Smart way of investing with various investment objectives you need to know

Table of Contents

Investing is a powerful tool to build wealth and secure financial independence. However, diving into the world of investments without a clear plan can feel overwhelming and even risky. This is where the concept of smart investment comes into play, it’s not just about investing money but doing so in a way that aligns with your financial goals and long-term aspirations.

Understanding the objectives of investment is important because these objectives guide you toward the right decisions, whether it’s growing your wealth, securing a steady income, or planning for retirement. Each person has unique goals, and your investment strategy should reflect those personal priorities. With a proper understanding of the investment purpose and strategies, you can avoid common mistakes and make your money work harder for you.

Investment Objectives Explained with an Example

Have you been hearing talks of investments from your colleagues or friends? Do they discuss the reasons why the wish to invest? Investment objectives refer to the different reasons due to which people invest their money.

Let us consider the example of Prabhat, who is now 30 years old. He has been working in a petroleum corporation for the last 8 years and earns a handsome salary. When he was 25, he started his investment journey with a few investment objectives in mind. going through these instances, you will be able to better grasp the concept of investment objectives.

First of all, Prabhat was tired of travelling by public transport, especially since he was required to attend meetings with senior executives. Appearance made a huge difference in this scenario, and travelling by the bus caused him to look dishevelled when he reached his destination.

Therefore, his first smart investment objective was to purchase a car over the next five years. This desire to buy a car falls under two different investment objective categories – to meet financial goals and to fulfil needs.

After planning for this investment objective, Prabhat turned his attention to his own security. He knew that, even as he had a good insurance policy, he could not afford to be glib about potential emergencies.

Therefore, he then allocated a fixed amount towards creating an emergency fund, which was his third investment objective. This fund helped him stay secure even when his company ended up docking two months’ salary during the COVID pandemic.

His final smart investment objective was to create a nest egg for the future. Like many people of his generation, Prabhat knew that he did not wish to work till he was 60. He wished to retire at 50 and spend his later years travelling and volunteering to the causes he cared about.

Since he was a part of the private sector, he would not have access to government pensions, making it imperative that he secure his future by saving up while he was employed.

From Prabhat’s example, you must have understood the four major types of investment objectives that prompt people to embark on an investing journey. Let us take a detailed look at these four investment objectives.

Common 4 Various Investment Objectives

To meet financial goals

Each of us have some financial goals in mind, be it purchasing a car or investing in a house. It could also be to pursue higher education abroad. Any and all financial goals require optimal planning and investment if you are to realise it in a fixed period of time. Therefore, one of the most common investment objectives that people have is usually related to the need to meet specific financial goals, just like you observed when considering Prabhat’s example.

To create an emergency fund

Nowadays, most people live independently, without any financial support from their parents. In this scenario, you may require emergency funds for any number of unexpected situations – be it an accident, or a layoff at work. The pandemic has highlighted the need for an emergency fund, as we saw many people being laid off or requiring costly treatments to overcome the virus.

Emergency funds are a must have for you, whether you are single or the member of a family, because emergencies never announce their arrival. As is frequently said, it is better to be safe than sorry. Facing financial duress in emergency situations can make the scenario infinitely worse so most people consider creating an emergency fund as one of their primary smart investment objectives.

To fulfil needs

As you move ahead in life and your career, you will find your needs increasing in line with your income and access to credit facilities. You may wish to live in a better apartment, in a more attractive locality and avail better amenities. Each of these needs cost money and, with the underlying inflation, the cost of even the most basic needs, like food, accommodation and clothing, are increasing significantly. Therefore, people may begin investing with the investment objective focused on fulfilling these needs in the course of time.

To create a nest egg for the future

While government employees have the provision of pensions post retirement, if you are in the private sector, you must create a nest egg to ensure a comfortable future. Old age comes with its specific set of health issues and needs, and having a nest egg means you need not depend on anyone to meet your requirements.

Further, if you also wish to retire early and pursue your interests, like Prabhat, then creating a nest egg for the future should be among your primary smart investment objectives. Also, given the consistent rise in inflation, you must prepare for a very costly future ahead, so it is important to begin investing early on as this helps you benefit from the power of compounding.

There may be many other reasons why people choose to invest but, on a holistic level, each of those reasons will fall under one or more of the categories discussed above. Once you know your investment objectives, it is easier to plan and implement your investment strategies so start analysing your motives right away.

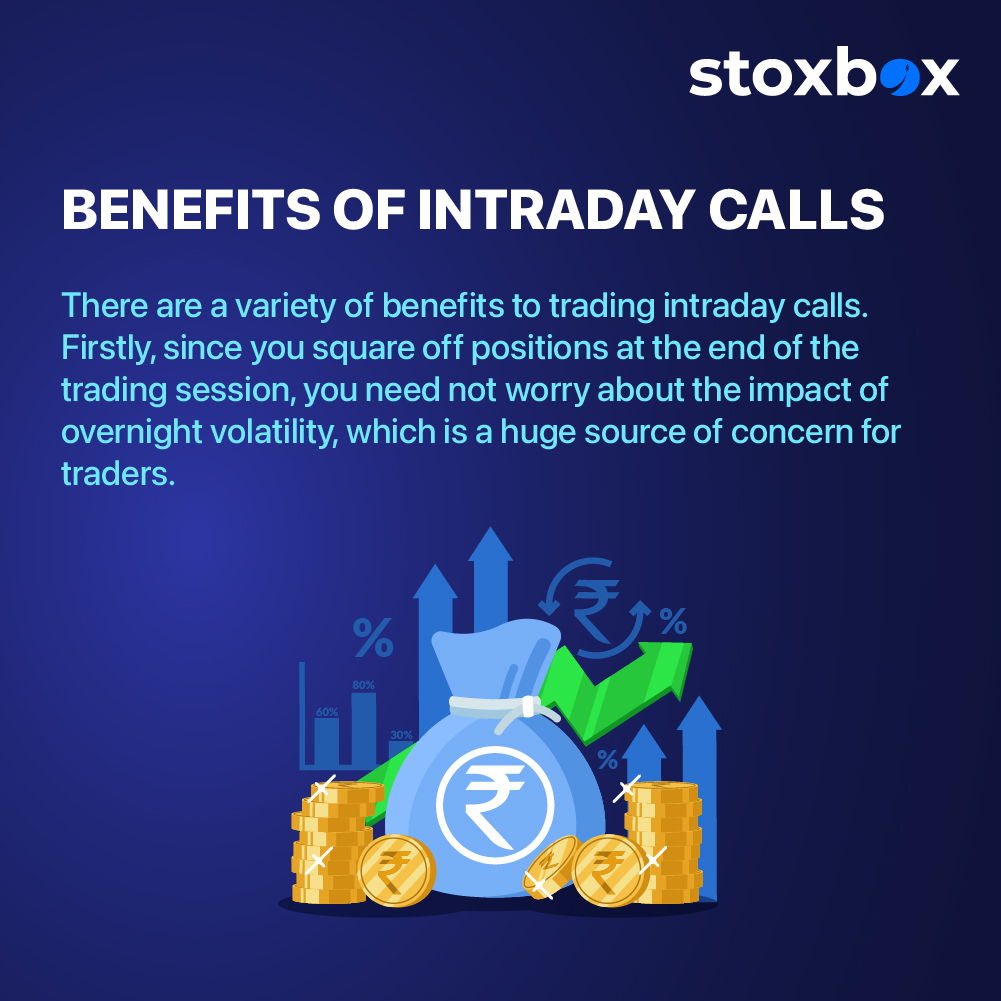

Benefits of Intraday Calls

There are a variety of benefits to trading intraday calls. Firstly, since you square off positions at the end of the trading session, you need not worry about the impact of overnight volatility, which is a huge source of concern for traders. With intraday calls, you stand a chance to earn profit during both market upswings and crashes, as long as you time your bets effectively. Volatility becomes your friend, ensuring that you gain even during bear markets.

Access to technical and derivative data and tips can help you realise strong gains from the market, that too without waiting for a longer period of time. With experience and practice, you can gain a strong understanding of the pulse of the market and gain the opportunity to earn a regular income as well as realise unforeseen profits if your calls prove favourable.

Intraday call trading is not for the faint of heart. You need to be patient and diligent while timing the market. You also need a high risk appetite to make it as an intraday calls trader. But if you have these qualities, the sky is your limit!

What Is a Smart Investment?

A smart investment is more than just putting money into assets and hoping for high returns, it’s a calculated approach that considers your financial goals, risk tolerance, and the broader market environment. Unlike conventional investing, which might focus solely on immediate profits, a smart investment prioritizes long-term growth, stability, and alignment with your personal objectives.

The true hallmark of a smart investment lies in its ability to balance risk and reward while serving a clear investment purpose. For instance, if your goal is retirement planning, a smart investment might involve diversifying into low-risk bonds and mutual funds. On the other hand, if you’re seeking wealth creation, you might focus on growth-oriented stocks or real estate.

What sets smart investments apart is the discipline to research, plan, and align your portfolio with your investment objectives. By focusing on your needs, whether it’s creating a safety net, funding your child’s education, or achieving financial independence, you can ensure that every decision supports your broader life goals.

Smart investing isn’t about chasing trends or gambling on unpredictable markets. Instead, it’s about making informed, purpose-driven decisions that compound over time, helping you reach your investment goals with confidence.

Understanding Smart Investment Objectives

The objectives of investment form the foundation of any financial plan. They act as a roadmap, guiding investors toward their goals while ensuring their decisions are well-informed and purpose-driven. Let’s break down the key aspects of smart investment objectives and their significance.

What Are the Objectives of Investment?

The objectives of investment are the reasons why individuals or businesses choose to invest their money. These objectives vary based on personal financial situations, time horizons, and risk tolerance. Here are the most common investment objectives examples:

- Wealth Creation: Many investors aim to grow their money over time by investing in high-return assets such as equities, mutual funds, or real estate.

- Income Generation: Investments like bonds, dividend-paying stocks, or rental properties provide steady cash flow, which is ideal for retirees or individuals seeking passive income.

- Risk Management: Diversification and secure investments, like government bonds, help protect wealth from market volatility and inflation.

Each objective requires a customized approach to ensure the investment aligns with the individual’s goals and risk appetite.

Purpose of Investment

The purpose of smart investment goes beyond simply growing money; it serves as a tool for achieving financial milestones and securing the future. Here are some common purposes:

- Financial Security: Investments provide a cushion for unexpected expenses and uncertainties in life.

- Retirement Planning: Building a retirement fund ensures financial independence in later years without relying solely on a pension or other income sources.

- Wealth Building: Strategic investing helps in creating generational wealth, allowing families to meet long-term needs like education, home purchases, or entrepreneurship.

The investment purpose varies across individuals but always aims to provide stability and growth.

Objectives of Investment Management

Investment management is the art and science of making decisions to maximize return on investment and minimize risks. The objectives of smart investment management ensure that investors:

- Maintain a balanced portfolio that aligns with their financial goals.

- Regularly review and adjust investments based on market conditions and personal changes.

- Optimize returns without taking unnecessary risks.

For example, someone saving for retirement in 20 years will focus on long-term growth through equity investments, whereas someone nearing retirement may focus on protecting their capital and earning a steady income. By understanding these objectives, investors can make informed decisions that align with their needs and future plans.

Types of Investment Objectives

Investment objectives vary based on individual needs, financial goals, and risk tolerance. They play an important role in determining where and how you should invest your money. Below is a structured overview of key smart investment objectives and their features:

| Investment objective | Purpose | Example |

|---|---|---|

| Income | Generate regular cash flow from investments | Bond. dividend - paying stocks, rental proporties |

| Capital Appreciation | Increase the value of your smart investments over time | Investing in growth s6tocks or real estate |

| Risk | Mitigation market volatility and reduce potential looses | Allocating funds to low- risk securities like government bonds. |

| Safety | Preserve the orignal investment amount | Fixed deposit, Treasuary bills and secure bonds |

| Speculation | Aim for high returns by taking on higher risks | Day trading, cryptocurrency investments |

| Moderate Income | Achieve a balance between risk and steady income | Balanced mutual funds and hybrid portfolio |

| Tax Efficiency | Minimize tax liabilities on investment returns. | Tax- saving mutual funds, and retirement saving accounts (e.g. 401 (k) plans). |

| Income Generation | Secure additional income streams, often for retirees or passive income. | Equity mutual funds, growth focused ETFs. |

| Return | Maximize returns while staying aligned with risk appetite. | Stock market investment , REITs (Real estate investment Trusts). |

| Capital Preservation | Protect wealth from erosion due to inflation or market downturns. | Gold, high- quality bonds, inflation- prtected securities |

| Growth | Expand financial assets for future milestones (e.g. education, retirement). | Equity- focused portfolios, real estate projects. |

| Diversification | Spread risk across various asset classes to minimize losses. | Investing in a mix of stocks, bonds and commodities. |

Best Practices for Smart Investing

Investing wisely requires a combination of thoughtful planning, disciplined execution, and a commitment to long-term financial goals. These best practices ensure that your investments remain aligned with your objectives and help you navigate challenges, whether you are allocating your salary, managing market volatility, or building consistent habits.

Best Way to Invest Your Salary

Using your salary efficiently is one of the smartest ways to build long-term wealth. The best way to invest your salary starts with careful budgeting to determine how much can be allocated toward smart investments without compromising essential expenses. A widely recommended method is the 50-30-20 rule: allocate 50% of your salary for necessities, 30% for discretionary spending, and 20% for savings and investments. However, this may vary depending on individual circumstances.

To determine how much to invest per month, consider factors such as your income stability, existing debt obligations, and short- and long-term financial goals. For instance, if your goal is to save for retirement, investing in employer-sponsored plans like 401(k)s or retirement mutual funds is a smart approach. For individuals with higher risk tolerance, channeling a portion of the salary into growth-oriented stocks or exchange-traded funds (ETFs) can be effective. Remember, the key is consistency, investing regularly, even in smaller amounts, can lead to substantial returns over time thanks to the power of compounding.

Tips for Investing During Volatile Markets

Market volatility can be intimidating, but it also presents opportunities for savvy investors. The first rule is to stay calm and avoid impulsive decisions driven by fear. Volatile periods often tempt individuals to react emotionally, but this can lead to losses or missed opportunities. Instead, focus on long-term objectives and stick to your smart investment plan.

One of the most important tips for investing during volatile markets is diversification. By spreading investments across different asset classes, such as stocks, bonds, and commodities, you reduce the impact of market fluctuations on your portfolio. Additionally, maintaining a mix of low-risk and growth-oriented assets ensures stability while capitalizing on potential returns.

It’s essential to understand the difference between investment vs gambling. While investing involves calculated risks based on research and market trends, gambling relies solely on luck. Treating volatile markets as an opportunity to “bet big” can lead to significant losses. Instead, use this time to rebalance your portfolio, and take advantage of discounted prices, and dollar-cost averages into high-quality assets.

Habits of Successful Investors

Building strong financial habits is critical for achieving long-term success in investing. Habits of successful investors include setting clear goals, conducting thorough research, and maintaining a disciplined approach. Successful investors understand the value of patience, they don’t chase quick wins but focus on consistent returns over time.

One key habit is keeping emotions in check. Markets go through cycles, and panicking during downturns often results in poor decisions. By staying informed and focusing on data-driven strategies, successful investors ensure their portfolios remain resilient. Another important practice is regularly reviewing and rebalancing portfolios to ensure alignment with financial objectives. This involves assessing risk levels, reallocating funds if necessary, and staying updated on market trends.

Finally, successful investors prioritize continuous learning. They stay informed about changes in the financial landscape, whether it’s understanding new asset classes or adapting to global economic shifts. By cultivating these habits, investors can build a strong foundation for financial independence and achieve their goals with confidence.

Addressing Common Investor Pain Points

Investing often feels challenging due to market uncertainties, emotional decision-making, and aligning financial goals with the right strategies. By addressing these common pain points, investors can make smarter decisions and achieve their objectives with greater clarity and confidence.

Stock Profit Taking Strategy

One of the key challenges for investors is knowing when to take profits. The right stock profit taking strategy helps you maximize returns without exposing your portfolio to unnecessary risks. A disciplined approach involves setting predefined price targets for selling stocks, either based on percentage gains or specific financial goals.

For example, if a stock has risen by 20-25% and aligns with your smart investment goals, it might be time to lock in profits. Similarly, having stop-loss orders in place ensures you cut losses if a stock’s price drops below a certain threshold. This strategy protects your capital and avoids emotional decisions during market fluctuations. Additionally, consider rebalancing your portfolio periodically, selling high-performing stocks to allocate funds to undervalued opportunities ensures a balanced and growth-oriented portfolio.

Aligning Goals with Investment Purposes

A major pain point for many investors is connecting their goals to the broader investment purpose. Often, investors jump into opportunities without a clear plan, resulting in misaligned portfolios that fail to deliver desired results. To explain the objectives of investment, let’s look at a practical scenario:

Imagine a young professional who wants to save for a house down payment in five years. The primary goal here is capital preservation with moderate growth. A smart approach would involve investing in low-risk instruments like fixed deposits, short-term bond funds, or balanced mutual funds. On the other hand, someone planning for retirement in 30 years can afford to take on more risk, investing in equity mutual funds, index funds, or growth stocks to achieve higher returns over the long term.

By clearly defining your objectives, such as wealth creation, income generation, or risk management, you can tailor your investment choices to meet specific needs. The ability to link financial goals with the right investments ensures a more focused and efficient strategy.

Smart Investment Quotes

Investing requires patience, discipline, and a long-term mindset. During challenging times, a few motivational Investment Quotes can keep you focused and inspire you to stay on track. Here are some timeless quotes that resonate with seasoned investors:

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” – Philip Fisher

“An investment in knowledge pays the best interest.” – Benjamin Franklin

“Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

“The goal of an investor should be to make a portfolio that suits them best, not what others are doing.” – Peter Lynch

These quotes remind investors of the importance of value-driven strategies, consistent savings, and aligning portfolios with individual objectives. Keeping such words of wisdom in mind can help you overcome doubts and maintain a disciplined approach to building wealth.

Conclusion

Understanding the objectives of investment and aligning them with your financial goals is essential for achieving both short-term and long-term success. Whether you aim for wealth creation, income generation, or risk management, a structured and disciplined investment strategy ensures that you make informed decisions.

For example, if you want equity exposure, you can choose to invest directly in the stock market, invest through equity mutual funds, or explore curated portfolios like an equity StoxBox, a reliable platform offering various investment solutions. StoxBox simplifies investing with tools like mutual funds, SIP calculators, and IPO services. Additionally, its trading platforms, including web traders and mobile apps, ensure seamless transactions for investors at all levels.

By leveraging smart tools like StoxBox, you can focus on optimizing your portfolio, diversifying assets, and achieving your investment objectives. Remember, smart investments today pave the way for financial security and independence in the future. Take your first step with confidence and the right resources.

Frequently Asked Questions

1. How do I align my financial goals with specific investment objectives?

To align financial goals with investment objectives, start by clearly defining your priorities. For example, if you’re saving for retirement, focus on long-term growth investments like equity mutual funds or ETFs. For short-term goals, prioritize safer instruments like bonds or fixed deposits. Tools like StoxBox’s SIP and Lumpsum Calculators can help you determine the investment amount needed to achieve your goals within a specific timeframe. Regularly reviewing and rebalancing your portfolio ensures that your investments remain in line with your objectives.

2. How do I balance risk and return in my portfolio?

Balancing risk and return involves diversifying your portfolio across asset classes like equities, bonds, and commodities. Higher-risk assets like stocks offer higher returns, while safer assets like bonds provide stability. The key is determining your risk tolerance and time horizon. For example, younger investors with a long-term horizon can allocate more to equities, while retirees may prioritize capital preservation. Platforms like StoxBox offer curated tools to help investors create portfolios customized to their risk preferences.

3. What’s the difference between investment and gambling in volatile markets?

The difference lies in strategy and analysis. Investing involves calculated decisions based on research, risk management, and aligning with investment objectives like wealth creation or income generation. Gambling, on the other hand, relies on chance and has no basis in long-term planning. To stay disciplined during market volatility, use strategies like dollar-cost averaging and stick to diversified portfolios. Tools like StoxBox’s Trading Platforms provide real-time insights to make informed decisions, ensuring you don’t fall into speculative traps.

4. How do I decide how much to invest monthly for my financial goals?

The amount to invest monthly depends on your financial goals, current expenses, and risk tolerance. Use the 50-30-20 rule as a baseline, 20% of your income should ideally go toward savings and investments. Advanced tools like SIP calculators available on platforms like StoxBox can help you determine the exact amount you need to invest to achieve your goals. For instance, if you’re aiming for a ₹10 lakh corpus in 10 years, these calculators provide a step-by-step investment plan.

5. What should I do if my portfolio is not performing as expected?

If your portfolio isn’t meeting expectations, start by revisiting your investment objectives. Analyze whether market conditions or poor diversification are affecting performance. Avoid panic selling and instead consider rebalancing your portfolio by shifting funds from underperforming to better-performing assets. Platforms like StoxBox provide tools and guidance to help you monitor your investments and make necessary adjustments to optimize returns.

Your Wealth-Building Journey Starts Here

You might also Like.

No posts found!