To say that the year 2020 was a roller-coaster ride would be an understatement. As the COVID-19 pandemic hit India, we saw what we had never seen before – lockdowns. Consecutive lockdowns brought a halt to life as we know it. Even the financial markets started falling as there was increased uncertainty.

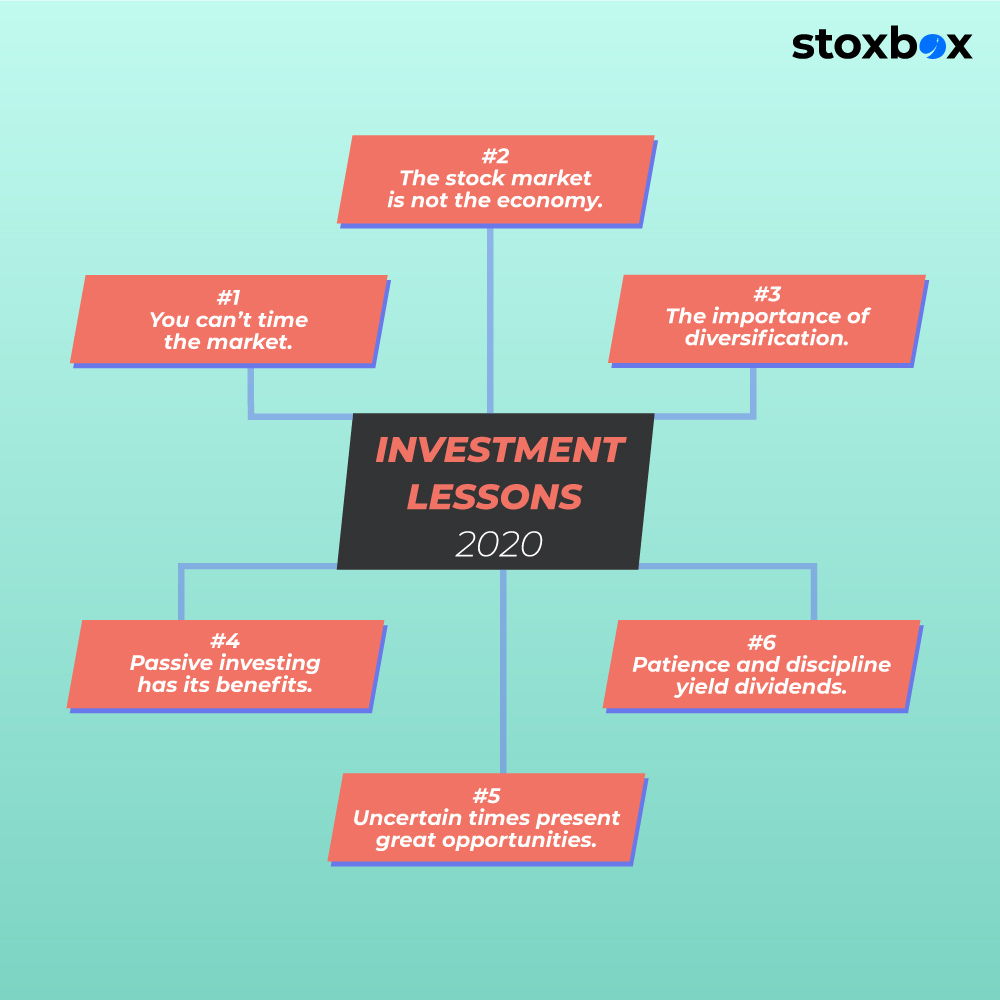

Though 2020 was an unusual year, it also taught us quite a few investment lessons. Want to know what these lessons were?

Let’s have a look!

Lesson#1 – You can’t time the market.

Financial markets are volatile. They fluctuate depending on the macroeconomic and microeconomic trends. One minute the market would be performing well, and the next minute it might crash. For instance, the NSE and BSE indices after the Janata Curfew were announced on 22nd March 2020. Both these indices fell by 29% and 13.2%, respectively, on 23rd March 2020. (Source: https://www.researchsquare.com/article/rs-57471/v1.pdf). Just one day and the market had a considerable fluctuation!

Timing the market is, therefore, difficult, especially if you are an amateur investor. If you are waiting for the right time, you might lose out on the profit potential of the market. So, invest your money regularly rather than waiting for the right time. If you are looking for where to invest money, you can start a SIP. It would allow you to invest without timing the market and create a good corpus over a long-term period.

Lesson#2 – The stock market is not the economy.

Another mistake that many investors make is to consider the stock market as the whole of the economy. It is not true. The stock market is a part of the economy, not the economy itself. So, even when the stock market might be rising, the economy might be in a slowdown. Take the latest scenario itself. Even though the stock markets recovered to their pre-COVID levels, the economy hit a recession.

So, read the economic and stock market trends independently when making investment decisions. If you want to invest in the stock market to maximize the return potential of your portfolio, start with basics. Learn the basics of trading in the stock market and then start your investment journey.

Lesson#3 – The importance of diversification.

Do you understand the importance of a balanced meal?

If you do, the same importance applies to a diversified portfolio. Playing favourites with the different investment options in India is bad. If you expose your savings to only one kind of investment avenue, you depend on the avenue for your returns. If the avenue does not perform as expected, you might face a loss. For instance, if you invested only in the stock market before the pandemic, the market crash following the lockdown would have wiped out your savings. On the other hand, if you had a diversified portfolio consisting of equity and other safe investments like debt, the debt component would have provided returns even when the market was falling. The year 2020, therefore, stressed the importance of a diversified portfolio which contains a range of investment avenues for diversifying the investment risks and maximizing returns.

If you are looking for a readymade diversified portfolio, you can opt for Stoxbox which contains different types of investment instruments. You can, therefore, diversify your savings for minimal risks and maximum returns.

Lesson#4 – Passive investing has its benefits.

Passive investing became beneficial when the pandemic was driving the market down. Through passive investing, you can try and match the market performance, especially in uncertain times. You can hold a diversified portfolio, minimize buying and selling activities and watch your investments perform as per the market movements. By switching to passive investing, you can minimize the investment risk which is associated with active investing. Moreover, if you are a beginner in the investment world, passive investing can prove to be a boon.

You can try passive investing through Stoxbox which allows you to invest in a basket of investment avenues, carefully picked based on fundamental, quantitative, and qualitative analysis by experts.

Lesson#5 – Uncertain times present great opportunities.

The year 2020 also proved that uncertain times do not have to be difficult times for investments. They can present great opportunities to invest in the stock market. Take the example of the Indian stock market during and after the pandemic. Even though the NSE and BSE fell considerably for months from March 2020, today they are at an all-time high!

Thus, during uncertain times, when the market is down, you can invest in good stocks at discounted prices. Thereafter, when the market recovers, as it always does, you can earn attractive returns as the stock prices rise.

Thus, do not get disheartened by uncertain times. Understand the stock market and take advantage of such times. They are a great opportunity to invest so that when the good times roll, your investments can rise with the rising markets.

Lesson#6 – Patience and discipline yield dividends.

The virtue of patience and discipline cannot be gainsaid when it comes to investing. In the words of Warren Buffet himself – ‘Successful investing takes time, discipline and patience. You can’t produce a baby in one month by getting nine women pregnant.’

2020 also taught us the importance of patience and discipline as investors held on to their investments when the markets were falling, only to benefit when the markets corrected themselves. If you want your investments to yield returns, you need to be a disciplined investor who has the patience to wait for the tides to turn. Impatience or the attraction of quick bucks never made smart investors.

Conclusion

Though unprecedented, the year 2020 was a good teacher. It gave us nuggets of investment wisdom which, if you apply in 2021 for investments in India, you can earn good returns. So, learn these important investment lessons from 2020 to avoid mistakes and to make 2021 and future years profitable.

You might also Like.

No posts found!