Have you ever considered how much to invest per month to effectively boost your financial growth? What if your 20K monthly savings could be transformed into a substantial financial reserve over time? This article explores practical strategies to ensure your investments truly pay off.

Curious about how much you should be investing each month to see real growth? We’ll address this question and provide solutions to common investment challenges, helping you to find the complexities of financial planning with ease.

Understanding Your Investment Options

When it comes to investing 20K monthly, it’s essential to understand the various avenues available to you, each offering unique advantages and potential returns. In this section, we’ll explore some of the most common investment options like stocks, bonds, and mutual funds, helping you decide on the best way to invest your salary for maximum impact.

Stocks

Investing in stocks is one of the most popular methods for those looking to significantly increase their wealth. Stocks represent a share in the ownership of a company and can provide impressive returns if the company grows or performs well.

This option is ideal if you’re looking for what to invest 20k in that has the potential for high growth. However, stocks also carry a higher risk due to market volatility, making them a thrilling yet strategic choice.

Bonds

Bonds are considered a safer investment compared to stocks. When you buy bonds, you are essentially lending money to a corporation or government, which they will repay with interest over a fixed period.

This makes bonds a smart investment for those who prefer a steady and predictable return, aligning well with strategies for how much to invest per month without facing too much risk.

Mutual Funds

Mutual funds allow you to pool your money with other investors to purchase a diversified portfolio of stocks, bonds, or other securities. This diversification helps reduce risk while allowing for growth, making mutual funds a smart investment for regular contributions like your monthly 20K.

They are particularly attractive to investors who prefer to leave investment decisions to a professional manager.

Real Estate Investment Trusts (REITs)

REITs are a great option for those interested in real estate without the hassle of buying or managing property. By investing in REITs, you can earn dividends from real estate investments, which is great if you’re exploring the best place to invest 20k.

REITs typically offer higher dividends than many other assets, providing a steady income stream and potential for appreciation.

Exchange-traded funds (ETFs)

ETFs combine the diversification of mutual funds with the ease of trading that stocks offer. They track an index, a commodity, bonds, or a basket of assets like an index fund but trade like a stock on an exchange.

ETFs expose you to a wide variety of investments with low expense ratios and fewer broker commissions, making them a smart investment for those looking to invest in a broad market segment.

Systematic Investment Plans (SIPs) in Mutual Funds

For those who wish to invest systematically, SIPs in mutual funds offer a disciplined approach to investing. By committing a fixed amount, like 20K monthly, to mutual funds, you benefit from the average cost effect and the potential of achieving substantial growth over time.

This method is particularly beneficial for those seeking how to invest 20k per month effectively, allowing you to build a considerable corpus without the stress of timing the market.

Gold

Investing in gold, whether in physical form or through gold funds, can be a prudent way to diversify your investment portfolio. Gold is often seen as a safe haven in times of economic instability and can act as a hedge against inflation.

This option can be particularly appealing if you are looking for a tangible asset or something that historically holds its value well.

Let’s Understand with an Example

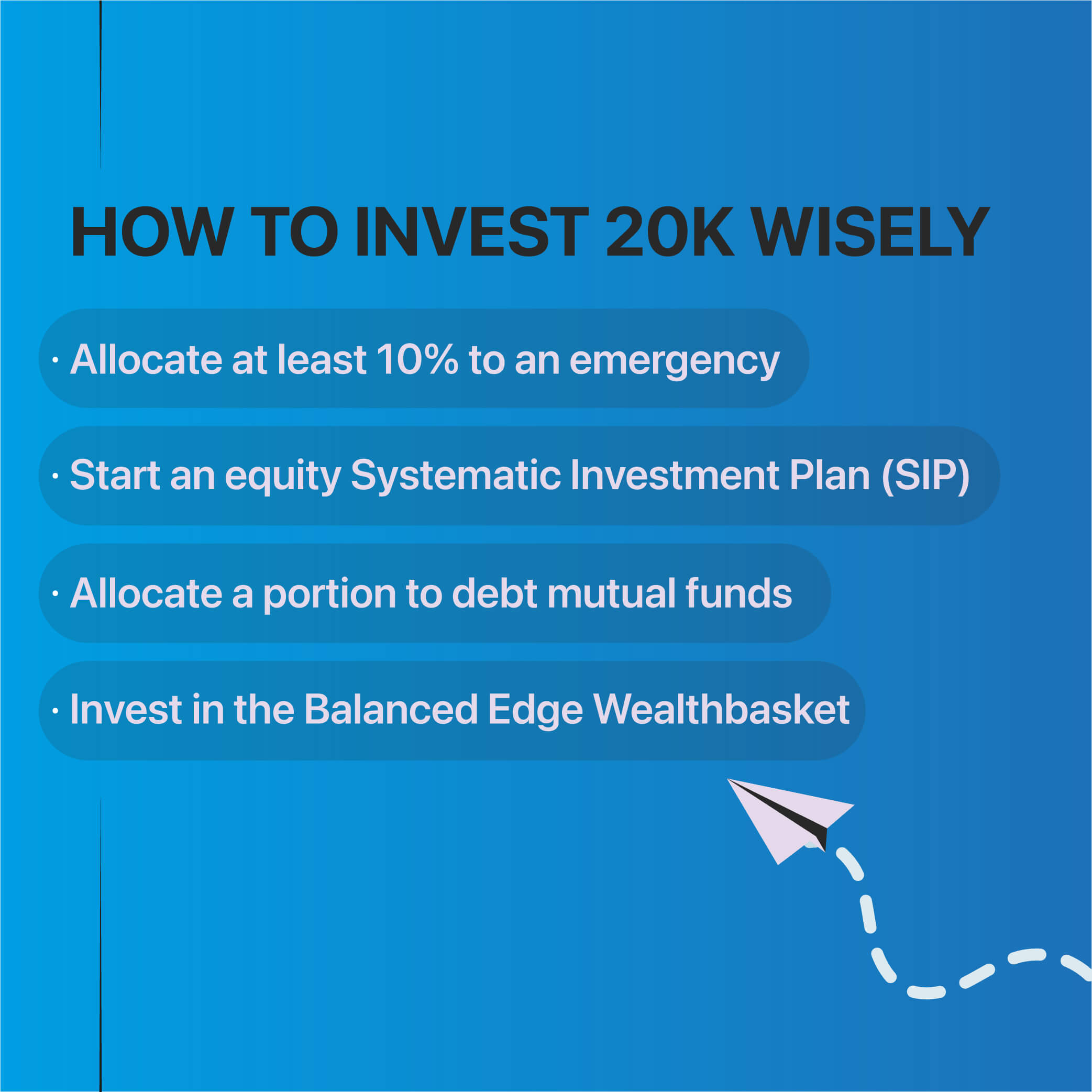

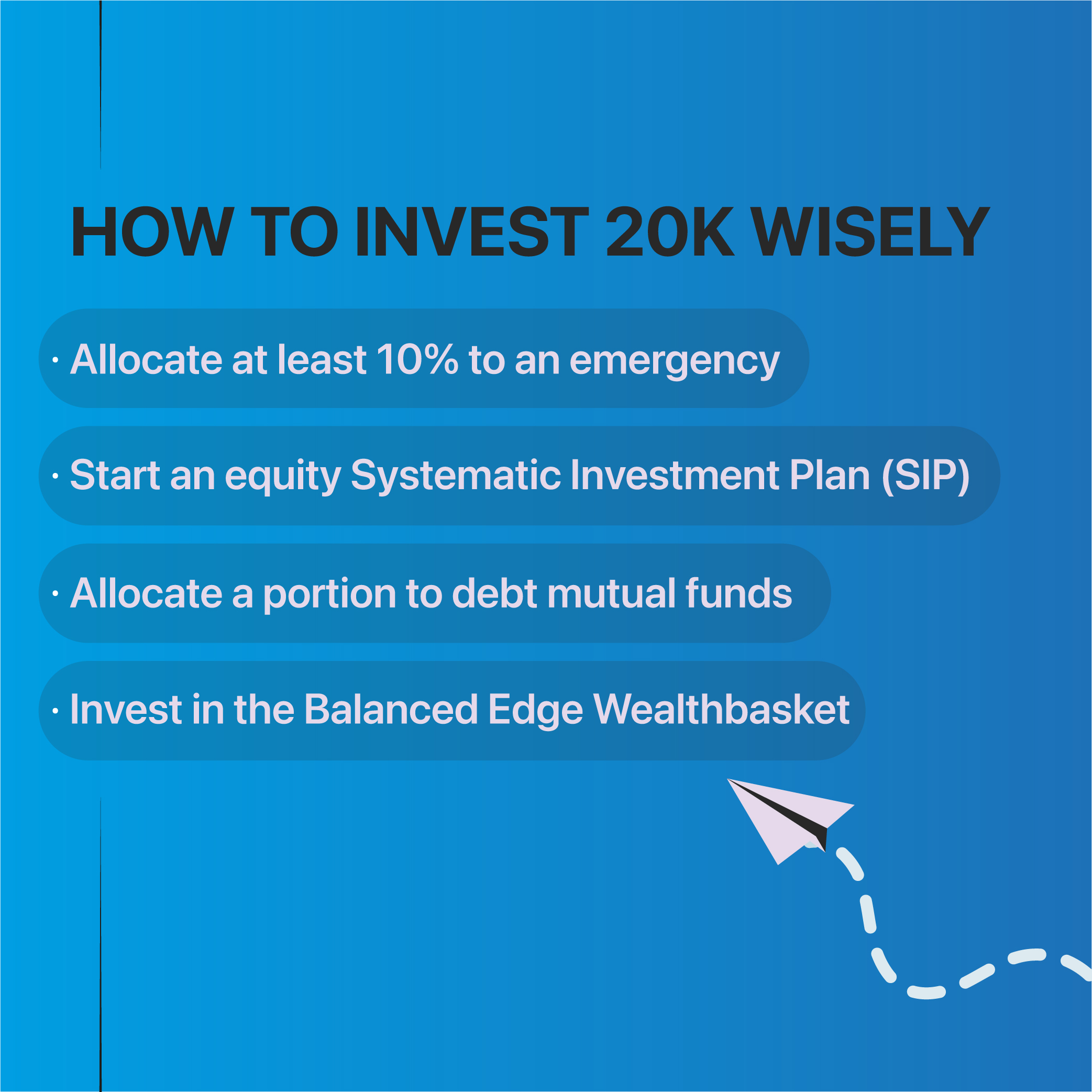

How to Invest 20K Wisely Each Month:

Starting your investing journey is one thing and doing it right is another. Assume that your monthly disposable income is Rs. 20,000.

Basically, this is the money you save after taking care of your non-discretionary as well as discretionary spending. 20k savings monthly are great and if invested well it can definitely put you on a fast track to achieving your financial goals.

The best part is that as an individual investor, you would have multiple investment options. However, the bigger question that you need to address is, ‘where and how to invest’?

While making an investment plan, always remember that you should avoid cookie cutter solutions. You are a unique individual with a unique set of goals, risk profile, and investment time horizon.

Your investment choices should reflect this uniqueness. Having said that, here are a few basic investments that you can consider if you were to invest 20k wisely every month.

Allocate at least 10% to an emergency

Life is uncertain and often emergencies can dig a hole in our bank account and derail us from our financial planning journey. Thus, it is always best to create a robust emergency fund that can come to your rescue in your time of need.

You must ensure that this money is invested in liquid and low-risk instruments like liquid funds that invest in money market instruments.

Start an equity Systematic Investment Plan (SIP)

An SIP entails investing a fixed amount of money, at periodic intervals in an instrument of your choice. Generally, equities are considered long-term vehicles of wealth creation. However, the level of risk associated with equities is also considerably higher, due to which many people avoid investing in equities.

An SIP helps you mitigate some of the risk in equity investing since it entails investing at fixed intervals. As a result, you end up participating at all market levels, thereby not getting overly impacted by market highs and lows. SIPs are a great way to participate in the equity markets and reap the long-term benefits of equity investing.

Allocate a portion to debt mutual funds

When building a portfolio, you must pay equal attention to both portfolio growth as well as portfolio protection. While equity investment potentially offers portfolio growth, debt investments can provide downside protection to the portfolio.

There are several debt investment options currently available in the market and you can choose the one which offers a good yield and reduced interest rate risk.

However, you must avoid debt funds that take on higher credit risk since this part of your allocation is primarily to provide downside protection.

Invest in the Balanced Edge Wealth basket

The Balanced Edge Wealth basket creates a readymade quality portfolio that dynamically allocates and switches exposure amongst equity, debt, and gold.

When equity markets are doing well, the Wealth basket will dynamically increase exposure to equities and when markets start falling, it will automatically reduce equity exposure and increase exposure to debt investments.

As a result, you are able to invest in a readymade quality portfolio, benefit from exposure to both debt and equity investments, and automate asset allocation.

While the above are investment options that you must consider if you are looking to invest 20k monthly, the amount that you allocate to each option will depend upon your risk profile and return requirements.

If you are a highly risk averse individual, then you must limit your equity exposure to 20% to 30% of your portfolio. On the other hand, if you have the ability and willingness to take on risk, then you can take your equity exposure to as high as 65% to 70%.

Setting Investment Goals

Establishing clear and achievable investment goals is important for any investor aiming to see a tangible.

Whether your focus is on short-term gains or securing your financial future long-term, setting precise objectives can guide your investment decisions effectively.

Here, we’ll break down how to set these goals and why they’re important for both immediate and future planning.

Defining Your Short-Term Investment Goals

- Immediate Needs: Short-term goals might include saving for a vacation or building an emergency fund, achievable within a few months to a few years.

- Investment Choices: For effective monthly investments like 20k per month, consider options like high-yield savings accounts or short-term corporate bonds, which offer quick liquidity and minimal penalties on withdrawals.

- Objective Setting: Establish goals that are specific, measurable, achievable, relevant, and time-bound (SMART) to enhance your financial discipline and success in achieving these objectives.

Planning Your Long-Term Investment Goals

- Future Planning: Long-term goals often encompass retirement savings, buying a home, or funding a child’s education, requiring sustained investment over many years.

- Compounding Benefits: Invest in vehicles like diversified mutual funds or ETFs that benefit from compounding interest, essential for growth over decades.

- Strategy: Focus on investments that match your risk tolerance and future financial needs, adjusting your portfolio as your circumstances and market conditions change.

Balancing Risk and Reward

- Risk Assessment: Understand the risks associated with different investment types; younger investors might opt for higher risks for potentially greater returns.

- Strategic Choices: Consider a mix of stocks for growth and bonds for stability, particularly if your investment horizon spans several decades.

- Review and Rebalance: Regularly assess and rebalance your portfolio to maintain a risk level appropriate to your age, investment goals, and market conditions.

Regular Review and Adjustment

- Consistent Evaluation: Review your investment goals annually or after significant life events to ensure they remain aligned with your financial situation and market opportunities.

- Flexibility: Be prepared to adjust your strategies based on personal changes or shifts in the economic landscape, which can impact the viability of your original investment choices.

- Performance Tracking: Use tools and resources to track the performance of your investments against your goals, making data-driven decisions to steer your financial journey.

Investment Strategies for 20K

Investing ₹20,000 monthly can significantly enhance your financial portfolio when approached with effective strategies. A diversified portfolio is important; allocating funds across various asset classes like equities, bonds, and mutual funds can mitigate risks and optimize returns.

For instance, investing in a mix of large-cap and mid-cap stocks provides exposure to both stability and growth potential. Additionally, including fixed-income securities such as government bonds can offer steady returns, balancing the volatility of equities.

Implementing a systematic investment plan (SIP) is a prudent approach to investing ₹20,000 monthly. SIPs allow for regular investments into mutual funds, benefiting from rupee-cost averaging and compounding over time. This method reduces the impact of market volatility and fosters disciplined investing.

For example, consistently investing ₹20,000 monthly in a mutual fund with an average annual return of 12% could grow to approximately ₹1 crore over 15 years, illustrating the power of regular, disciplined investments.

Effectively managing gains is essential to maximize returns. Using a stock profit taking strategy, such as setting predefined target prices or trailing stop-loss orders, can help lock in profits and protect against market downturns.

For instance, setting a target to sell a stock after a 20% gain ensures that profits are realized, preventing potential losses from market corrections. Regularly reviewing and adjusting your investment portfolio in response to market conditions and personal financial goals is vital for sustained growth and risk management.

Risks and Rewards

Investing comes with its share of risks, but it also offers the potential for substantial rewards when approached strategically.

Understanding how investing differs from gambling is key to managing risks effectively.

By comparing the two, you can gain insight into the strategic thinking necessary for successful investing while minimizing losses.

Investment vs Gambling: A Clear Distinction

Investment vs Gambling involves two entirely different approaches to handling money. Investing involves informed decision-making based on research, market trends, and financial analysis.

It focuses on building wealth over time through calculated risks and diversified portfolios. In contrast, gambling is driven by chance and immediate outcomes, often without a strategic plan.

For instance, when you invest 20k, you have control over where your money goes, whether in stocks, bonds, or mutual funds, with a clear understanding of potential risks and returns.

Gambling, on the other hand, relies on luck and offers no control over the odds, making it a much riskier endeavor.

Tips for Investing During Volatile Markets

Market volatility can be intimidating, but with the right approach, it can also present opportunities. Here are some tips for investing during volatile markets to help you navigate uncertain times effectively:

- Stay Invested: Panic selling during market downturns can lead to realized losses. Instead, focus on the long-term benefits of staying invested and riding out the volatility.

- Diversify Your Portfolio: Spreading your investments across different asset classes, such as equities, fixed income, and commodities, reduces the impact of poor performance in any one area.

- Use Rupee-Cost Averaging: Consistently investing a fixed amount, like ₹20,000 monthly, allows you to buy more units when prices are low and fewer when they are high, averaging out the cost.

- Follow a Stock Profit-Taking Strategy: Setting predefined targets for gains and losses can help you lock in profits and prevent emotional decision-making during volatile periods.

Building Healthy Investment Habits

Successful investing isn’t just about the right strategies; it’s about cultivating habits that lead to consistent and informed decisions.

Adopting the habits of successful investors can help you stay focused, disciplined, and adaptable, ensuring long-term financial growth.

Start with Clear Goals

Successful investors always have a plan. They set clear short-term and long-term goals, whether it’s saving for retirement, buying a home, or achieving a specific return on investment. Having these goals provides direction and helps in choosing the right investment avenues.

Practice Consistency

Consistency is key to building wealth. Investing ₹20,000 monthly, for instance, allows you to take advantage of compounding over time. Regular contributions through methods like SIPs help maintain a disciplined approach, even during volatile markets.

Manage Emotions

Markets can be unpredictable, and emotional decisions often lead to losses. Successful investors practice patience and avoid panic selling during market downturns. They focus on long-term growth and stick to their strategies, even in the face of uncertainty.

Regularly Review and Adjust

A good investor regularly reviews their portfolio to ensure it aligns with their goals and risk tolerance. Adjustments are made based on performance and changing financial needs, ensuring that investments remain optimized for growth.

Inspiration Through Investment Quotes

Sometimes, a single piece of wisdom can change how you think about investing. Here’s one to reflect on:

“Do not put all your eggs in one basket.” – Andrew Carnegie

This timeless advice emphasizes the importance of diversification in investing. Spreading your money across various assets like stocks, bonds, and mutual funds reduces risk and protects your portfolio from unpredictable market fluctuations.

Investment quotes like this remind us that smart investment decisions are about strategy and balance, helping you stay focused and motivated on your financial journey.

Conclusion

Investing ₹20,000 monthly is a smart way to grow your wealth, achieve financial goals, and build a secure future.

By understanding the risks and rewards, setting clear goals, and exploring the best investment options, you can create a strategy customized to your needs. Whether it’s through stocks, mutual funds, or bonds, diversification and consistency are key to success.

For example, if you want equity exposure, you can choose to invest directly in the stock market, invest via equity mutual funds, or opt for curated portfolios like an equity StoxBox. StoxBox offers a range of financial solutions, including StoxCalls for expert stock tips, Mutual Fund schemes for seamless investments, and user-friendly utilities tools like SIP and Lumpsum Calculators. Their Trading Platforms make it easy to trade across web and mobile platforms, ensuring a smooth investing experience.

By partnering with trusted platforms like StoxBox, you can take control of your financial future and invest smarter to achieve your goals. Make your 20K monthly investment work harder and start building your wealth today!

Frequently Asked Questions

1. Is ₹20,000 enough to start building a diversified investment portfolio?

Yes, ₹20,000 is a great starting amount to build a diversified portfolio. By allocating funds strategically, such as ₹10,000 in equity mutual funds, ₹5,000 in debt funds, and ₹5,000 in SIPs for gold or ETFs, you can balance risk and return effectively. Diversification ensures that your portfolio isn’t overly reliant on the performance of a single asset class.

2. What is the best way to allocate ₹20,000 monthly for long-term financial goals like retirement?

For long-term goals like retirement, allocating ₹20,000 can be optimized by focusing on equity-based investments. Consider investing ₹15,000 in index funds or equity mutual funds for high growth potential and ₹5,000 in bonds for stability. Over time, the power of compounding and systematic investments can create a substantial corpus.

3. How can I minimize risks while investing ₹20,000 per month?

To minimize risks, ensure your investments are diversified across different asset classes such as equities, debt, and commodities. Use tools like SIPs to invest consistently, which reduces the impact of market volatility. Additionally, review your portfolio every six months to rebalance based on your risk appetite and financial goals.

4. What if I don’t want to invest directly in the stock market but still want equity exposure?

If direct stock investments feel risky, you can opt for equity mutual funds, index funds, or curated portfolios like equity StoxBox, which provide equity exposure without requiring active management. These options are managed by professionals, ensuring diversification and reduced risk while still offering the potential for higher returns.

5. Can I invest ₹20,000 monthly if my income fluctuates?

Yes, even with fluctuating income, you can consistently invest ₹20,000 by automating your savings. Set up a SIP or use tools like a Lumpsum Calculator to adjust contributions during higher-earning months. Platforms like StoxBox can help create a flexible portfolio customized to your income patterns.

6. How do I track and evaluate the performance of my ₹20,000 investments?

You can track your investments using financial platforms or calculators, like the SIP and Lumpsum Calculators offered by StoxBox. These tools provide insights into portfolio performance and future projections. Regularly reviewing your portfolio and comparing it against your financial goals ensures you stay on the right track.

Your Wealth-Building Journey Starts Here

You might also Like.

No posts found!