Understand the difference between ETF Vs Mutual Funds

Table of Contents

Investing can be a powerful tool to grow your wealth, but with so many options available, it’s easy to feel overwhelmed. Exchange-Traded Funds (ETFs) and Mutual Funds are two popular investment options in India, offering distinct benefits and catering to different investor needs. While both aim to grow your wealth, their structures, costs, and operational mechanisms differ significantly.

In this guide, we will explore ETF vs Mutual Funds, highlighting their key features, advantages, and how to choose between them based on your investment goals.

What are ETFs and Mutual Funds?

Investors often encounter ETFs and mutual funds as accessible and popular tools for building a diversified portfolio. Although they share the goal of simplifying investments and spreading risk, the way they operate, trade, and are managed sets them apart.

What Are ETFs?

An Exchange-Traded Fund (ETF) is a type of investment fund traded on stock exchanges, much like individual stocks. ETFs aim to track the performance of an index, sector, commodity, or other asset, providing investors with a cost-effective and flexible way to gain market exposure.

Key Characteristics:

- Structure: ETFs pool money from investors to create a portfolio of securities, with each unit representing fractional ownership in the portfolio.

- Trading: ETFs are traded throughout the day on stock exchanges, with prices fluctuating based on market demand and supply, just like stocks.

- Diversification: Most ETFs replicate an index, offering exposure to various stocks, bonds, or commodities in a single purchase.

Examples:

- Indian ETFs: Nifty 50 ETF, Bharat Bond ETF.

- Global ETFs: SPDR S&P 500 ETF (SPY), iShares MSCI Emerging Markets ETF (EEM).

What Are Mutual Funds?

A Mutual Fund is a professionally managed investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Mutual funds are designed to cater to a wide range of financial goals and risk appetites.

Key Characteristics:

- Types: Mutual funds come in various forms, such as equity funds, debt funds, hybrid funds, and index funds, each with a specific investment focus.

- Management: Actively managed mutual funds aim to outperform the market, relying on fund managers’ expertise, while passively managed funds (e.g., index funds) track an index’s performance.

- Pricing: Mutual funds are bought and sold based on their net asset value (NAV), which is calculated at the end of each trading day.

Examples:

- Indian Mutual Funds: SBI Bluechip Fund, HDFC Hybrid Equity Fund.

- Global Mutual Funds: Vanguard Total Stock Market Index Fund, Fidelity Contrafund.

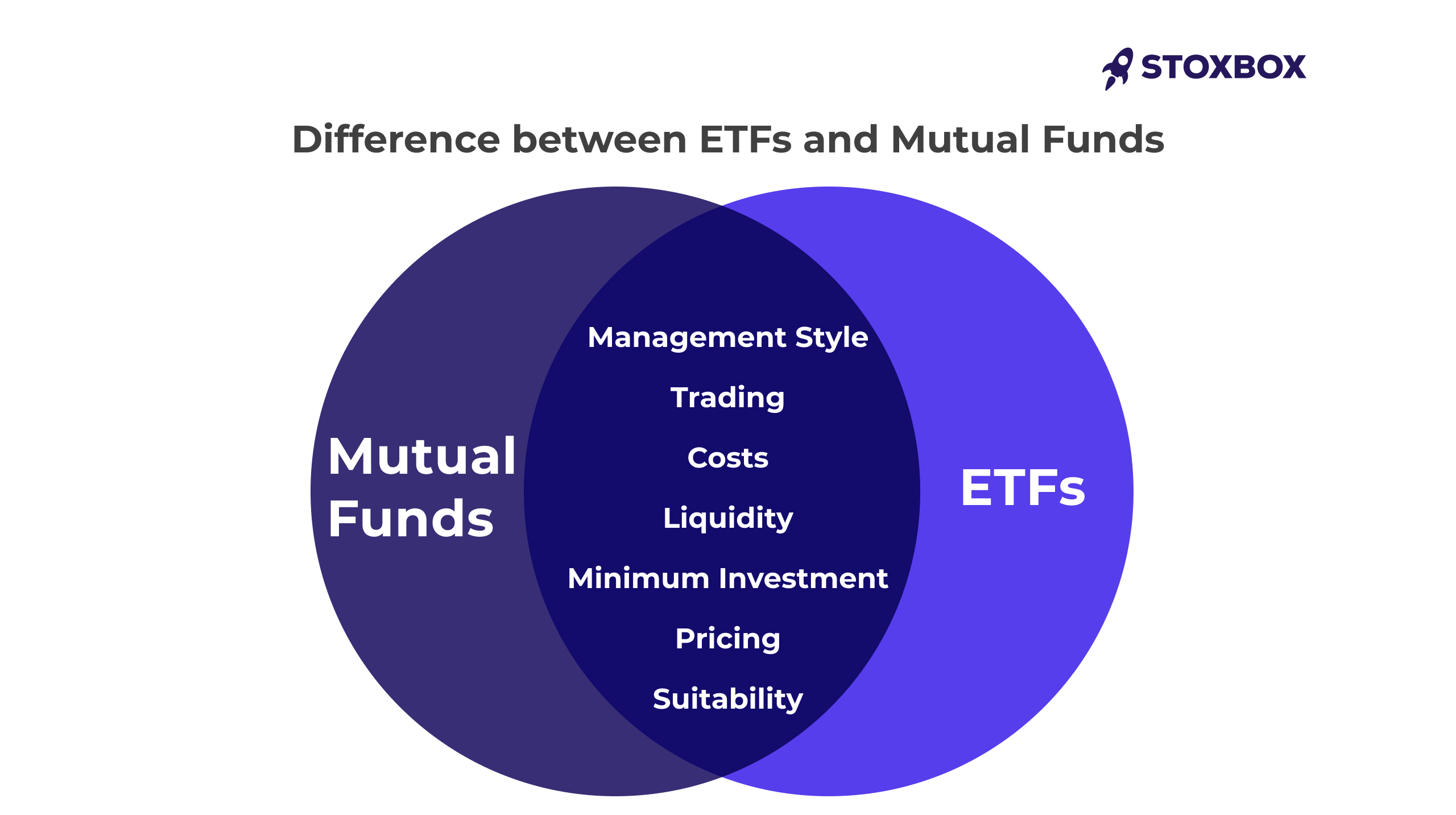

Difference between ETFs and Mutual Funds

Understanding their key differences is crucial when deciding between ETFs and mutual funds. The following table highlights their distinctions across essential criteria:

| Criteria | ETFs | Mutual Funds |

|---|---|---|

| Management Style | Passively managed; tracks an index or asset | Actively or passively managed |

| Trading | Traded on stock exchanges like shares | Bought and sold via AMC at the NAV |

| Costs | Low expense ratio; brokerage fees apply | Higher expense ratio; no brokerage fees |

| Liquidity | Highly liquid; trades during market hours | Less liquid; transactions processed at day’s end |

| Minimum Investment | No minimum investment required | Minimum amount varies (as low as ₹100 for SIPs) |

| Pricing | Fluctuates throughout the day | Fixed NAV at day’s end |

| Suitability | Ideal for hands-on, cost-conscious investors | Suitable for long-term, hands-off investors |

Advantages of ETFs and Mutual Funds

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Advantages of ETFs

The benefits of ETFs are as follows –

1. Cost Efficiency

One of the standout features of Exchange-Traded Funds (ETFs) is their low expense ratio. These funds are passively managed, which means they aim to mirror the performance of an index like the Nifty 50 or Sensex, rather than actively outperform it. This passive approach results in reduced management fees.

For example, the Nippon India ETF Nifty BeES has an expense ratio of around 0.05%, making it one of the most cost-effective investment options available. This low cost is particularly advantageous for long-term investors as it allows for compounding returns without significant deductions for management fees.

2. Liquidity

ETFs are traded on stock exchanges, offering high liquidity. Investors can buy or sell ETF units during market hours, just like trading stocks. This flexibility is especially beneficial for active traders or those who want to take advantage of market movements throughout the day.

Unlike mutual funds, where transactions are processed at the end-of-day Net Asset Value (NAV), ETFs allow real-time trading, giving investors greater control over their investments.

3. Transparency

Transparency is a key advantage of ETFs. These funds disclose their holdings daily, enabling investors to see exactly where their money is allocated. This is in contrast to many mutual funds, which disclose their portfolios monthly or quarterly. Daily transparency builds trust and helps investors align their investment choices with their financial goals.

Comparison: Mutual funds typically disclose their holdings on a less frequent basis, offering less visibility into the portfolio.

4. No Minimum Investment

Unlike many mutual funds that require a minimum investment amount, ETFs do not have such restrictions. Investors can buy even a single unit of an ETF, making it accessible to everyone, from retail investors with modest capital to institutional investors with significant funds. This flexibility encourages new and small-scale investors to participate in the market.

Advantages of Mutual Funds

Benefits of mutual funds are as follows –

1. Professional Management

One of the key benefits of mutual funds is that they are actively managed by professional fund managers. These managers use their expertise to analyze markets, select high-potential securities, and make adjustments to the portfolio to maximize returns.

For instance, funds like the HDFC Flexi Cap Fund and the Axis Bluechip Fund have demonstrated consistent performance under skilled fund managers. This professional oversight is invaluable for investors who lack the time or expertise to manage their investments actively.

2. SIP (Systematic Investment Plans) Option

Mutual funds offer the convenience of Systematic Investment Plans (SIPs), which allow investors to contribute small, regular amounts toward their investments. SIPs are particularly beneficial for those who want to start investing with limited funds or prefer a disciplined approach to wealth creation.

For example, starting a SIP with just ₹500 a month in an equity mutual fund can lead to significant returns over time, leveraging the power of compounding and market growth.

3. Wide Variety

Mutual funds cater to a wide range of investment objectives and risk profiles. Investors can choose from:

- Equity Funds: For long-term growth.

- Debt Funds: For stable returns and low risk.

- Hybrid Funds: A mix of equity and debt for balanced returns.

- Sectoral Funds: Focused on specific industries like technology or healthcare. This variety allows investors to build a diversified portfolio tailored to their financial goals and risk tolerance.

4. Tax Benefits

Certain mutual funds, such as Equity-Linked Saving Schemes (ELSS), provide tax benefits under Section 80C of the Income Tax Act. By investing in ELSS, investors can claim deductions of up to ₹1.5 lakh annually, while also benefiting from the potential for higher returns compared to other tax-saving instruments like fixed deposits. This dual advantage of tax saving and wealth creation makes ELSS funds an attractive choice for long-term investors.

Limitations / Disadvantages of ETFs & Mutual Funds

Disadvantages of ETFs

Brokerage Fees

ETFs require the use of a Demat account, and transactions involve brokerage fees. While the expense ratios are low, these transaction costs can accumulate, especially for frequent traders.

Bid-Ask Spreads

The bid-ask spread — the difference between the buying and selling price — can affect returns, particularly for ETFs with lower liquidity. This means the price at which you buy may be slightly higher than what you receive when you sell, especially in volatile markets.

Disadvantages of Mutual Funds

Higher Expense Ratios

Actively managed mutual funds charge higher management fees to cover the cost of the fund managers’ expertise. These fees can reduce your overall returns over time, especially in long-term investments.

Limited Trading Flexibility

Unlike ETFs, mutual fund units are only bought and sold once a day at the NAV calculated at market close. This makes mutual funds less flexible for investors who want to trade throughout the day or take advantage of real-time market movements.

Common Misconceptions About ETFs and Mutual Funds

When it comes to investment vehicles like ETFs and mutual funds, misconceptions can often lead to confusion and potentially missed opportunities. In this section, we’ll debunk some of the most common myths surrounding ETFs and mutual funds, providing clarity with evidence and practical insights.

Misconception 1: ETFs Are Only for Experienced Investors

- Reality: While ETFs can be a powerful tool for active traders, they are not exclusively for experienced investors. In fact, ETFs offer several advantages that make them accessible to beginners. For instance, their low expense ratios and flexibility in trading make them an appealing option for cost-conscious investors. Many ETFs track broad market indices like the Nifty 50 or Sensex, providing an easy way for new investors to gain exposure to a diverse range of stocks without needing expert knowledge. Additionally, investors can start by purchasing a small number of units to get familiar with how ETFs work.

- Practical Insight: A beginner investor can invest in an ETF like the Nippon India ETF Nifty 50, which mirrors the Nifty 50 Index, providing broad exposure to the top 50 Indian companies. This approach reduces the need for stock-picking expertise while still offering potential growth.

Misconception 2: Mutual Funds Always Outperform ETFs

- Reality: It’s a common belief that actively managed mutual funds will always outperform ETFs due to professional fund managers actively selecting stocks. However, this is not always the case. Many actively managed mutual funds come with higher management fees, which can eat into the returns over time. Additionally, past performance is not always indicative of future results. There are plenty of ETFs that outperform certain actively managed mutual funds, especially when considering factors like expense ratios and the long-term nature of index-tracking strategies.

- Practical Insight: While actively managed mutual funds like the HDFC Flexi Cap Fund might have performed well in the past, ETFs like the SBI ETF Sensex or the Nippon India ETF Nifty 50 offer lower fees and similar market exposure, often making them a more cost-effective choice over the long term.

Misconception 3: Mutual Funds Are Too Expensive

- Reality: Not all mutual funds are expensive. While actively managed mutual funds do tend to have higher expense ratios due to the costs associated with professional management, there are also passively managed mutual funds, such as index funds, which offer low expense ratios similar to ETFs. For example, an index fund tracking the Nifty 50 may have a lower expense ratio than a typical actively managed equity fund. Furthermore, mutual funds offer the benefit of systematic investment plans (SIPs), making it easier for investors to invest smaller amounts regularly.

- Practical Insight: Investors seeking low-cost mutual funds can explore index funds or passively managed funds that track market indices, which provide broad exposure to the market at lower costs compared to actively managed funds.

Misconception 4: ETFs Are Too Volatile

- Reality: While ETFs are traded throughout the day like stocks, this does not necessarily mean they are more volatile than mutual funds. In fact, many ETFs track major indices, such as the Nifty 50 or Sensex, which are generally less volatile than individual stocks. ETFs provide diversification, which can help mitigate risk. The daily price fluctuations that ETFs experience are often exaggerated due to their ability to be traded intraday, but the long-term growth potential remains stable, especially for broad-market ETFs.

- Practical Insight: For instance, investing in an ETF like the ICICI Prudential Nifty Next 50 ETF provides exposure to the next 50 largest companies in India, thus reducing exposure to volatility seen in individual stocks while still offering significant growth potential.

Misconception 5: Mutual Funds Are Less Tax Efficient Than ETFs

- Reality: While ETFs tend to be more tax-efficient due to their structure, mutual funds can also be tax-efficient, especially if held for the long term. In India, equity mutual funds are subject to long-term capital gains tax at 10% on gains above ₹1 lakh, similar to ETFs. Additionally, tax-saving mutual funds, such as ELSS funds, offer unique tax benefits under Section 80C of the Income Tax Act. In some cases, mutual funds may also be more tax-efficient for investors who invest through SIPs, as it helps to lower the average cost of purchase (rupee cost averaging).

- Practical Insight: ELSS mutual funds, like the Axis Long Term Equity Fund, offer both tax-saving benefits and the potential for high returns, making them an attractive option for long-term investors looking to minimize taxes and build wealth simultaneously.

Now that we’ve debunked these common myths, let’s explore how you can make an informed choice based on factors like cost, risk, and investment goals.

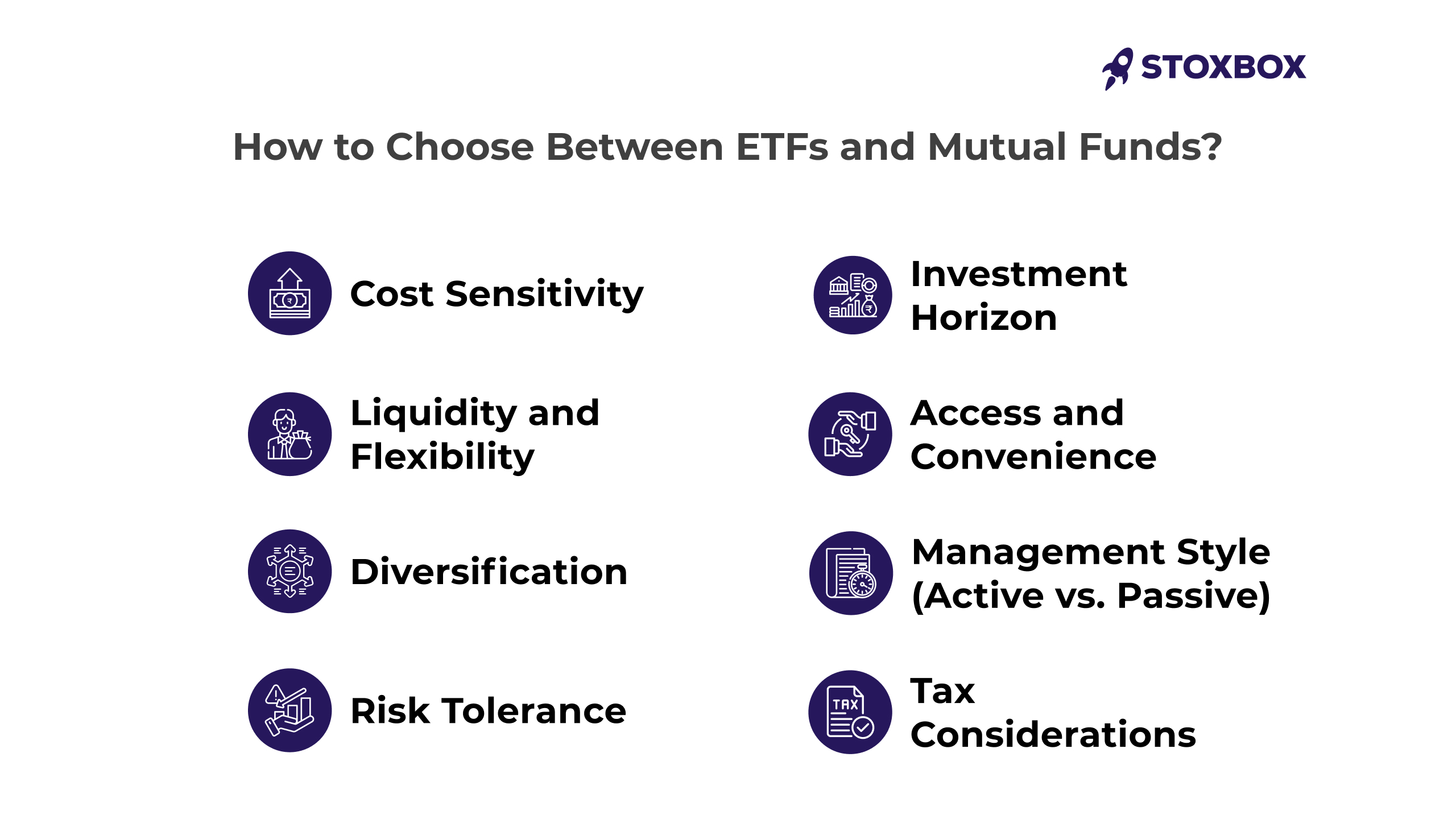

How to Choose Between ETFs and Mutual Funds?

1. Cost Sensitivity

When deciding between ETFs and mutual funds, cost should be a primary consideration:

- ETFs generally have lower expense ratios due to their passive management style. This makes them ideal for cost-conscious investors, especially those looking to invest for the long term and avoid high fees eating into their returns.

- Mutual funds, on the other hand, often come with higher expense ratios, particularly actively managed funds. While these fees support the cost of professional management, investors should weigh the higher costs against the potential benefits of active oversight. For those using Systematic Investment Plans (SIPs), mutual funds can also be more convenient, even if slightly costlier.

2. Investment Horizon

The investment horizon will greatly influence your choice:

- If you’re investing for the long term, both ETFs and mutual funds can offer great benefits, depending on your preferences. ETFs offer a hands-off investment that tracks broad market indices with minimal fees.

- Mutual funds can be particularly useful for volatility or market-specific conditions, where actively managed funds can adjust the portfolio to optimize returns during uncertain times. If you’re considering short to medium-term goals, actively managed funds can give you the flexibility to respond to market conditions, while ETFs are better suited for long-term, steady growth.

3. Liquidity and Flexibility

Liquidity and the ability to trade your investments may be crucial:

- ETFs are traded on stock exchanges during market hours, offering greater flexibility and real-time trading. This makes them ideal for those who want to actively manage their investments or take advantage of market fluctuations.

- Mutual funds, however, are bought and sold based on the end-of-day NAV, which can be less flexible. While this isn’t an issue for long-term investors, those who need immediate liquidity or wish to trade on market movements might find mutual funds less suited to their needs.

4. Access and Convenience

- ETFs are easy to access and trade, much like stocks. They are available on stock exchanges, meaning investors can purchase them through brokers or trading platforms. This ease of access is perfect for investors who are comfortable with online trading and prefer the autonomy to buy or sell throughout the day.

- Mutual funds are also easy to access but typically require an investment through AMCs (Asset Management Companies) or platforms. While the process might take longer, especially for SIP investments, the convenience of automated contributions can be a huge benefit for those who want a hands-off investment experience.

5. Diversification

- ETFs offer excellent diversification by tracking indices like the Nifty 50 or Sensex, providing broad market exposure. While you get diversified exposure to an entire sector or market, diversification can be somewhat limited in specialized ETFs that track a niche or a specific asset class.

- Mutual funds provide customizable diversification because fund managers select a mix of assets based on the fund’s strategy (equity, debt, hybrid, etc.). This provides flexibility in building a portfolio based on specific risk tolerances and investment goals. They can be an ideal choice if you are looking for sector-specific diversification or want exposure to more complex strategies.

6. Management Style (Active vs. Passive)

The management style of a fund can be an important factor in your decision:

- ETFs are typically passively managed, which means they track the performance of an index (like the Nifty 50 or Sensex). This keeps costs low but also means you’re relying on the performance of the entire index rather than the decisions of a fund manager.

- Mutual funds, particularly actively managed funds, offer professional management, where fund managers actively select stocks and adjust the portfolio to outperform the market. If you’re an investor who values expert insights and dynamic adjustments, mutual funds may align better with your needs.

7. Risk Tolerance

Assessing your risk tolerance is key:

- If you’re seeking diversification with lower individual stock volatility, ETFs might be the better choice. Since they typically track indices, they provide broad exposure to a range of assets, which can help spread risk.

- Mutual funds, especially those focused on specific sectors or small-cap stocks, may come with higher risk, but the potential for higher returns exists due to the fund manager’s expertise. If you’re comfortable with more risk for potentially higher returns, these funds may be a better fit.

8. Tax Considerations

Both ETFs and mutual funds are subject to capital gains tax, but their tax treatment differs slightly:

- ETFs generally have lower tax implications due to their passive structure, meaning fewer taxable events occur. This can be advantageous for tax-conscious investors.

- Mutual funds, especially ELSS (Equity-Linked Saving Schemes), offer additional tax-saving opportunities under Section 80C, making them appealing if you’re looking to reduce taxable income while investing for the long term.

ETFs vs Mutual Funds: A Final Verdict

Choose ETFs If:

- Cost-Conscious: ETFs typically offer lower expense ratios, making them a great choice for budget-conscious investors. However, keep in mind the need for a Demat and trading account.

- Intraday Traders: ETFs allow flexibility with intraday trading, providing real-time decision-making.

- Sector/Commodity Investors: ETFs like Gold ETFs and sector-specific funds offer targeted exposure to certain markets or commodities.

Choose Mutual Funds If:

- Professional Management: If you prefer professional fund management, mutual funds, with their experienced managers, are ideal.

- Tax-Saving: ELSS mutual funds offer tax-saving benefits under Section 80C of the Income Tax Act.

- SIP Investors: For those looking to invest small amounts regularly, mutual funds are perfect due to SIP options that enable disciplined investing.

Conclusion

Both ETFs and Mutual Funds are excellent investment vehicles, catering to a wide range of financial goals and preferences. While ETFs are ideal for cost-conscious, hands-on investors, mutual funds offer the benefit of professional management and systematic investment plans (SIPs). By understanding your investment goals, risk tolerance, and financial needs, you can make an informed decision that aligns with your wealth-building strategy.

Invest wisely, whether through top-performing ETFs like Nippon India ETF Nifty 50 or reliable mutual funds like Axis Long Term Equity Fund, to achieve your financial objectives.

Frequently Asked Questions

Can I buy fractional shares of ETFs and mutual funds?

Most mutual funds allow for investments in fractional shares, while some brokerages now offer fractional shares of ETFs, but this is not universally available.

How do dividends work in ETFs and mutual funds?

Both ETFs and mutual funds can distribute dividends to investors; however, ETFs typically pay dividends more frequently, often quarterly.

Who should consider investing in ETFs versus mutual funds?

Investors looking for flexibility, lower costs, and tax efficiency may prefer ETFs, while those seeking professional management or specific investment strategies may opt for mutual funds.

Are ETFs cheaper than mutual funds?

Yes, ETFs generally have lower expense ratios and no upfront or exit loads. However, brokerage fees for ETF transactions can slightly increase costs, especially for frequent traders.

Can I convert my mutual fund to an ETF?

While you can’t directly convert a mutual fund into an ETF, you can sell your mutual fund units and use the proceeds to buy ETFs. It’s important to consider potential capital gains tax implications when making this switch.

Are ETFs suitable for long-term investors?

Yes, ETFs can be a great choice for long-term investors. They offer low costs, tax efficiency, and diversification, making them an attractive option for those looking to build wealth over time. Investors can track broad market indices or specific sectors with minimal management fees.

What are the risks of investing in ETFs?

While ETFs offer diversification and liquidity, they are subject to market risks. The value of an ETF can fluctuate based on the underlying assets or indices. Additionally, some ETFs may be more volatile, especially sectoral or thematic ETFs.

Can I invest in ETFs with small amounts?

Yes, you can invest in ETFs with small amounts, as there is no minimum investment requirement. You can buy as little as one unit of an ETF, making it accessible for both beginner and experienced investors.

What are the key differences between equity ETFs and bond ETFs?

Equity ETFs invest in stocks and track indices like the Nifty 50 or Sensex, while bond ETFs invest in government or corporate bonds. Equity ETFs are generally more volatile and suitable for growth, while bond ETFs offer stability and are ideal for conservative investors seeking fixed income.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Your Wealth-Building Journey Starts Here

You might also Like.

ETF vs Mutual Fund: Which Investment Option Suits You Best?

Understand the difference between ETF Vs Mutual Funds Table of...