Hindalco Heats Up Market

- 21st March 2025

Aaj Ka Bazaar

U.S. stock markets paused their three-day positive rally on Thursday and ended below the flat line, with the S&P 500 down 0.2%, the Nasdaq 100 slipping 0.3%, and the Dow Jones unchanged amidst trade uncertainties. In contrast, most Asia Pacific markets showed positive movement. Indian markets are expected to be influenced by global trends, with the GIFT Nifty indicating a positive start for the day, though concerns over U.S. trade tariffs persist. Foreign portfolio investors (FPIs) are shifting towards a buying stance, signaling an end to heavy selling. In stock-specific news, Bajaj Finance may see gains after appointing Rajeev Jain as vice chairperson and Anup Kumar Saha as managing director. Investors will also monitor the upcoming India-U.S. trade negotiations and foreign institutional investor (FII) activity.

Markets Around Us

BSE Sensex – 76,212.30 (-0.18%)

Nifty 50 – 23,146.05 (-0.19%)

Bank Nifty – 49,962.70 (-0.21%)

Dow Jones – 41,951.17 (-0.01%)

Nasdaq – 17,691.63 (-0.33%)

FTSE – 8,701.99 (-0.05%)

Nikkei 225 – 37,873.54 (0.32%)

Hang Seng – 23,699.15 (-2.15%)

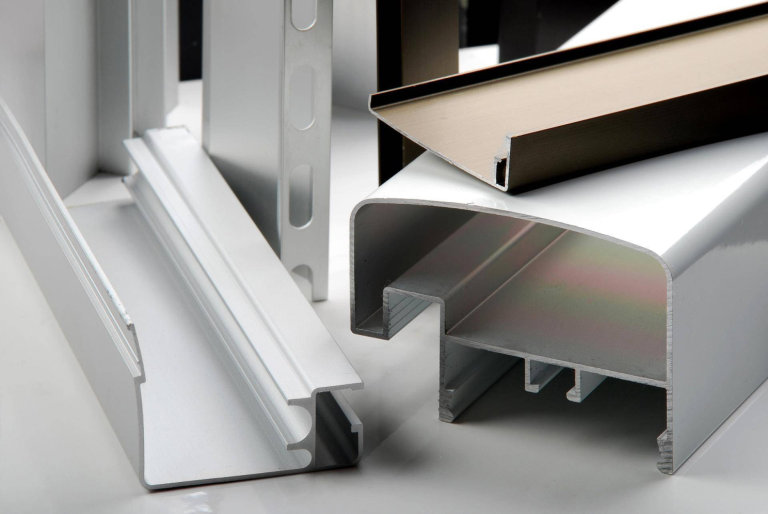

Sector: Aluminium

Hindalco's ₹45K Cr Expansion Boosts Growth

Hindalco Industries, part of the Aditya Birla Group, is in the spotlight after Chairman Kumar Mangalam Birla announced a massive ₹45,000 crore investment to expand its aluminium, copper, and specialty alumina businesses. This move aims to boost the company’s presence in high-precision, next-gen products and support growth in sectors like electric vehicles (EVs), renewable energy, and semiconductors. Hindalco is already India’s largest integrated aluminium producer and plans to strengthen its position further with new facilities, including a copper foil plant for EVs and a battery foil unit. This expansion is part of the Birla Group’s aggressive growth strategy, which also includes recent entries into the paints and cables segments. Over the past year, Hindalco shares have delivered a strong 31% return, beating the Nifty 50’s 5% rise, making it a stock to watch closely for both seasoned traders and young investors exploring long-term opportunities in India’s growing industrial sectors.

Why it Matters:

Hindalco’s ₹45,000 crore expansion boosts its role in key sectors like EVs, renewable energy, and semiconductors, aligning with India’s industrial growth. This move strengthens its global leadership in aluminium and copper while supporting next-gen technologies. Given its strong stock performance, it’s a company investors should keep on their radar.

NIFTY 50 GAINERS

BAJFINANCE– 8953.50 (3.16%)

NESTLEIND– 2255.95 (1.55%)

NTPC – 346.50 (1.39%)

NIFTY 50 LOSERS

INFY – 1584.15 (-1.94%)

TCS – 3518.05 (-1.27%)

WIPRO – 264.80 (-1.19%)

Sector : NBFC

Manappuram Finance Shares surged 3%

Manappuram Finance shares rose nearly 3% after the company announced that Bain Capital will invest ₹4,385 crore to acquire an 18% stake through a preferential allotment at ₹236 per share. This includes 9.29 crore equity shares and an equal number of convertible warrants, giving Bain Capital the option to increase its stake over time. Once completed, Bain Capital will become a joint promoter alongside the current promoters and gain the right to appoint a director to the board. The deal is subject to approval from shareholders at the EGM on April 16 and clearances from RBI and CCI. If all approvals are granted, Bain may trigger a mandatory open offer to acquire up to 26% more, potentially raising its total holding to over 40%. This strategic investment signals strong long-term confidence in the NBFC, making the stock one to watch for both experienced investors and young market participants.

Why it Matters:

Bain Capital’s ₹4,385 crore investment boosts Manappuram’s growth potential and strengthens its balance sheet. As a joint promoter with board presence, Bain adds strategic value, making the stock more attractive to investors.

Around the World

Asian markets traded mostly flat to lower on Friday as investors reacted to concerns about rising U.S. tariffs, interest rates, and a potential economic slowdown. Chinese stocks slipped further after recent gains driven by stimulus hopes and AI-related optimism, with profit-taking dragging down major tech names. Japan’s Nikkei and TOPIX saw modest gains after slightly higher-than-expected inflation data increased the chances of more rate hikes from the Bank of Japan, possibly as soon as May. In contrast, Hong Kong’s Hang Seng dropped due to profit booking, especially in tech stocks. Broader markets like Singapore and South Korea showed limited movement, while Australia’s ASX 200 gained 0.4%. Traders remained cautious amid weak global cues, mixed signals from the U.S. Fed, and ongoing tariff concerns. Futures for India’s Nifty 50 indicated a flat start after a recent strong rally began to cool. Overall, markets are in wait-and-watch mode amid global economic uncertainty.

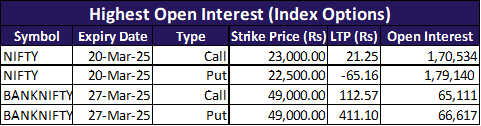

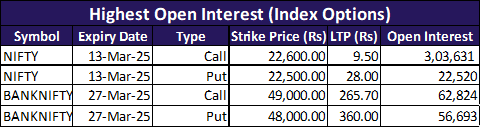

Option Traders Corner

Max Pain

Nifty 50 – 23000

Bank Nifty – 49700

Nifty 50 – 23127 (Pivot)

Support – 23,037, 22,884, 22,794

Resistance – 23,280, 23,369, 23,523

Bank Nifty – 49996 (Pivot)

Support – 49,837, 49,612, 49,454

Resistance – 50,221, 50,380, 50,605

Have you checked our latest YouTube Video

Did you know?

India’s Retail Investor Surge: Market Participation Hits Record Highs in 2024

India’s stock market has seen a 36% rise in retail participation, with over 50 million investors active by 2024. This surge is driven by increased financial literacy, digital trading platforms, and government initiatives. Systematic Investment Plans (SIPs) have also gained popularity, with monthly contributions hitting ₹14,000 crore in early 2025. These trends reflect growing confidence in India’s equity markets.