Understand the concept of long-legged doji candlestick and how it helps

Table of Contents

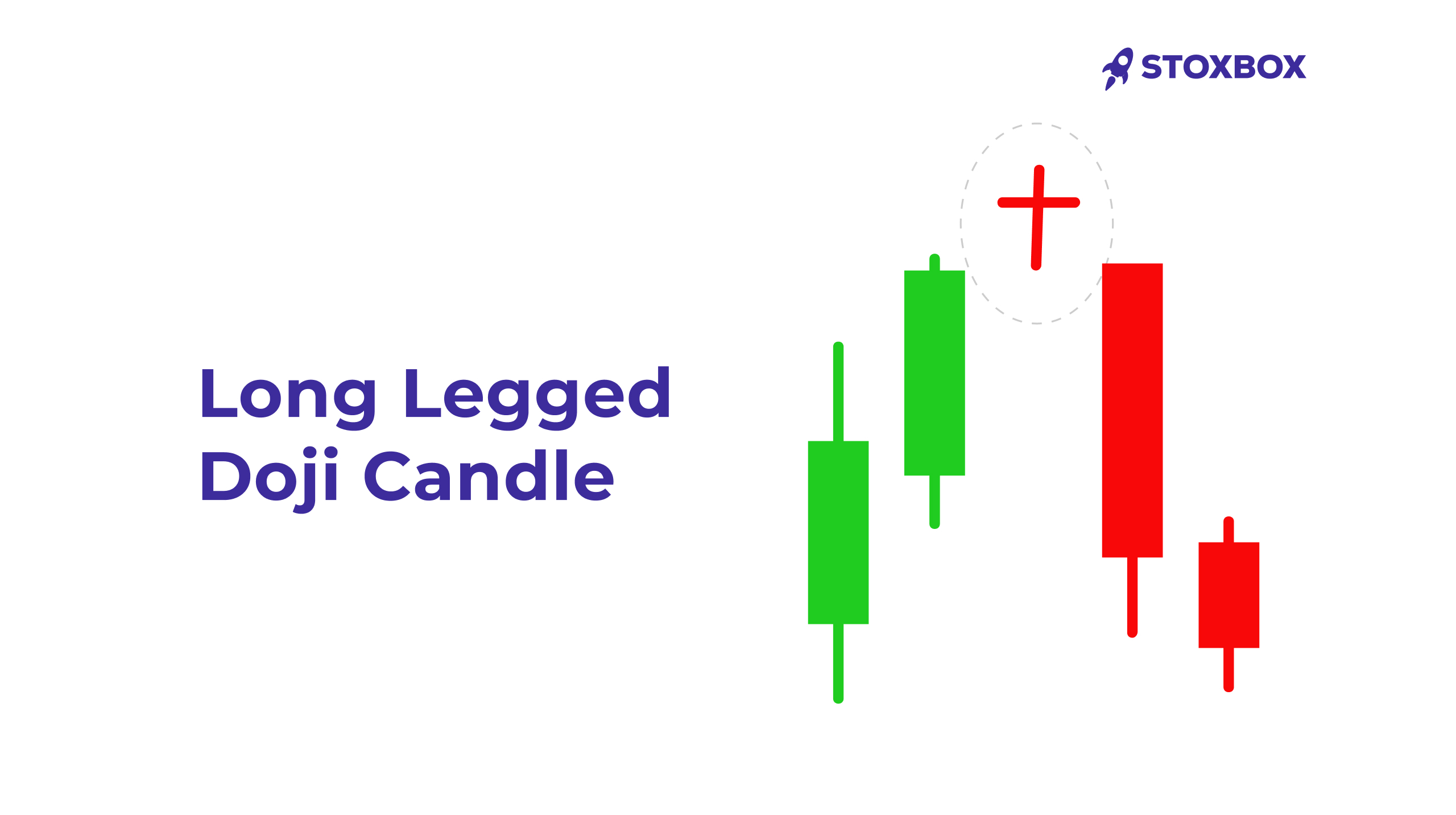

Candlestick patterns are critical in technical analysis, helping traders understand market behavior and make informed decisions. Among these patterns, the long-legged doji stands out for its ability to signal indecision in the market. This blog will explore the long-legged doji candlestick pattern, its meaning, and how Indian traders can leverage it effectively.

What is a Long-Legged Doji?

The long-legged doji is a unique candlestick pattern that indicates market indecision. It forms when the opening and closing prices of an asset are nearly the same, resulting in a small real body, but with long extended shadows (wicks) above and below. These long shadows indicate significant price fluctuations during the session.

Significance in Technical Analysis

The long-legged doji candlestick is a cornerstone of technical analysis, reflecting a critical state of market indecision. This pattern emerges when buyers and sellers are in a tug-of-war, with neither side managing to take control by the session’s end. The resulting candlestick has a small real body, indicating that the opening and closing prices are nearly identical, despite significant price movement throughout the session.

For Indian traders, spotting a long-legged doji on key stocks like Reliance Industries, Infosys, or indices like Nifty 50 or Sensex is particularly important. These patterns often occur at pivotal moments in the market, such as after sustained uptrends or downtrends, signaling potential reversals or periods of consolidation. This makes them an invaluable tool for predicting changes in market sentiment.

Why Traders Should Pay Attention?

Indicative of Reversals

The long-legged doji often precedes a reversal in trend. For instance, after a prolonged downtrend, its appearance might signal the exhaustion of selling pressure, setting the stage for an upward movement. Conversely, after an uptrend, it could indicate a loss of bullish momentum.

High Occurrence in Indian Markets

Large-cap stocks like HDFC Bank, Tata Consultancy Services (TCS), or sectors represented in Sensex frequently display this pattern. Given the volatility in these markets, the long-legged doji candle often provides early warnings for impending market shifts, especially during earnings seasons or macroeconomic policy announcements.

Adaptability Across Markets

This candlestick pattern is versatile and valuable for traders across different strategies. Intraday traders can use it to time entries or exits, while positional traders can view it as a signal to reassess long-term strategies.

Characteristics of the Long-Legged Doji

Visual Features and How to Identify It

The long-legged doji is easily recognizable due to these distinct characteristics:

- Small Real Body: Positioned at the center of the candle, the real body reflects minimal difference between the opening and closing prices.

- Long Shadows (Wicks): The upper and lower shadows are significantly extended and nearly equal in length, indicating substantial price movement in both directions.

- Neutral Color: The candle can be green or red, depending on slight variations in price.

- Support or Resistance Zones: This pattern frequently forms near crucial levels of support or resistance, where buying and selling pressures are evenly matched.

Why It Matters

The long-legged doji is crucial for understanding market sentiment because:

- Indecision in the Market: It reveals that, despite aggressive buying and selling, the market fails to commit to a definitive direction.

- Momentum Shift Indicator: This indecision often signals a potential shift in momentum, making it an essential indicator for traders.

- Strategic Advantage: By recognizing its visual cues and analyzing its occurrence within the broader market context, traders can use this pattern to refine their timing and enhance decision-making.

Difference from Other Doji Patterns

| Pattern | Features | Market Context | Potential Implications |

|---|---|---|---|

| Long-Legged Doji | Long shadows on both sides, small real body. | Extreme indecision; found near trend exhaustion. | Signals potential reversal or consolidation. |

| Dragonfly Doji | Long lower shadow, little or no upper shadow. | Common in downtrends, signals a potential reversal. | Indicates a bullish reversal if followed by confirmation. |

| Gravestone Doji | Long upper shadow, little or no lower shadow. | Appears in uptrends, suggesting bearish reversal. | A bearish reversal if confirmed by the next candle. |

| Standard Doji | Small or no shadows, the real body is nearly absent. | Found during periods of low market activity or equilibrium. | Reflects indecision, often requiring context for interpretation. |

| Four-Price Doji | No shadows, single horizontal line as open, close, high, and low prices are identical. | Rare; indicates extremely low volatility. | Usually signals a consolidation phase or lack of trading interest. |

What Does a Long-Legged Doji Indicate?

Market Indecision and Its Implications

The long-legged doji reflects market indecision, where buyers and sellers battle for control, pushing prices high and low, but the market ultimately closes near its opening price. This pattern indicates that neither bulls nor bears have the upper hand, often signaling hesitation or exhaustion in the prevailing trend.

Potential for Trend Reversals

The long-legged doji frequently acts as a precursor to trend reversals:

- Bullish Reversal: Appears after a prolonged downtrend, suggesting that selling pressure is diminishing and buyers may begin to take control.

- Bearish Reversal: Found at the peak of an uptrend, indicating that upward momentum may be waning, with sellers preparing to dominate.

These reversals occur because the extended wicks show failed attempts to maintain higher or lower price levels, often marking the exhaustion of the current trend.

Importance of Confirmation

While the long-legged doji can hint at potential reversals, traders should wait for confirmation from subsequent price action or other technical indicators:

- Bullish Confirmation: A strong green candle following the doji validates an upward reversal.

- Bearish Confirmation: A red candle after the doji confirms a downward reversal.

Additional confirmation tools, such as increased trading volume, support/resistance levels, or momentum indicators, can further enhance reliability. Recognizing this pattern in broader market contexts, like near support or resistance zones, increases its predictive value.

Example Scenarios in the Indian Market

Bullish Reversal Example

Consider Infosys during a prolonged downtrend. A long-legged doji forms near a key support level, indicating that selling pressure has exhausted. The next candlestick is a bullish green candle, confirming a reversal. Traders interpret this as a buying opportunity, supported by increased trading volume.

Bearish Reversal Example

Suppose Reliance Industries experiences a strong rally and forms a long-legged doji near a key resistance level. The following day, a red candle confirms the reversal, signaling that the rally has likely peaked. Traders may take this as an opportunity to exit long positions or initiate short trades.

| Stock/Index | Scenario | Signal | Supporting Indicators |

|---|---|---|---|

| Infosys | Long-legged doji at a downtrend | Bullish reversal | High volume, support zone |

| Reliance Industries | Long-legged doji after an uptrend | Bearish reversal | Low volume, resistance zone |

Case Study: Nifty 50 in 2023

In mid-2023, the Nifty 50 index witnessed a long-legged doji after a steep rally fueled by robust FII inflows and optimism around quarterly earnings. The pattern appeared near a key resistance level. The next day, a bearish red candle confirmed a reversal, leading to a 2% correction over the following week. This shift marked the start of a broader consolidation phase in the market.

Key Insights from the Case Study:

- The long-legged doji signaled exhaustion in buying momentum.

- Confirmation came with a decline in volume and a bearish candlestick.

- Traders who identified the pattern and acted early were able to secure profits or adjust their portfolios.

How to Trade Using Long-Legged Doji

The long-legged doji candlestick is a powerful indicator for traders when combined with proper entry, exit, and risk management strategies. This candlestick reflects market indecision, and traders should wait for confirmation from subsequent candlesticks or other technical indicators before acting.

Entry and Exit Points

Entry Strategy

Bullish Trade:

Enter a buy position if the candlestick following the long-legged doji is green and closes above the high of the doji. This indicates that buying pressure has overtaken the indecision, potentially initiating an uptrend.

Example: A doji forms after a downtrend in Reliance Industries near a support level. If the next candle is green with a higher close, it suggests a potential bullish reversal.

Bearish Trade:

Enter a sell or short position if the next candle is red and closes below the low of the doji. This suggests that selling pressure has gained control, signaling a potential downward movement.

Example: A long-legged doji forming at resistance for Infosys followed by a bearish red candle could signify a downward trend.

Exit Strategy

Exit your position when:

- The trend shows signs of exhaustion, such as a reversal candlestick or declining momentum.

- Your predefined profit target is reached.

Example: If the bullish trade in Tata Motors achieves a 5% gain, exit to lock in profits, especially if the market shows signs of reversal.

Stop-Loss Placement

For Bullish Trades:

- Place the stop-loss slightly below the lower shadow (wick) of the long-legged doji. This accounts for minor price fluctuations while protecting against significant downward movements.

- Example: If the lower wick is at ₹250, a stop-loss at ₹248 provides reasonable protection.

For Bearish Trades:

- Place the stop-loss slightly above the upper shadow (wick) of the doji to safeguard against sudden upward price spikes.

- Example: If the upper wick is at ₹300, a stop-loss at ₹303 minimizes risk.

Combining with Other Indicators

Moving Averages (MA)

- The significance of a long-legged doji increases when it forms near major moving averages, such as the 200-day MA.

- Bullish Example: A doji near the 200-day MA on HDFC Bank stock followed by a green candle may indicate a strong reversal.

- Bearish Example: A doji at the 200-day MA resistance followed by a red candle could signal a bearish trend.

Relative Strength Index (RSI)

- Pair the long-legged doji with the RSI to confirm overbought or oversold conditions:

- Bullish Reversal: If the RSI is below 30 (oversold) and a doji forms, it strengthens the likelihood of an upward reversal.

- Bearish Reversal: If the RSI is above 70 (overbought) and a doji forms, it suggests a potential downward movement.

Additional Tools:

- Volume: Increased trading volume following the doji strengthens the confirmation of a breakout or reversal.

- Trendlines: A Doji near key trendline supports or resistances adds reliability to the signal.

Practical Example Table

| Scenario | Action | Stop-Loss Placement |

|---|---|---|

| Doji at Support + Green Candle | Enter a bullish trade; confirmation via RSI below 30 or MA breakout. | Below the lower wick of the doji. |

| Doji at Resistance + Red Candle | Enter a bearish trade; confirmation via RSI above 70 or trendline break. | Above the upper wick of the doji. |

| RSI Oversold + Bullish Doji | Strengthens bullish reversal signal; wait for volume confirmation. | Below the doji's lower wick. |

| RSI Overbought + Bearish Doji | Strengthens bearish reversal signal; exit long or enter short positions. | Above the doji's upper wick. |

By integrating long-legged doji candles with entry and exit rules, stop-loss placement, and confirmatory indicators, traders can navigate market indecision and improve their trading outcomes effectively.

Pros and Cons of Using Long-Legged Doji

Pros:

- Easy to Identify: The long-legged doji is visually distinct, making it accessible even for beginner traders.

- Spotting Market Reversals: It is highly effective in identifying potential turning points in trends when used with confirmation.

- Versatility: This pattern applies to all asset classes (stocks, commodities, forex) and works across different timeframes, from intraday to long-term trading.

Cons:

- Requires Confirmation: The long-legged doji is not reliable in isolation. False signals are common without corroborating indicators or candlestick patterns.

- False Signals in Consolidation: During periods of consolidation or sideways markets, the pattern’s predictive power is limited and often misleading.

- Dependency on Market Context: Its effectiveness varies depending on factors such as trend strength, support/resistance levels, and volume.

Common Mistakes When Trading Long-Legged Doji

The long-legged doji candlestick can be a powerful trading tool, but it requires careful interpretation and execution. Here are some common mistakes traders make and why avoiding them is crucial.

1. Ignoring Confirmation

A major pitfall for traders is acting solely on the appearance of a long-legged doji without waiting for the next candlestick to confirm the market direction. Since the doji itself reflects indecision, relying on it without validation can lead to premature trades and losses.

Why Confirmation is Essential: The next candle reveals whether the market resolves its indecision towards a bullish or bearish direction. For example:

- If a green candle forms after the doji and closes above the doji’s high, it confirms a bullish signal.

- Conversely, a red candle closing below the doji’s low indicates bearish momentum.

Mistake in Practice: A trader sees a long-legged doji during a downtrend in Reliance Industries and immediately buys without waiting for confirmation. If the next candle is bearish, the trader incurs losses.

2. Overlooking Context

Another frequent mistake is interpreting the long-legged doji in isolation without considering the broader market context, such as trends, support, resistance, and trading volume.

Why Context Matters:

- A long-legged doji near support could signal a bullish reversal, while a doji near resistance might indicate a bearish reversal.

- Trading volume provides clues about the strength of the signal. Higher volumes lend more credibility to the pattern.

Mistake in Practice: A trader identifies a long-legged doji in Infosys but ignores the fact that it formed in a consolidating market. Acting on it without recognizing the lack of a decisive trend leads to a false trade.

3. Using in Isolation

Relying solely on the long-legged doji without combining it with other technical indicators or market signals is a common error. While the doji provides valuable information, it is not foolproof and benefits greatly from additional confirmation.

Why Supplementary Indicators Help:

- Moving Averages (MA): Help confirm trends or reversals when the doji forms near significant moving averages.

- Relative Strength Index (RSI): Confirms overbought or oversold conditions, increasing the accuracy of the signal.

- Volume Analysis: High trading volume during a doji formation adds weight to its significance.

Mistake in Practice: A trader sees a doji at resistance but ignores that the RSI is not in the overbought zone. This oversight weakens the validity of the bearish signal and may lead to missed opportunities or losses.

How to Avoid These Mistakes

- Always Wait for Confirmation: Make trades based on the candlestick following the doji to avoid false signals.

- Analyze Market Context: Use support/resistance levels, trends, and volume to add depth to your analysis.

- Combine with Indicators: Incorporate tools like moving averages, RSI, or MACD for enhanced accuracy.

- Stay Objective: Avoid emotional trading by sticking to a clear strategy and being patient for confirmations.

By addressing these mistakes, traders can significantly improve their success rate when using the long-legged doji candlestick pattern.

Long-Legged Doji vs Other Candlestick Patterns

| Aspect | Long-Legged Doji | Hammer | Shooting Star | Spinning Top | Engulfing Candlestick |

|---|---|---|---|---|---|

| Shadows | Long on both sides of the real body. | Long lower shadow, no upper shadow. | Long upper shadow, no lower shadow. | Shorter shadows on both sides. | No shadows; the second candle engulfs the first. |

| Meaning | Reflects market indecision between buyers and sellers. | Indicates a bullish reversal after a downtrend. | Suggests a bearish reversal after an uptrend. | Indicates indecision but with less price movement. | Indicates strong reversal (bullish or bearish). |

| Position in Trend | Appears at the top or bottom of trends. | Found at the end of a downtrend. | Found at the end of an uptrend. | Can appear in consolidations or trends. | Found at trend extremes, signaling reversals. |

| Strength of Signal | Requires confirmation from subsequent candles. | Strong bullish signal with confirmation. | Strong bearish signal with confirmation. | Weak signal compared to the long-legged doji. | Strong signal, often does not need confirmation. |

| Volume Impact | High volume during the doji adds credibility. | High volume strengthens the reversal signal. | High volume confirms selling pressure. | Volume adds limited significance. | Volume adds strength to the engulfing pattern. |

Key Takeaways

Versatility of the Long-Legged Doji

Unlike many patterns (e.g., hammer, shooting star), the long-legged doji is neutral, signaling indecision rather than a clear reversal direction. It is equally likely to appear at the top or bottom of a trend, making it versatile but dependent on confirmation.

Strength in Confirmation

The long-legged doji relies heavily on the subsequent candle for confirmation, unlike patterns like the engulfing candlestick, which are inherently stronger signals.

Complementary Role

It is most effective when combined with indicators like volume, support/resistance levels, or momentum tools like RSI, while patterns like the hammer or shooting star are more definitive in isolation.

Market Context

The long-legged doji’s significance is amplified in volatile markets or near key price zones. Patterns like the hammer or shooting star are more straightforward in trending markets.

Conclusion

The long-legged doji candlestick pattern is a vital tool for traders to interpret market indecision and potential reversals. While it holds significance, confirmation with supplementary indicators and analysis is essential. Indian traders can use this pattern effectively in actively traded markets like Nifty 50, Sensex, or major stocks such as Reliance and Infosys.

By incorporating historical data, technical indicators, and risk management strategies, you can unlock the true potential of this pattern to make informed trading decisions. Whether you are analyzing a long-legged doji candle meaning for bullish reversals or bearish setups, remember that context and confirmation are key to success in the stock market.

Frequently Asked Questions

What does a long-legged doji mean in Nifty trading?

It indicates market indecision, often signaling a potential reversal in the Nifty 50 index.

Is the long-legged doji pattern reliable for day trading in India?

Yes, but it should be used with other indicators like RSI or volume for better accuracy.

How do you confirm a reversal after a long-legged doji on Sensex?

Wait for the next candle. A green candle signals a bullish reversal & a red candle suggests a bearish reversal.

Can the long-legged doji indicate trend continuation?

Rarely. It usually signals reversal but it can sometimes suggest consolidation in strong trends.

What does a long-legged doji at resistance mean?

It indicates strong indecision and a potential bearish reversal at resistance levels.

What is the difference between a red doji candle and a long-legged doji?

A red doji candle has a slight bearish bias, while a long-legged doji reflects pure indecision, with equal pressure from buyers and sellers.

Your Wealth-Building Journey Starts Here