Table of Contents

Investing in the stock market is a significant way individuals can grow their wealth, especially in an expanding economy like India’s. Among the various types of investments available, equity shares hold a special place. But what exactly are equity shares, and why do they matter to investors, both seasoned and new? This blog will help you understand the essence of equity shares from an Indian perspective, aiming to highlight why they could be a valuable component of your investment portfolio.

What is Equity Shares?

Equity shares, also known as ordinary shares or common stock, represent partial ownership in a company. When individuals purchase equity shares, they become shareholders and gain certain rights, including voting in key company decisions and receiving a share of profits in the form of dividends (if declared).

These shares carry the highest risk among all types of securities but also offer the potential for higher returns through capital appreciation. Unlike preference shares, equity shareholders are the last to receive residual assets in the event of company liquidation, reinforcing their role as true owners with both upside potential and downside risk.

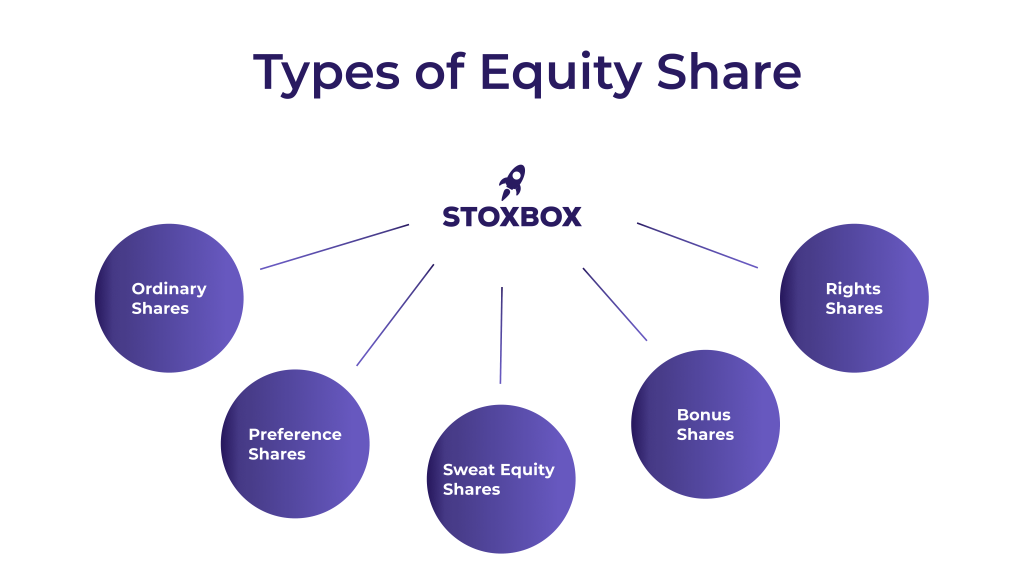

Types of Equity Shares

Understanding the various types of equity shares is crucial. These shares represent ownership in a company, but with some key distinctions. Here’s a breakdown of the most common types of equity shares:

1. Ordinary Shares (Common Stock):

These are the standard ownership units of a company.

- Voting Rights: Ordinary shareholders hold voting rights, allowing them to participate in important decisions that affect the company’s future, such as electing board members and approving major financial proposals. Their voting power is usually proportional to the number of shares they hold (more shares, more say).

- Dividends: Dividends for ordinary shareholders are not guaranteed. The company’s board of directors decides whether or not to distribute dividends based on profitability. Even when dividends are declared, the payout amount can fluctuate depending on the company’s financial performance.

2. Preference Shares:

As the name suggests, preference shareholders hold preferential rights over some aspects compared to ordinary shareholders. However, they typically don’t have voting rights.

- Dividend Distribution: Preference shareholders enjoy a fixed dividend rate, which is usually predetermined at the time of issuance. This means they receive a set amount per share, regardless of the company’s profits, as long as there are sufficient earnings to cover dividend payments. Preference shareholders get their dividends before any dividends are distributed to ordinary shareholders.

- Capital Repayment: In the unfortunate event of a company liquidation (closure), preference shareholders have priority over ordinary shareholders when it comes to repayment of capital. They receive their predetermined share of the company’s remaining assets before anything is distributed to ordinary shareholders.

3. Sweat Equity Shares:

These are a unique type of equity share issued to employees or directors as a form of compensation for their contributions to the company’s growth.

- Acquisition: Sweat equity shares are typically acquired through stock option plans or performance-based incentives.

- Restrictions: These shares might come with vesting periods or restrictions on selling them for a certain timeframe.

4. Bonus Shares:

Bonus shares are essentially free shares issued to existing shareholders as a form of dividend.

- Issuing Process: Companies might issue bonus shares to reward shareholders for their loyalty or to reflect an increase in the company’s retained earnings (profits not paid out as dividends).

- Impact: The company’s total share capital increases with the issuance of bonus shares, but the proportionate ownership of existing shareholders remains unchanged.

5. Rights Shares:

These are shares offered to existing shareholders at a discounted price to raise additional capital for the company.

- Subscription Rights: Existing shareholders receive subscription rights, which give them the opportunity to purchase these new shares at a preferential price.

- Protective Measure: Rights offerings can be a way for companies to raise capital while safeguarding the existing ownership stake of their current shareholders.

Features of Equity Shares

- Ownership: Equity shares represent partial ownership in a company. The number of shares you hold reflects your proportional stake in the company’s assets and profits.

- Voting Rights: Most equity shares (common stock) come with voting rights. You can participate in crucial company decisions by voting on matters like electing board members and approving major financial proposals. The voting power is usually proportional to the number of shares held.

- Dividend Distribution: Dividends are a portion of the company’s profits that are distributed to shareholders. However, dividend payouts are not guaranteed and depend on the company’s board of directors and its financial performance.

- Capital Appreciation: The value of your equity shares can fluctuate over time. Ideally, you aim for capital appreciation, where the share price increases, allowing you to sell them for a profit.

- Limited Liability: A key benefit of equity shares is limited liability. This means your personal assets are generally not at risk if the company faces financial troubles or goes bankrupt. Your liability is limited to the amount you invested in the shares.

- Risk: Equity shares are generally considered riskier investments compared to fixed-income options like bonds. The value of your shares can go down, resulting in potential losses.

- Liquidity: Equity shares traded on stock exchanges offer good liquidity. You can typically buy and sell them relatively easily, depending on the specific share.

- Marketability: Depending on the company and the exchange, equity shares can be highly marketable. This means there’s a readily available market to buy and sell them.

- Information Rights: Shareholders have the right to access certain information about the company’s financial performance and operations. This allows you to make informed decisions about your investment.

- Transferability: Equity shares are transferable. You can sell them to other investors on the stock exchange or through private transactions.

How Equity Shares Work?

When a company lists its shares on the stock exchange, it invites the public to buy a part of its ownership. The price of these shares can go up or down based on the company’s performance, market conditions, and investor sentiment. Equity shares can be bought back by the company, reducing the number of shares available in the market and potentially increasing the value of remaining shares.

Advantages of Investing in Equity Shares

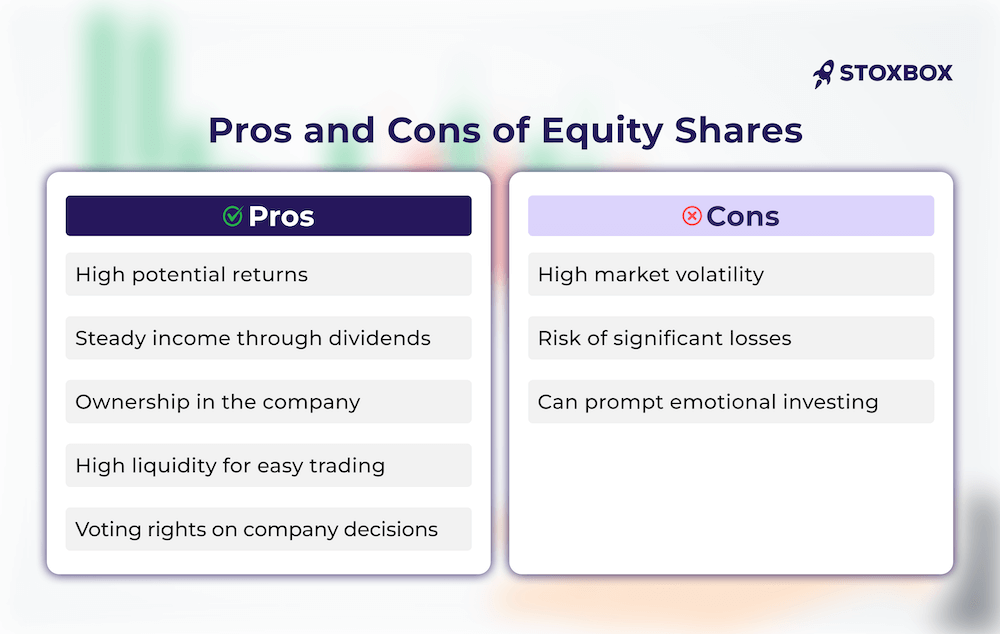

Investing in equity shares offers several advantages that can appeal to both seasoned investors and those new to the stock market. Here are ten benefits of investing in equity shares:

- Potential for High Returns: Equity shares have the potential to yield high returns compared to other forms of investment like bonds or bank deposits. Over time, the stock market tends to generate higher returns due to economic growth and corporate earnings expansion.

- Dividend Income: Apart from potential capital gains, equity shares can provide investors with a steady stream of income through dividends. Companies distribute a portion of their profits to shareholders as dividends, which can be a reliable source of income.

- Ownership Stake: Buying equity shares means acquiring a portion of ownership in a company. Shareholders thus have a claim on the company’s assets and earnings, proportionate to the amount of stock they own.

- Liquidity: Equity shares are generally highly liquid, especially those listed on major stock exchanges. This liquidity means you can quickly buy or sell shares at market prices without a significant impact on the share price.

- Voting Rights: Shareholders have the right to vote on important company decisions, including corporate policies and board elections, at annual general meetings or special meetings, which allows them to influence the direction of the business.

- Capital Appreciation: Over time, the value of equity shares can increase, leading to capital appreciation. This growth is often driven by underlying company performance, market expansions, and general economic conditions.

- Diversification: Equity shares provide an excellent opportunity to diversify an investment portfolio. By investing in different companies across various sectors, investors can reduce risk and enhance potential returns.

- Hedge Against Inflation: Historically, investments in the stock market have provided returns that surpass the inflation rate, helping investors maintain the purchasing power of their capital.

- Participation in a Company’s Growth: By investing in a company’s equity shares, an investor gets to participate in the company’s growth story and potentially benefit from it financially if the company succeeds.

Investing in equity shares, while advantageous in many aspects, also carries a level of risk, which is generally higher than that of bonds or bank investments. However, the potential for higher returns and other benefits like dividends, voting rights, and liquidity make it an attractive option for many investors.

Disadvantages of Investing in Equity Shares

- Market Risk: Share prices can be volatile, influenced by various external factors.

- No Guarantee of Returns: Dividends are not guaranteed, and there’s the potential for loss.

How to Invest in Equity Shares?

Understanding Equity Shares

- Before diving into the investment process, it’s crucial to grasp the equity shares definition and equity shares meaning. Equity shares, known as common shares or ordinary shares, represent ownership in a company, giving shareholders a claim on part of the company’s assets and earnings.

Starting Your Investment Journey

- Investing in equity shares in India involves several steps, primarily centred around setting up the appropriate accounts needed to trade. Here’s a detailed look at the process:

Opening a Demat and Trading Account

Before you can start buying and selling shares, you need to set up two main types of accounts through a brokerage firm: a Demat account and a trading account.

- Demat Account: Short for “Dematerialized Account,” this account holds shares and securities in electronic form, eliminating the need for physical share certificates. It’s essential for trading in the modern stock market. The Demat account safely stores the shares you own and keeps track of all your holdings.

- Trading Account: While the Demat account is where your shares are stored, a trading account is what you use to actually buy and sell shares. When you place a trade, your trading account interacts with the stock exchange to execute buy or sell orders.

Choosing a Brokerage Firm

To open these accounts, you must first choose a brokerage firm. Brokerage firms are licensed to buy and sell shares on the stock exchanges and offer various services including account opening, trading facilities, research support, and advice on investments. You can choose from traditional brokers, who offer full services including personalised advice and portfolio management, or discount brokers, who offer lower fees but limited services focusing mainly on the Trading Platform.

Setting Up the Accounts

The process to open these accounts is straightforward:

- Application: Fill out the application forms for both Demat and trading accounts. This can usually be done online on the brokerage firm’s website.

- Documentation: Submit necessary documents for identity and address proof. This typically includes PAN card, Aadhar card, passport-size photographs, and proof of address like utility bills or bank statements.

- Verification: Undergo a verification process, which may include a phone call or an in-person verification to confirm the details provided.

- Activation: Once your application is approved and processed, your accounts will be activated. The brokerage will provide you with account numbers and login credentials for online access.

Start Trading

With your Demat and trading accounts ready, you can start trading by logging into your account on the brokerage’s platform. Here’s how you can start:

- Link Bank Account: You’ll need to link your bank account with your trading account for fund transfers. This is necessary for purchasing shares.

- Market Watch: Set up a market watch on your trading platform to monitor the stocks listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), which are the major stock exchanges in India.

- Buying and Selling: Place buy orders to purchase shares that are then stored in your Demat account. When you sell, shares are moved out of your Demat account. The funds from sales or purchases flow between your trading and linked bank account.

Continuous Learning

For new investors, understanding the stock market can take some time. Most brokerage platforms provide educational resources that can help you understand trading strategies, stock market basics, and how to analyse stocks for investment. Utilising these resources can greatly enhance your trading experience and investment decisions.

Setting up your Demat and trading accounts is just the beginning of your investment journey in the Indian stock market. A thoughtful approach to choosing the right stocks to invest in, diversifying your portfolio, and staying updated with market trends are crucial for successful investing.

Factors You Must Consider Before Investing In Equity Shares

Financial Goals and Risk Tolerance

- Align your investment in equity shares with your financial goals and risk tolerance. The difference between equity and preference shares lies in the risk and returns profile, which investors should consider carefully.

Company Performance and Sector Analysis

- Evaluate the company’s financial health, management quality, and growth prospects. Understanding the sector in which the company operates can also provide insights into potential returns on equity share capital.

Timing Markets

- While timing the market is challenging, staying informed about economic conditions and market trends can help in making better investment decisions regarding equity shares and preference shares.

What are dividends?

Dividends are a portion of a company’s earnings distributed to shareholders, essentially a reward for investing in the company’s equity shares. The frequency and amount of these dividends can vary widely between companies, and not all firms choose to pay them. For investors, dividends can provide a steady income stream, making equity shares an attractive investment option. However, the equity share price often reflects the company’s dividend policy.

Are equity shares risky?

Yes, investing in equity shares carries risk. Market volatility can significantly affect the share price, leading to potential gains or losses. Unlike preference shares, which typically offer fixed dividends and priority over equity in case of liquidation, equity shares expose investors to the full brunt of market fluctuations. The difference between equity and preference shares largely lies in this risk profile. However, with higher risk comes the potential for higher rewards, making equity shares a vital part of diversified investment portfolios.

What is the difference between equity shares and preference shares?

| Feature | Equity Shares | Preference Shares |

|---|---|---|

| Voting Rights | Yes, proportional to holding | No, or limited voting rights |

| Dividend Distribution | Not guaranteed, variable | Fixed rate, prioritised |

| Dividend Payment | Paid after preference shares | Paid before ordinary shares |

| Capital Repayment | No priority | Priority over ordinary shares |

| Price | Generally higher | Generally lower |

| Risk | Potentially higher | Potentially lower |

| Target Investor | Growth-oriented investors | Income-oriented investors |

How can I track the performance of my equity shares?

Monitoring the performance of your equity shares is crucial for making informed investment decisions. Investors can track their shares through various means, including stock market app, financial news platforms, and brokerage account dashboards. These tools provide real-time updates on equity share price, market trends, and company-specific news that could impact your investment. Regularly reviewing your portfolio’s performance can help you adjust your investment strategy as needed.

Tracking the performance of your equity shares is crucial to managing your investment portfolio effectively. In India, several methods can help you keep an eye on how your stocks are doing, ranging from using brokerage platforms to accessing financial news and utilising mobile apps.

Example: Tracking Performance through a Brokerage Platform

Let’s consider an example where you, as an investor, own shares in major Indian companies like Reliance Industries, TCS, and HDFC Bank. Here’s how you can track their performance:

Step 1: Log into Your Brokerage Account

Most modern brokerage firms in India offer an online platform or a mobile app that allows you to view and manage your investments. After logging into your account, you would navigate to the portfolio section, where you can see all the stocks you own.

Step 2: Review Your Portfolio

In your portfolio, each stock will typically be listed with details like the number of shares owned, the purchase price, the current market price, and the unrealized gains or losses. For example:

- Reliance Industries: Purchased at Rs 1,950, current market price Rs 2,100.

- TCS: Purchased at Rs 2,800, current market price Rs 2,900.

- HDFC Bank: Purchased at Rs 1,400, current market price Rs 1,450.

Step 3: Analyse Performance

From the data available in your portfolio, you can calculate the percentage gain or loss for each stock. For instance:

- Reliance Industries: The gain is ((₹2,100 – ₹1,950) / ₹1,950) * 100 = 7.69%

- TCS: The gain is ((₹2,900 – ₹2,800) / ₹2,800) * 100 = 3.57%

- HDFC Bank: The gain is ((₹1,450 – ₹1,400) / ₹1,400) * 100 = 3.57%

Step 4: Monitoring News and Updates

Staying informed about news and developments related to the companies in which you own shares is essential. For instance, if Reliance Industries announces a major new partnership, it might impact the stock price positively. Conversely, regulatory challenges or poor financial results could affect the stock negatively. Brokerage platforms often provide news updates, or you might use dedicated financial news websites.

Step 5: Setting Alerts

Many brokerage platforms allow you to set alerts on stock prices. For example, you can set an alert for Reliance Industries if the stock price reaches Rs 2,200, which could be your target sell price, or Rs 2,000, which could be a warning to reassess your holding if the price is dropping.

By regularly monitoring your equity shares using these steps and tools, you can stay informed about your investments and make strategic decisions based on the latest market conditions and company performance.

Can I lose all my money in equity shares?

While investing in equity shares offers the potential for significant returns, it also comes with the risk of losses, including the possibility of losing your entire investment. Factors such as poor company performance, market downturns, and economic crises can drastically reduce share prices. However, diversifying your investments and conducting thorough research before investing can mitigate these risks. Remember, equity shares should be viewed as a long-term investment, and patience is often key to weathering market volatility.

Equity shares represent a fundamental aspect of investing in India’s share market, offering opportunities for growth while posing certain risks. Understanding the nuances of dividends, the inherent risks, the differences between equity and preference shares, and methods to track share performance is essential for investors. While the potential for loss exists, strategic investment and portfolio diversification can help manage risk and foster financial growth. As you navigate the complexities of the stock market, remember that knowledge and caution are your best allies in the pursuit of investment success.

Regulatory Framework in India

The Securities and Exchange Board of India (SEBI)

- SEBI is the regulatory body overseeing the securities market in India, ensuring that the trading of equity shares is conducted in a fair and transparent manner. Understanding SEBI regulations is crucial for investors in equity and preference shares.

Company Acts and Compliance

- Companies issuing equity shares must comply with the Companies Act, which outlines the rules for issuing, buying back, and transferring shares. Sweat equity shares meaning and regulations, for instance, are defined under this Act.

Investing in equity shares offers the dual advantage of potentially high returns and being a part of a company’s growth story. However, it comes with its share of risks, necessitating thorough research and an understanding of the equity meaning in share market. The Indian regulatory framework, led by SEBI, provides a structured and secure environment for investors, which, when navigated wisely, can lead to fruitful investment outcomes. As you embark on or continue your investment journey, remember that knowledge, patience, and a well-thought-out strategy are your best allies in achieving success in the equity market.

Frequently Asked Questions

Why do people invest in equity shares?

Investors buy equity shares for several reasons, including the potential for capital growth and dividends. Investing in equity shares offers the opportunity to be part of a company’s growth story, which can lead to substantial returns over time despite the inherent market risks.

How do I buy equity shares in India?

To buy equity shares in India, you first need to open a Demat and trading account with a registered broker or brokerage platform. Once your account is active, you can start buying and selling shares through the stock exchanges like the Bombay Stock Exchange (BSE) or the National Stock Exchange (NSE).

What are dividends?

Dividends are a portion of a company’s profits distributed to shareholders. However, it’s important to note that not all companies pay dividends, and the amount can vary based on the company’s profitability and dividend policy.

Are equity shares risky?

Yes, investing in equity shares involves risks due to market volatility. The equity share price can fluctuate based on various factors, including economic conditions, company performance, and market sentiment. However, with higher risk comes the potential for higher rewards.

What is the difference between equity shares and preference shares?

The main difference between equity and preference shares lies in the rights and benefits accorded to their holders. Equity shareholders have voting rights in company decisions but receive dividends after preference shareholders, who get dividends at a fixed rate and prior claim on assets in case of liquidation but typically do not have voting rights.

How can I track the performance of my equity shares?

Investors can track the performance of their equity shares through financial news platforms, stock market apps, and brokerage account dashboards. These platforms provide real-time data on equity share prices, market trends, and company news that can impact stock performance.

Can I lose all my money in equity shares?

While it’s rare for well-established companies to go to zero, investing in equity shares does carry the risk of losing part or all of your investment, especially if a company underperforms or goes bankrupt. Diversifying your investment portfolio can help mitigate these risks.

What is equity share capital?

Equity share capital refers to the amount of funds raised by a company through the sale of its equity shares. This capital forms the foundation of a company’s financial structure, representing the shareholders’ investment used for business operations and growth. It’s a key indicator of the company’s financial health and investor confidence.

What is the equity meaning in the share market?

In the share market, equity refers to the ownership interest in a company, represented by the equity shares held. This term is often used interchangeably with stocks or shares, highlighting an investor’s stake in the company’s assets and earnings.

What are unlisted equity shares?

Unlisted equity shares are stocks of a company that are not traded on the official stock exchanges. These shares are typically held by private companies’ founders, employees, and investors. Although they offer potential for significant returns, unlisted shares come with higher risks and lower liquidity compared to listed shares.

Equity shares are also called as?

Equity shares are also known as common shares or ordinary shares. These terms highlight the fundamental nature of these investments, offering common ownership rights, dividends, and voting powers in company matters, subject to the degree of risk and market fluctuations.

Equity shares vs preference shares: Which one should I choose?

The choice between equity shares and preference shares depends on your investment goals, risk tolerance, and preference for dividends. Equity shares are suited for investors looking for growth and are willing to accept higher risk for potentially higher returns. Preference shares might appeal to those seeking more stable dividends and priority over equity shareholders in asset liquidation, albeit with generally less capital appreciation potential.

Equity shares cannot be issued for the purpose of?

Equity shares cannot be issued for the purpose of providing immediate returns or guaranteed dividends. Investments in equity shares are subject to market risks, and returns are dependent on the company’s performance and market conditions. Equity shares represent a long-term investment in a company’s growth, not a short-term profit-making mechanism.

Difference between share and equity: Is there any?

In general parlance, there’s no significant difference between the terms ‘share’ and ‘equity’; both refer to the ownership stake in a company. However, ‘share’ specifically denotes the individual units of ownership, while ‘equity’ can refer more broadly to the concept of ownership interest in the company.

Can equity shares be converted into preference shares?

Typically, equity shares cannot be directly converted into preference shares as they are distinct classes of stock with different rights and privileges. However, a company may offer options for equity shareholders to participate in rights issues or offer preference shares under certain conditions, subject to regulatory approvals and company policies.

Your Wealth-Building Journey Starts Here