The short answer is wealth creation. Your salary can only get you so far. The rest of the gap can be covered with disciplined savings and investments. By investing your money, you allow it to multiply and grow over time. You also save it from getting robbed by inflation, which can eventually render your savings less valuable. However, being a young, independent individual translates to a hectic schedule in today’s times. This probably means you may not always have the time to invest in options like direct equities, where you have to build your portfolio yourself, time the market, and devise exit strategies. This is where ETFs come in as the ideal investment option.

What are ETFs?

ETFs are like a big hamper of different securities, including stocks, bonds, and commodities that tracks an underlying index. This means that an ETF follows a benchmark index and tries to replicate its performance. An ETF in India is a combination of a stock and a mutual fund. It is traded on the stock exchanges like stocks. It is also highly liquid like shares and can be bought and sold throughout the day. This means you can buy and sell units of ETFs from the stock market anytime you want.

The short answer is wealth creation. Your salary can only get you so far. The rest of the gap can be covered with disciplined savings and investments. By investing your money, you allow it to multiply and grow over time. You also save it from getting robbed by inflation, which can eventually render your savings less valuable. However, being a young, independent individual translates to a hectic schedule in today’s times. This probably means you may not always have the time to invest in options like direct equities, where you have to build your portfolio yourself, time the market, and devise exit strategies. This is where ETFs come in as the ideal investment option.

What are ETFs?

ETFs are like a big hamper of different securities, including stocks, bonds, and commodities that tracks an underlying index. This means that an ETF follows a benchmark index and tries to replicate its performance. An ETF in India is a combination of a stock and a mutual fund. It is traded on the stock exchanges like stocks. It is also highly liquid like shares and can be bought and sold throughout the day. This means you can buy and sell units of ETFs from the stock market anytime you want.

Further, it pools money from different investors, as in the case of mutual funds. The fund manager invests your money further, and the profits are given back to you as returns. ETFs also have a Net Asset Value (NAV) like mutual funds.

Some ETF examples in India include the Nippon ETF Nifty BeES, LIC MF ETF – CNX Nifty 50, and ICICI Prudential Nifty ETF, among several others. [SS1] There are also different types of ETFs like equity ETFs, gold ETFs, bond ETFs, and international ETFs. You can invest in any of these based on your financial goals.

The past, present, and future of ETFs

The Nifty Benchmark Exchange-Traded Scheme (Nifty BeES) was the first-ever ETF in India introduced in 2001. It was offered by the Benchmark Mutual Fund. This was followed by Liquid BeES in 2004, the first debt ETF in the country. However, ETFs really thrived after the economic crisis of 2008 that engulfed the world. ETFs presented investors with comparatively more security and thus appealed to beginners and experts alike.

According to AMFI, asset under management (AUM) for ETFs grew by 1345.77% between 2015 and 2020 in the country1. There was a further increase of 136% in ETF AUM between 2020 and 2022, stated a survey report by Morningstar India2. These rising numbers are testament to the fact that ETFs are attracting many investors and are indeed here to stay.

ETF benefits

Further, it pools money from different investors, as in the case of mutual funds. The fund manager invests your money further, and the profits are given back to you as returns. ETFs also have a Net Asset Value (NAV) like mutual funds.

Some ETF examples in India include the Nippon ETF Nifty BeES, LIC MF ETF – CNX Nifty 50, and ICICI Prudential Nifty ETF, among several others. [SS1] There are also different types of ETFs like equity ETFs, gold ETFs, bond ETFs, and international ETFs. You can invest in any of these based on your financial goals.

The past, present, and future of ETFs

The Nifty Benchmark Exchange-Traded Scheme (Nifty BeES) was the first-ever ETF in India introduced in 2001. It was offered by the Benchmark Mutual Fund. This was followed by Liquid BeES in 2004, the first debt ETF in the country. However, ETFs really thrived after the economic crisis of 2008 that engulfed the world. ETFs presented investors with comparatively more security and thus appealed to beginners and experts alike.

According to AMFI, asset under management (AUM) for ETFs grew by 1345.77% between 2015 and 2020 in the country1. There was a further increase of 136% in ETF AUM between 2020 and 2022, stated a survey report by Morningstar India2. These rising numbers are testament to the fact that ETFs are attracting many investors and are indeed here to stay.

ETF benefits

Here are some ETF benefits that can help you make the decision to invest in them:

Here are some ETF benefits that can help you make the decision to invest in them:

- ETFs offer a lot of convenience: They are passively managed by a fund manager, so the burden to manage your investment and time the market is off you.

- ETFs are highly liquid: ETFs can be bought and sold at any time of the day. They are ideal if you are in a financial emergency and need immediate funds.

- ETFs can help you lower portfolio risk: You can take care of your portfolio’s diversification needs by adding ETFs. ETFs are great at diversification. However, keep in mind that they are still susceptible to market volatility.

- ETFs may have a lower expense ratio: ETFs can be a cost-effective investment option with lower expense ratios than most mutual funds.

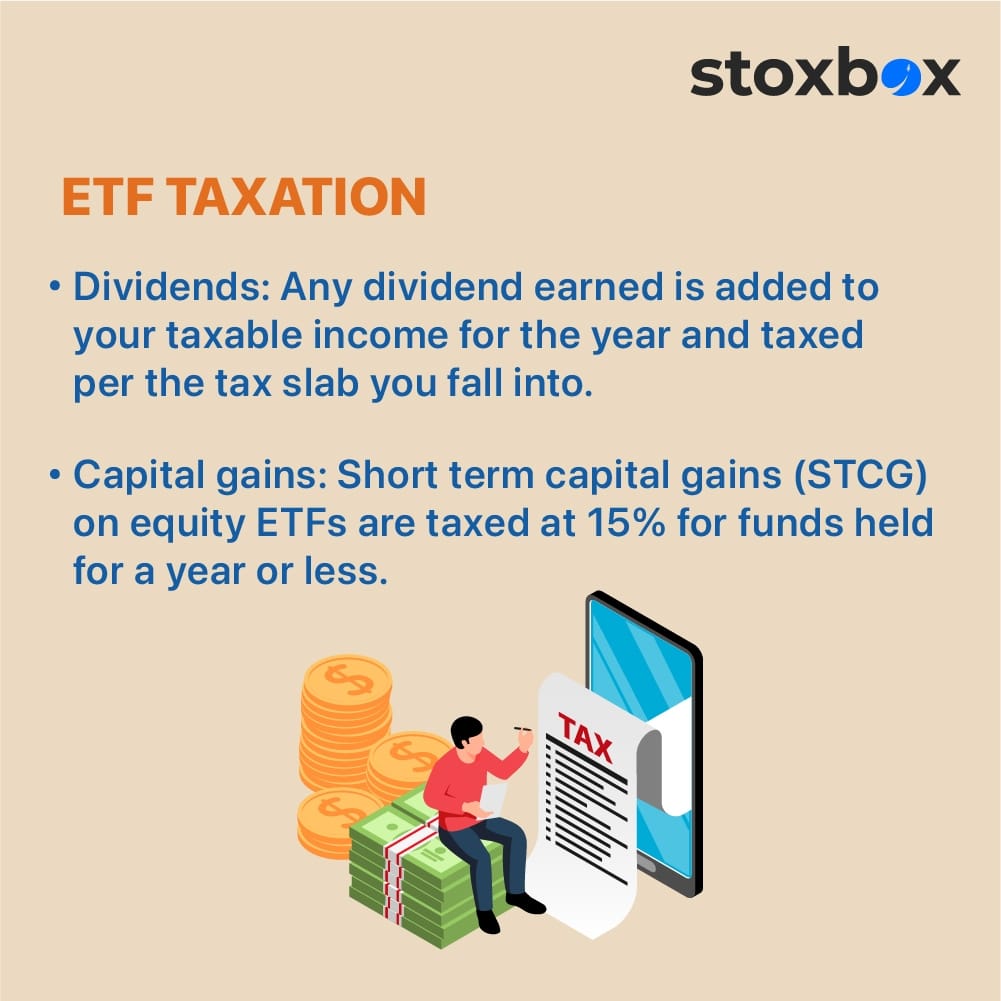

To understand ETF taxation, you first need to know that there are two types of incomes that you can earn from investing in an ETF in India – a dividend and a capital gain. Here’s how each of these is taxed:

To understand ETF taxation, you first need to know that there are two types of incomes that you can earn from investing in an ETF in India – a dividend and a capital gain. Here’s how each of these is taxed:

- Dividends: Any dividend earned is added to your taxable income for the year and taxed per the tax slab you fall into.

- Capital gains: Capital gains are taxed according to the type and duration of the fund. Equity ETFs are levied long term capital gains (LTCG) tax on earnings in excess of Rs. 1 lakh per annum at the rate of 10% for funds held for longer than a year. Short term capital gains (STCG) on equity ETFs are taxed at 15% for funds held for a year or less.

- All other ETFs like debt, gold, etc., are taxed like debt funds. LTCG for funds held for longer than three years are taxed at 20% with indexation benefits. STCG tax is levied on profits from funds held for three years or less. Like dividends, these earnings are added to your taxable income for the year and taxed accordingly.

Frequently Asked questions

1. How are ETFs different from mutual funds in India?

ETFs are traded on stock exchanges like shares and typically have lower expense ratios, while mutual funds are bought or redeemed through fund houses and may involve higher management fees.

2. Can ETFs be used for long-term wealth creation in India?

Yes, ETFs can be a good option for long-term wealth creation as they offer diversification, low costs, and exposure to a wide range of sectors or indices.

3. Are ETFs suitable for first-time investors in India?

ETFs can be suitable for beginners due to their simplicity, low costs, and transparency. However, investors should understand how the stock exchange works to trade ETFs effectively.

4. What are the most popular indices tracked by ETFs in India?

Commonly tracked indices by Indian ETFs include the Nifty 50, Sensex, Nifty Next 50, and sectoral indices like Nifty IT and Nifty Bank.

5. How do sectoral ETFs work in the Indian market?

Sectoral ETFs focus on specific industries, such as technology or banking, offering concentrated exposure to that sector’s performance.

6. Do ETFs in India pay dividends?

Yes, some ETFs distribute dividends to investors if the underlying securities in their portfolio pay dividends. Investors can also opt for growth-based ETFs that reinvest earnings.

7. How does liquidity affect ETF trading in India?

Liquidity in ETFs depends on the trading volume and the market-making mechanism. Highly traded ETFs like Nifty ETFs generally have better liquidity, reducing the bid-ask spread for investors.

You might also Like.

ETF vs Mutual Fund: Which Investment Option Suits You Best?

Understand the difference between ETF Vs Mutual Funds Table of...