In the world of mutual funds, Flexi Cap Funds have gained popularity for their versatility and potential to balance growth and risk. They provide fund managers the freedom to invest in companies of all sizes—large-cap, mid-cap, and small-cap—based on market conditions. This article covers everything you need to know about Flexi Cap Funds, including what they are, their benefits and risks, top-performing funds, and guidance on selecting the best Flexi Cap mutual funds for your portfolio.

Table of Contents

What is a Flexi Cap Fund?

A Flexi Cap Fund is an equity mutual fund that invests in companies of all market capitalizations without fixed proportions. This flexibility allows fund managers to shift investments between large-cap, mid-cap, and small-cap stocks according to market dynamics, optimizing for both growth and stability.

Flexi-cap funds differ from Multi-Cap Funds, which have specific investment limits across different market caps. In Flexi-cap Funds, the manager has greater discretion when navigating the markets.

Why Are Flexi Cap Funds Popular?

Flexi Cap Funds are particularly popular among retail investors in India due to their adaptable structure, which gives fund managers the flexibility to adjust allocations as needed. This flexibility means the manager can capitalize on growth opportunities in mid or small caps during bullish times, and switch to large caps during more volatile periods, balancing potential risks and rewards.

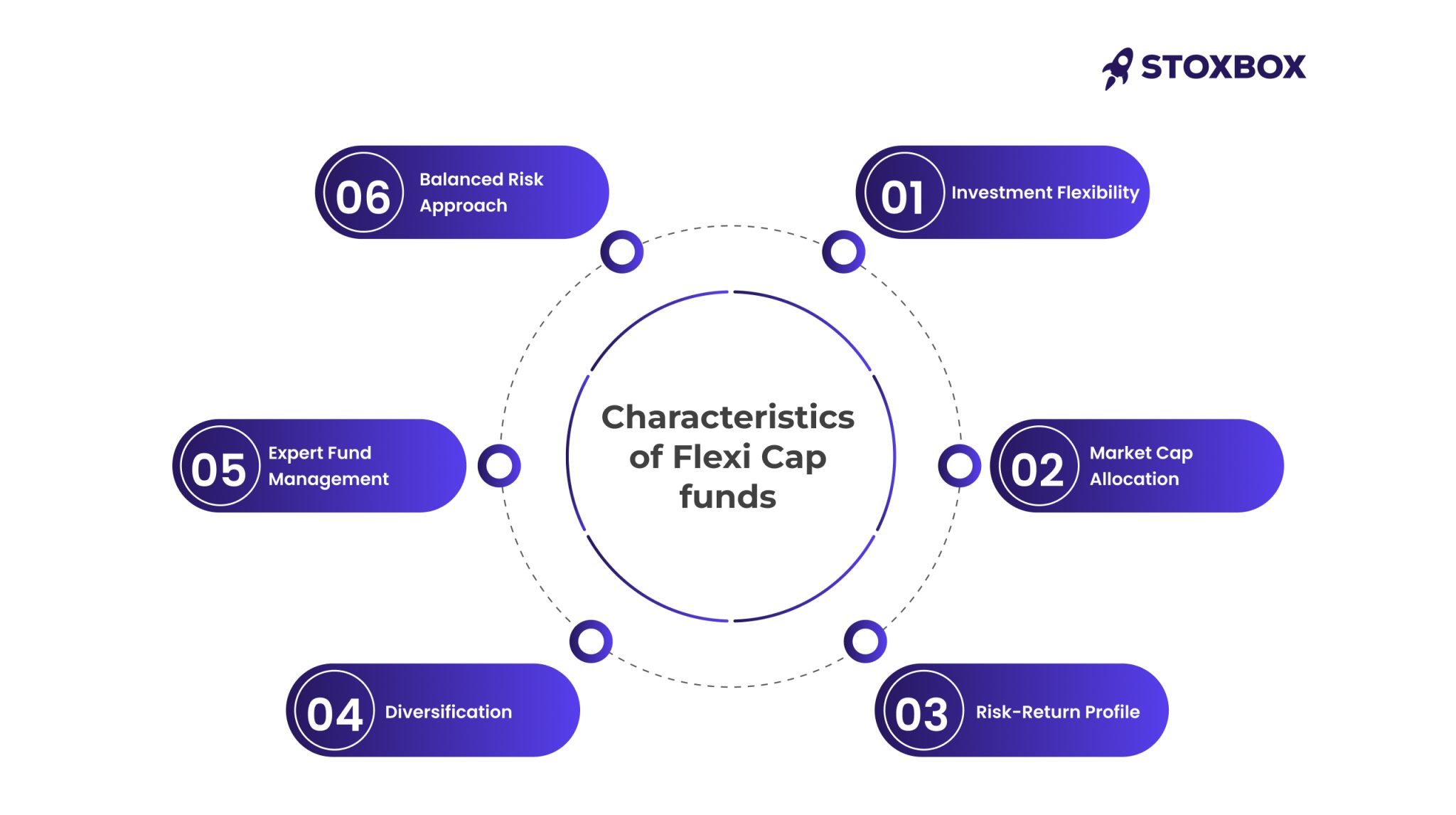

Characteristics and Benefits of Flexi Cap Funds

1. Investment Flexibility

Flexi Cap Funds allow fund managers to adapt investments across market caps as per the economic climate. During market upswings, managers may increase mid and small-cap stocks to capitalize on growth. Conversely, in a downturn, managers can lean on large-cap stocks, offering greater resilience.

2. Market Cap Allocation

The allocation between large, mid, and small-cap stocks in a Flexi Cap Fund is not fixed. Fund managers make allocation decisions to leverage market opportunities while balancing growth with stability.

3. Risk-Return Profile

Flexi Cap Funds typically offer moderate risk, given their ability to diversify across market caps. Their balanced approach offers growth potential with relatively lower volatility than purely small or mid-cap funds.

4. Diversification

Flexi Cap Funds provide diversification benefits by investing across sectors and market caps. This mix mitigates risk compared to funds that focus solely on one segment, allowing for greater stability.

5. Expert Fund Management

Fund managers actively manage Flexi Cap Funds, which means professional insights drive allocation decisions. Their expertise can help investors navigate volatile markets more effectively, potentially enhancing returns.

6. Balanced Risk Approach

The blend of large, mid, and small-cap stocks in Flexi Cap Funds provides a balanced approach, making these funds suitable for investors seeking both stability and growth.

Risks Involved in Flexi Cap Funds

Market Risks

Flexi Cap Funds are exposed to overall market risks that affect all equity investments. These risks are influenced by macroeconomic factors such as changes in government policies, global economic conditions, inflation, interest rate fluctuations, and geopolitical events. For instance, a downturn in the broader market can lead to significant losses in the value of investments within Flexi Cap Funds.

Allocation Risks

One of the primary risks with Flexi Cap Funds is the allocation decision made by the fund manager. Since these funds are flexible, the fund manager might allocate a larger proportion to small or mid-cap stocks, which can be riskier compared to large-cap stocks. Incorrect allocation or misjudging the market trend can lead to suboptimal returns or even losses. The success of these funds largely depends on the expertise of the fund manager in balancing the allocation between large, mid, and small-cap stocks.

Volatility

Flexi Cap Funds invest in companies across different market capitalizations, including mid and small-cap stocks, which are inherently more volatile compared to large-cap stocks. This makes Flexi Cap Funds more susceptible to short-term market volatility. During periods of market correction, small and mid-cap stocks tend to be more adversely affected, resulting in higher fluctuations in the fund’s value. While this volatility can present opportunities for high returns, it also exposes investors to the risk of significant short-term losses.

Example Scenarios in the Indian Market

1. Performance During Bull Market

During a bull market, where the stock market is experiencing an upward trend, Flexi Cap Funds tend to allocate more towards mid and small-cap stocks, which have higher growth potential. For instance, in the bull market of 2020-2021, many Flexi Cap Funds saw substantial gains by investing heavily in sectors like IT and pharmaceuticals, which showed considerable growth during that period. This strategy allows the funds to capitalize on the rapid appreciation of smaller companies when investor sentiment is optimistic and growth is strong.

2. Performance During Bear Market

In a bear market, characterized by declining prices and negative investor sentiment, Flexi Cap Funds may shift their allocation towards larger, more stable companies to minimize risk. For example, during the market correction in early 2020 due to the COVID-19 pandemic, many Flexi Cap Funds reallocated investments into large-cap stocks like Reliance Industries and HDFC Bank, which are relatively less volatile and provide stability during downturns. This approach helped to cushion the impact of market declines and limit the downside for investors.

List of Top Flexi Cap Funds in India

The following funds are some of the best-performing Flexi Cap Funds based on historical returns, asset quality, and management experience:

- SBI Flexi Cap Fund

- HDFC Flexi Cap Fund

- ICICI Prudential Flexi Cap Fund

- Parag Parikh Flexi Cap Fund

- Axis Flexi Cap Fund

- UTI Flexi Cap Fund

- Kotak Flexi Cap Fund

- Nippon India Flexi Cap Fund

- Mirae Asset Flexi Cap Fund

- Bajaj Finserv Flexi Cap Fund

- Tata Flexi Cap Fund

- HSBC Flexi Cap Fund

Key Factors to Evaluate When Choosing a Flexi Cap Fund

When selecting the best Flexi Cap mutual funds, consider the following factors:

1. Historical Returns

- Consistency Across Market Cycles: One of the most reliable indicators of a fund’s potential is its historical performance, specifically its consistency over a 3-5 year period. Flexi Cap funds that perform well across different market cycles, including both bullish and bearish trends, demonstrate their resilience and management strength.

- Benchmark Comparison: Look at how the fund’s returns compare to its benchmark index. A strong Flexi Cap fund will often outperform its benchmark, especially during market upswings and downturns, indicating robust management strategies and the fund’s ability to adapt to changing economic conditions.

- Risk-Adjusted Returns: It’s important to not only focus on raw returns but also evaluate the risk-adjusted returns, such as the Sharpe Ratio. This measure helps investors understand how well the fund performed in relation to the level of risk taken, offering a clearer picture of its efficiency in generating returns.

2. Expense Ratio

- Lower Cost, Higher Net Returns: The expense ratio represents the percentage of the fund’s assets used to cover its operating expenses, including management and administrative costs. A lower expense ratio means a larger portion of the fund’s gross returns is retained, resulting in higher net returns for investors.

- Impact on Compounded Growth: Over the long term, even a small difference in expense ratios can significantly impact compounded growth. For example, a difference of 0.5% in the expense ratio can result in a substantial difference in returns over a 10-15 year horizon.

- Comparative Analysis: It’s essential to compare expense ratios among funds within the same category. A competitive expense ratio for a Flexi Cap fund can indicate efficient fund management, which may improve investor returns while keeping operational costs low.

3. Fund Manager’s Experience

- Expertise and Track Record: The fund manager’s experience and track record are critical, especially in Flexi Cap funds, where allocations vary across market caps. An experienced manager is more likely to make timely decisions and adjust allocations based on market conditions, ensuring the fund is well-positioned to capture growth while managing risk.

- Adaptability and Strategic Decision-Making: Flexi Cap fund managers often have to make decisions about balancing large-cap stability with mid and small-cap growth potential. Managers with a strong background in handling diverse market conditions can add value by strategically adjusting the portfolio’s composition to optimize returns.

- Investment Philosophy: Understanding the manager’s investment philosophy, including their approach to market cap allocation, risk tolerance, and sector preference, can also give investors insight into how the fund might behave over the long term and align with their personal investment goals.

4. Assets Under Management (AUM)

- Stability and Liquidity: A higher AUM often indicates that a fund has the stability and liquidity necessary to handle large transactions without significantly impacting its price. Large funds can distribute fixed costs across a more extensive asset base, helping them achieve greater operational efficiency and stability.

- Investor Confidence: Large AUM generally reflects strong investor confidence and interest in the fund, suggesting it has performed well historically and has attracted a substantial amount of capital.

- Impact on Strategy: Although larger AUM can add stability, overly large funds may have limited flexibility to invest in smaller or mid-cap stocks without influencing the market price. This can sometimes constrain the fund’s ability to take advantage of high-growth opportunities. It’s important for investors to consider whether the fund’s AUM aligns with its strategy and market cap allocation approach.

By evaluating these criteria—historical returns, expense ratio, fund manager experience, and AUM—investors can make informed decisions when selecting a Flexi Cap fund that aligns with their financial goals and risk tolerance, ultimately contributing to a balanced and potentially rewarding investment portfolio.

Tax Implications for Flexi Cap Funds

Capital Gains Tax

Gains from Flexi Cap Funds held for less than one year are taxed at 15% (short-term capital gains). Gains from investments held for more than one year are taxed at 10% (long-term capital gains) for gains exceeding ₹1 lakh.

Dividend Distribution Tax

If you choose the dividend payout option, dividends are subject to a 10% dividend distribution tax.

Who Should Invest in Flexi Cap Funds?

Flexi Cap Funds are versatile mutual funds that appeal to a range of investors due to their flexible investment approach. Let’s break down the profiles, investment goals, and risk tolerance levels that make Flexi Cap Funds an ideal choice for many.

Investor Profiles

- Moderate to High-Risk Tolerance: Flexi Cap Funds suit investors who can handle moderate to high levels of risk. Unlike large-cap-focused funds, which offer relative stability, Flexi Cap Funds invest across large, mid, and small-cap stocks. This diversified allocation means they carry slightly more risk than purely large-cap funds, but they offer growth potential that can reward investors with higher risk tolerance.

- Medium to Long-Term Investment Horizons: These funds are particularly suitable for investors who can commit to a medium to long-term investment horizon, typically 5 to 10 years or more. The long-term approach allows investors to weather short-term market volatility, capitalizing on potential growth opportunities in both mid and small-cap stocks. The flexible allocation within Flexi Cap Funds gives fund managers the ability to shift investments according to market conditions, which tends to benefit patient, long-term investors.

Investment Goals

- Growth Potential with Stability: Flexi Cap Funds offer a balanced mix of growth and stability, which can appeal to investors looking for capital appreciation without excessive risk. They provide exposure to the growth potential of mid and small-cap stocks, which tend to deliver higher returns in bull markets, while large-cap stocks contribute stability. This makes Flexi Cap Funds suitable for investors who seek higher returns than conservative large-cap funds but want to avoid the volatility of pure small or mid-cap funds.

- Diversification Across Market Caps: A key benefit of Flexi Cap Funds is their diversification across all market caps, giving investors exposure to various sectors and market conditions. This balanced allocation can be advantageous for investors aiming for a well-rounded portfolio that doesn’t rely solely on one segment of the market. It ensures that the fund can capture opportunities across all market segments, allowing for growth in dynamic economic environments.

Risk Tolerance and Financial Goals

- Balanced Risk-Return Profile: The flexibility of Flexi Cap Funds in shifting investments based on market dynamics results in a balanced risk-return profile. For investors with moderate risk tolerance, Flexi Cap Funds are appealing because they can benefit from mid and small-cap growth while being buffered by the stability of large-cap stocks. This mix reduces the impact of market downturns on the portfolio, as fund managers can adjust allocations to safer large-cap stocks during volatile periods.

- Participation in Market Growth: For investors looking to participate in market growth without taking on the concentrated risks of small or mid-cap-focused funds, Flexi Cap Funds offer a strategic solution. They allow investors to benefit from high-growth stocks during market upswings while maintaining some stability during downturns. This makes them an excellent choice for individuals who wish to capitalize on equity market growth but prefer a diversified approach.

- Alignment with Financial Goals: Flexi Cap Funds cater to investors who aim for moderate to high growth in their investment portfolios, aligning with goals such as wealth accumulation for future needs, funding major expenses, or retirement planning. The diversified nature of Flexi Cap Funds can meet various financial goals, as they offer a balanced approach to investing that neither skews too conservatively nor aggressively.

Comparing Flexi Cap Funds with Other Types of Funds

| Comparison | Flexi Cap Funds | Multi Cap Funds | Large Cap Funds | Mid Cap and Small Cap Funds | Sectoral/Thematic Funds |

|---|---|---|---|---|---|

| Definition | Equity funds that can invest across large, mid, and small-cap stocks without any fixed allocation constraints. | Equity funds with fixed minimum allocations to large, mid, and small-cap stocks (usually 25% each). | Equity funds that primarily invest in large-cap stocks, focusing on stable, established companies. | Equity funds that focus solely on mid or small-cap stocks, with high growth potential but increased volatility. | Equity funds that focus on specific sectors (e.g., technology, healthcare) or themes (e.g., ESG, infrastructure). |

| Flexibility in Allocation | Highly flexible, allowing fund managers to dynamically shift across market caps based on market conditions. | Fixed allocation requirements, limiting the fund manager’s ability to adapt to changing market conditions. | Limited to large-cap stocks; minimal flexibility to diversify into mid or small-cap stocks. | Focused allocation in mid or small-cap stocks, offering little diversification into larger, more stable companies. | Restricted to specific sectors or themes, limiting flexibility in investment allocation. |

| Risk Profile | Moderately diversified; balanced risk by mixing large, mid, and small caps. | Moderately diversified across all market caps but with fixed exposure, which may increase risk in certain markets. | Lower risk due to focus on large-cap, stable companies, making it suitable for conservative investors. | Higher risk due to focus on volatile mid or small-cap stocks, suitable for aggressive investors seeking growth. | Higher risk as investments are concentrated in specific industries or themes, increasing vulnerability to sector-specific risks. |

| Return Potential | Good growth potential due to exposure to all market caps, with stability from large caps and growth from mid/small caps. | Moderate to high, depending on market conditions and fixed exposure requirements. | Stable returns; less growth potential as compared to Flexi Cap due to limited exposure to smaller-cap growth. | High growth potential in bull markets due to focus on smaller, high-growth companies. | High returns possible in specific market cycles, but highly dependent on sector or theme performance. |

| Diversification | Provides broad diversification across sectors and market caps. | Broad diversification across market caps but lacks flexibility. | Limited diversification; focused mainly on large caps. | Limited diversification within mid or small caps; concentrated risk. | Limited to specific sectors/themes; lacks comprehensive diversification. |

| Ideal for | Investors seek a mix of stability and growth with moderate risk and flexibility to adapt to market changes. | Investors who prefer a structured allocation across market caps and can handle moderate risk. | Conservative investors looking for stability with minimal exposure to mid or small-cap stocks. | Aggressive investors with a high-risk tolerance looking to capitalize on high-growth mid and small-cap stocks. | Sector-savvy investors with a high-risk tolerance, who understand sector-specific dynamics. |

| Market Conditions Impact | Performs well in both stable and volatile markets due to flexible allocation. | Allocation limits may restrict performance if a particular market cap segment underperforms. | Performs well in stable markets; may lag behind in growth cycles dominated by smaller caps. | Performs best in bullish markets where mid/small caps thrive; high risk during downturns. | Highly volatile and dependent on sector-specific trends; risky during sector downturns. |

| Investment Horizon | Suitable for medium to long-term investment horizons. | Suitable for medium to long-term investment horizons due to fixed allocation across market caps. | Ideal for long-term investors seeking steady returns with less risk. | Suitable for long-term investors who can handle volatility in pursuit of higher returns. | Suitable for long-term investors familiar with sector-specific risks, aiming to leverage sector boom |

Conclusion

Flexi Cap Funds offer a balanced approach to equity investment, combining growth and stability by investing across large, mid, and small-cap stocks. They are well-suited for investors seeking diversified exposure to the equity market with moderate to high risk tolerance and a long-term view.

With popular funds such as the Parag Parikh Flexi Cap Fund, HDFC Flexi Cap Fund, Axis Flexi Cap Fund, SBI Flexi Cap Fund, and ICICI Flexi Cap Fund, there are plenty of options for both novice and experienced investors. By understanding the unique features of these funds and assessing their historical performance, expense ratios, and management, you can make an informed decision that aligns with your financial goals.

In choosing the right Flexi Cap Fund, remember that a well-managed fund can provide a secure yet flexible investment experience in India’s evolving financial landscape, helping you achieve your investment objectives over time.

Frequently Asked Questions

How do Flexi Cap Funds offer flexibility in investment?

Flexi Cap Funds provide flexibility by allowing fund managers to allocate investments across large, mid, and small-cap stocks without any fixed proportion. This means that fund managers can shift the portfolio focus based on market conditions and opportunities, potentially enhancing returns and managing risk more effectively.

Can Flexi Cap Funds help mitigate risk through diversification?

Yes, Flexi Cap Funds help mitigate risk through diversification as they invest in companies across various market caps and sectors. This diversified approach can reduce the impact of poor performance in any single segment, balancing growth potential with stability and reducing volatility compared to single cap-focused funds.

What are the potential downsides of investing in Flexi Cap Funds?

While Flexi Cap Funds offer diversification, they still carry some risks. Market volatility can impact performance, particularly when the fund manager’s allocation decisions do not align with market trends. Additionally, returns may vary based on the fund manager’s expertise and market timing, which can lead to underperformance in certain market phases.

How can a retail investor evaluate which Flexi Cap Fund to choose?

Retail investors should look at factors such as the fund’s historical performance, expense ratio, and the experience of the fund manager. Evaluating the fund’s consistency in returns over various market cycles and the assets under management (AUM) can also provide insights into the fund’s stability and potential. Seeking a fund with a low expense ratio and a skilled manager can lead to better net returns.

Do Flexi Cap Funds have a fixed percentage for large, mid, and small-cap investments?

No, Flexi Cap Funds do not have a fixed allocation for large, mid, and small-cap stocks. This structure allows fund managers the freedom to invest in any proportion across market caps based on market conditions, valuations, and growth opportunities, maximizing the fund’s adaptability and potential returns.

Is there an ideal market condition for investing in Flexi Cap Funds?

Flexi Cap Funds are designed to adapt to various market conditions, making them suitable for both bullish and bearish markets. They perform well in a bullish market as they can invest in mid and small-cap stocks, which tend to outperform. During market downturns, managers can pivot to large-cap stocks for greater stability, making Flexi Cap Funds versatile in most market environments.

Your Wealth-Building Journey Starts Here