Investing a portion of your salary can significantly impact your financial stability and growth. By allocating funds to various investment vehicles, you not only build wealth over time but also benefit from compound interest and potential tax advantages.

Understanding the power of smart investment strategies can set the foundation for achieving your financial goals and securing a comfortable retirement.

Smart investment isn’t just about choosing the right stocks or real estate; it’s about making informed decisions based on your financial situation, goals, and risk tolerance.

This involves regular financial health check-ups, setting realistic goals, and understanding the market dynamics to optimize your investment returns while minimizing risks.

Investing your salary wisely

Your first salary is always special. It is something that we have all dreamt about as it finally brings you on the threshold of financial independence. Most of you would remember what you might have done with your first salary.

Maybe you bought your parents some gifts, partied with your friends, and even splurged on yourself. However, how many of you apportioned a part of your first salary to an investment?

Probably not many. That’s alright. You can always spend your entire first salary. However, from the second salary onwards you must start investing. After all, true financial independence does not come from earning.

It comes from investing the money you earn and growing it over the long-term. As Warren Buffet said, “If you buy things you do not need, soon you will have to sell things you need”.

This might sound grim but there is no reason why things should come to that. All you need to do is save and invest your salary wisely – if you do this right, there will be no need for you to compromise.

Understanding Your Financial Health

Assessing Income and Expenses

Effectively managing your finances begins with a thorough assessment of your income and expenses. It’s important to track your financial inflow and outflow meticulously to manage your salary more effectively.

Utilizing budgeting tools or apps can help you visualize where your money goes each month, highlighting areas where you can cut back or need to allocate more funds. This first step is fundamental in creating a solid foundation for making Smart Investment choices.

Setting Short and Long-Term Goals

Setting financial goals is not just about stating what you hope to achieve; it’s about defining clear, actionable targets.

Whether it’s saving for a down payment on a house, preparing for retirement, or funding an education, each goal should have a distinct timeline and a specific plan.

This strategic approach ensures that you are not just saving but are saving with purpose, which is essential for long-term financial success.

Debt Management

Before you can effectively invest your salary, it’s important to address any outstanding debts. Strategies for reducing debt might include consolidating loans, opting for lower interest-rate credits, and prioritizing payments on high-interest debts.

Efficient debt management not only improves your credit score but also frees up more of your income for investments, which can yield a better return on investment over time.

Creating a Salary Investment Plan

Creating a custom investment plan is important for ensuring your financial stability and achieving your long-term goals.

Let’s explore how to determine the right amount to invest, choose between investment methods, and the importance of emergency funds.

How Much to Invest

Determining how much of your salary should you invest is a serious step in managing your finances wisely. Here’s a step-by-step method to help you decide:

- Evaluate your financial obligations: Before deciding how much to save and invest, ensure your basic living expenses, debts, and emergency savings are adequately covered.

- Follow the 50/30/20 rule: A popular method suggests allocating 50% of your income to necessities, 30% to wants, and 20% to savings and investments.

- Adjust based on goals: If you have specific financial goals, you might want to adjust these percentages. For more aggressive savings goals, increase the investment percentage.

Monthly vs. Lump-Sum Investments

Choosing between monthly and lump-sum investments can affect the growth of your investments. Deciding how much to invest per month is a key factor in this process, as it helps you build discipline and consistency in your investment journey. Here are the steps to decide which method suits you best:

- Assess cash flow stability: If your income is regular and predictable, monthly investments can be a good way to build the habit of saving, which aligns with the Habits of Successful Investors who prioritize consistency and discipline in their financial strategies.

- Consider market timing: Lump-sum investments can be advantageous if you receive a windfall or when the market is favorable, but they require careful timing.

- Use dollar-cost averaging: By investing a fixed amount regularly, you reduce the risk of bad timing and potentially lower the average cost per share over time.

Emergency Funds

The importance of emergency funds cannot be overstated. They provide financial security by ensuring liquidity during unforeseen circumstances. Here’s how to establish one:

- Determine the size of the fund: Typically, an emergency fund should cover 3-6 months of living expenses.

- Start small: If you’re just starting out, aim to save a smaller, more achievable amount like ₹10,000 or ₹20,000, then build from there.

- Keep it accessible: Your emergency fund should be easily accessible, kept in a savings account or a money market fund where you can withdraw it without penalties.

Establishing a robust emergency fund is a fundamental aspect of financial planning that safeguards against unexpected financial challenges, allowing you to continue investing confidently.

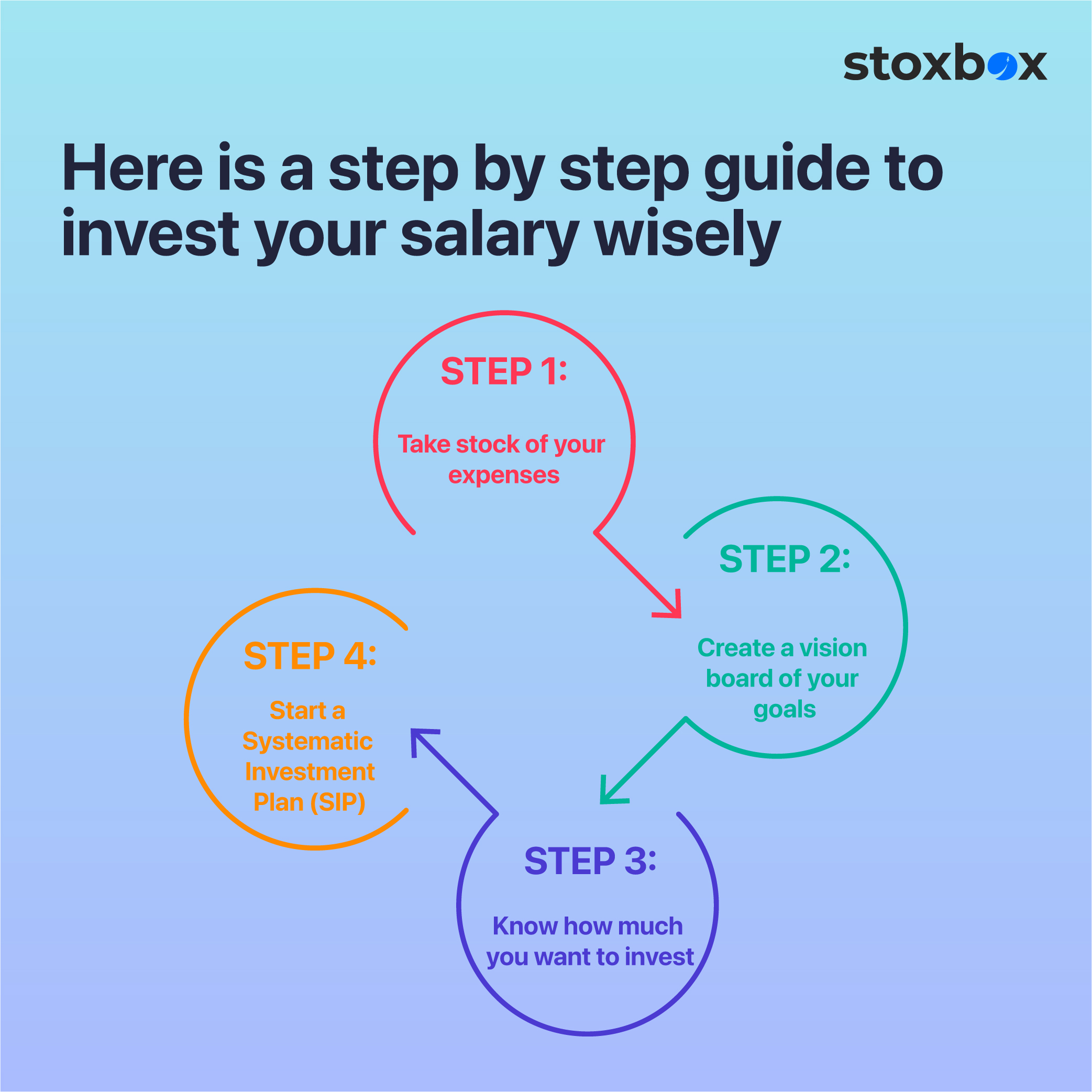

Here’s a guide to maximize your salary investments

Step 1: Take stock of your expenses:

You must always follow the maxim, ‘invest before you spend’. There are some expenses that are an absolute must.

These would include money spent on house rent, taxes, groceries, and utilities like phone and electricity bills. Then, there are some expenses that are discretionary in nature, i.e., you don’t have to spend that money.

These expenses include money spent on eating out or ordering food online, buying expensive gadgets, splurging on clothes and shoes, etc.

Now, while the non-discretionary expenses are a must, it is the discretionary expenses that you can curb. Does that mean that you stop having fun? Not at all.

Step 2: Create a vision board of your goals:

The main purpose of saving and investing is to achieve your goals or postpone consumption to a later day.

As an individual you might have myriad short-term and long-term goals ranging from going on a vacation to the Maldives to buying a 2BHK in your city. So, go ahead and create a vision board of all your goals.

However, if you really want to achieve them, you need to go a step further and create a proper plan. Ask yourself questions like, when do you want to achieve the goal, how much money will you require, how important is the goal, etc.

Step 3: Know how much you want to invest:

You already know your monthly salary and the non-discretionary expenses. When you subtract the non-discretionary expenses from your monthly salary, you arrive at an amount that needs to be apportioned between investments and discretionary investments.

Depending on your goals and the time frame of your goals, you can choose to invest anything between 15% to 50% of this amount. The balance can be spent on discretionary expenses. This way, you can have your cake and eat it too.

Step 4: Start a Systematic Investment Plan (SIP):

An Systematic Investment Plan (SIP) is a great way to start your investing journey. It entails investing a fixed amount of money, on a periodic basis, in an investment instrument of your choice.

An SIP inculcates discipline and gives you an opportunity to reap the benefits of rupee cost averaging and the power of compounding.

Most importantly, you can start an SIP with as little as Rs. 500. So, there really is no minimum investment hurdle that you need to surmount.

These small steps can ensure that you can really maximise the earnings potential of your salary. However, the first step needs to be taken by you. A great way to start would be by exploring our range of curated portfolios that can meet your multiple requirements and help you on your wealth creation journey.

Choosing the Right Investment Avenues

Understanding where to invest your salary is just as important as deciding how much to invest. The right investment options can help you achieve your financial goals while balancing potential returns and risks. Let’s dive into the key avenues that salaried individuals can explore to grow their wealth.

Exploring Stocks and Bonds

Stocks and bonds are among the most traditional and popular investment options. Here’s how they work:

- Stocks for Growth: Investing in stocks gives you part ownership of a company, allowing you to benefit from its growth and profits. Over time, well-chosen stocks can provide significant returns, especially when coupled with a smart stock profit taking strategy to lock in gains at the right time.

- Bonds for Stability: Bonds, on the other hand, are more stable. They are essentially loans you give to a company or government in exchange for regular interest payments and eventual repayment of the principal.

- Balancing Both: A balanced portfolio of stocks and bonds can provide both growth and stability, which is ideal for salaried investors aiming for a steady return on investment.

By combining stocks for higher returns and bonds for security, you can create a diversified portfolio that suits your financial needs.

Real Estate and Fund Investments

For salaried individuals, real estate and mutual funds are excellent options for wealth creation. Here’s why:

- Real Estate for Long-Term Security: Property investments can offer steady appreciation and potential rental income. In India, real estate is often considered a reliable way to grow wealth.

- Mutual Funds for Convenience: Mutual funds allow you to pool money with other investors, which is then managed by experts. Systematic Investment Plans (SIPs) are a great way to invest in mutual funds with small monthly contributions, making it the best way to invest your salary if you want diversification and expert management.

Real estate provides a tangible asset, while mutual funds offer flexibility and professional management for smaller investments.

Retirement Accounts

Securing your future through retirement accounts should be a priority for salaried individuals.

- Employee Provident Fund (EPF): A government-mandated savings scheme in India where both employer and employee contribute, offering tax benefits and a secure retirement corpus.

- National Pension System (NPS): This voluntary retirement savings scheme provides tax benefits under Section 80C and 80CCD(1B), along with market-linked returns.

- Public Provident Fund (PPF): A long-term investment option with tax-free interest and a lock-in period of 15 years, ideal for risk-averse individuals.

Retirement accounts not only ensure financial security but also offer significant tax-saving opportunities.

Alternative Investments

While traditional avenues are popular, alternative investments can also be a part of your salary investment plan.

- Gold and Commodities: Investing in gold or other commodities can act as a hedge against inflation.

- Cryptocurrency: High-risk but potentially high-reward, crypto investments should only be a small part of your portfolio and handled cautiously.

- Startups or Peer-to-Peer Lending: For risk-tolerant investors, these alternatives can provide exciting returns but require careful evaluation.

Alternative investments can diversify your portfolio further, offering unique opportunities for growth while balancing risks.

Adjusting Investments in Volatile Markets

Navigating through volatile markets can be intimidating, but with the right strategies and some tips for investing during volatile markets, you can protect your investments and even find opportunities to grow them. Let’s delve into how to stay resilient during market fluctuations.

Recognizing Market Trends

Understanding market trends is the first step toward managing investments during volatile times. Market trends often indicate whether prices are likely to rise or fall, and recognizing these patterns can help you make informed decisions.

For instance, during a bull market, investors tend to focus on growth opportunities, whereas a bear market demands caution and preservation of capital.

By keeping an eye on economic indicators, market reports, and industry news, you can anticipate changes and adjust your strategy accordingly.

Adapting Your Strategy

Volatility requires flexibility. Adapting your investment strategy can mean rebalancing your portfolio to reduce exposure to high-risk assets or increasing investments in more stable options like bonds or blue-chip stocks.

Unlike investment vs gambling, where gambling relies on chance, a well-planned investment strategy focuses on calculated decisions.

It’s also important to stay calm and avoid rash decisions based on short-term market movements. A long-term perspective helps you ride out market turbulence while keeping your goals intact.

Safe Havens During Market Downturns

During market downturns, certain investments, often referred to as “safe havens,” can protect your capital. Assets like gold, government bonds, and fixed deposits are less affected by market swings and offer stability.

Additionally, having a diversified portfolio that includes these options can minimize losses while waiting for markets to recover.

Inspiration Through Investment Quotes

Sometimes, a little wisdom from seasoned investors can provide the motivation you need to stay on track. Here’s an insightful example:

“Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

This quote emphasizes the importance of prioritizing savings and investments over discretionary spending.

Reflecting on such Investment Quotes can reinforce the value of smart financial habits and help you focus on building long-term wealth.

Conclusion

Investing your salary wisely is a powerful way to achieve financial security and long-term growth. From understanding your financial health to exploring diverse investment avenues like stocks, bonds, mutual funds, and even alternative assets, the key lies in planning, consistency, and adapting to market conditions.

Avoid common mistakes, adopt strategies used by successful investors, and ensure your investment choices align with your financial goals.

If you want equity exposure, you can choose to invest directly in the stock market, invest via equity mutual funds, or opt for curated portfolios like an equity StoxBox.

StoxBox is a versatile platform that offers services like StoxCalls for curated stock tips, Mutual Fund investments, easy access to IPOs, and trading tools through their advanced Trading Platforms. With utilities like the SIP Calculator and Lumpsum Calculator, StoxBox makes investing seamless and efficient for every kind of investor.

Frequently Asked Questions

1. How much of my salary should I invest each month?

It depends on your financial goals, current obligations, and risk tolerance. A common guideline is the 50/30/20 rule, where 20% of your income goes toward investments and savings. However, if you have aggressive goals like early retirement, you may consider increasing this percentage to 30% or more. Tools like SIP calculators can help you determine the ideal amount to start with.

2. Is it better to invest in the stock market or mutual funds as a salaried individual?

Both options have their advantages and depend on your investment knowledge and risk appetite. The stock market offers potentially higher returns but requires active monitoring and expertise, while mutual funds, especially equity funds, are professionally managed and provide diversification. Many salaried individuals start with mutual funds via SIPs for a structured and disciplined approach.

3. What’s the best way to manage salary investments during volatile markets?

During volatile markets, focus on long-term goals and avoid making panic-driven decisions. Use strategies like dollar-cost averaging through monthly SIPs and consider diversifying into safer assets like bonds or gold. For short-term uncertainties, adopting a stock profit taking strategy can help lock in gains while protecting your capital.

4. Should I prioritize paying off debt or investing my salary?

The answer depends on the type of debt you have. High-interest debt like credit cards should always be prioritized and paid off first, as the interest cost often outweighs potential investment returns. For low-interest loans (e.g., home loans), you can allocate a portion of your salary to investments while gradually paying off the debt.

5. How do I determine the right investment plan for my salary?

Start by evaluating your financial goals, risk tolerance, and current obligations. Build an emergency fund to cover at least 3-6 months of expenses before investing. Diversify your investments across equity, debt, and alternative options based on your risk profile. Using tools like StoxBox’s SIP and Lumpsum calculators can simplify the planning process.

6. What is the safest investment option for salaried individuals in India?

Safe investment options for salaried individuals include the Public Provident Fund (PPF), the National Pension System (NPS), and fixed deposits. These instruments provide stable returns with low risk. However, if you’re looking for slightly higher returns with moderate risk, consider balanced mutual funds or large-cap equity funds.

You might also Like.

No posts found!