC Top 100 | 19.34 | 19.23 |

Features of Blue Chip Funds

Assured returns

Blue chip funds generate returns as dividends. The blue chip companies are well-established and serve as a safe investment avenue. An assured income and steady returns are guaranteed.

Creditworthiness

Blue chip companies can easily generate enough capital to clear their financial dues. Hence, this makes shares issued by such companies highly creditworthy.

Risk factor

With steadiness in financial performance, the stocks issued by these companies have a lower risk factor.

Investment horizon

Blue chip funds are suitable for long-term investments. Investing in these stocks or funds helps greatly in achieving financial goals.

Growth prospect

Blue chip companies are those that have reached their maximum growth potential. Therefore, a steady timeline of growth is a characteristic of blue chip shares.

Taxation

As per the Income Tax Act, Section 80C, short-term goals are subjected to taxation at a rate of 15%. The taxation rate is 10% for gains exceeding Rs 1 lakh.

Blue Chip Safety Considerations

Track record of the AMC

Before investing in any blue chip company, one must look into its track record. Additionally, these funds can withstand huge investors’ unpredicted withdrawal pressure.

Investment style

Investors must choose funds that suit their risk appetite. Checking on the fund manager’s investment style is equally significant. It must add value to the portfolio that favours growth, value, or a combination of both.

Expense ratio

The expense ratio is the expense of running a mutual fund. Choosing funds with a lower expense ratio may give you more returns over time.

The fund’s portfolio

An investor must conduct a thorough portfolio analysis to know where the blue chip fund is investing. These are large-cap and mid-cap funds, ensuring that the large-cap fund adheres to its investment objectives.

Performance against benchmark

Select blue chip funds that have outperformed both the benchmark and their competitors over time. Then, track their records for the past three to five years to check their performance.

Frequently Asked Questions

How do blue chip mutual funds compare to index funds?

Blue chip funds and index funds both fall under the category of Mutual Fund but have key differences:

Blue Chip Fund:

- These funds invest in large, established companies with a history of stable performance.

- They focus on industry leaders, considered safer investments.

- These funds aim for growth and steady income in the long term.

- It is managed by a fund manager who decides which are the best investment options to buy and sell based on research.

Index Fund:

- These funds aim not only to beat the benchmark performances but also outperform.

- Known for low fees and expenses due to less required research.

- Offer diversified exposure to a broad market or specific sector without individual stock selection.

How do global events impact the performance of blue chip mutual funds?

Global events such as geopolitical tensions, natural disasters, or pandemics are likely to have ripple effects on the financial markets and also the performance of mutual fund schemes. These events can increase market volatility and uncertainty, affecting fund returns across various asset classes.

What is the average holding period for investments in blue chip mutual funds?

Blue-Chip mutual funds invest in the top 100 companies, which provides stable and long term growth. Therefore, one should look at investing in mutual funds for the long-term with a minimum horizon of 5 years.

Is it possible to switch from one blue chip mutual fund to another?

One thing to remember is, switching between mutual schemes is only possible within the schemes of the same AMC or fund house. Also, switching mutual funds is not a difficult process, it involves certain factors, rules, charges, and tax implications that you should be aware of.

Your Wealth-Building Journey Starts Here