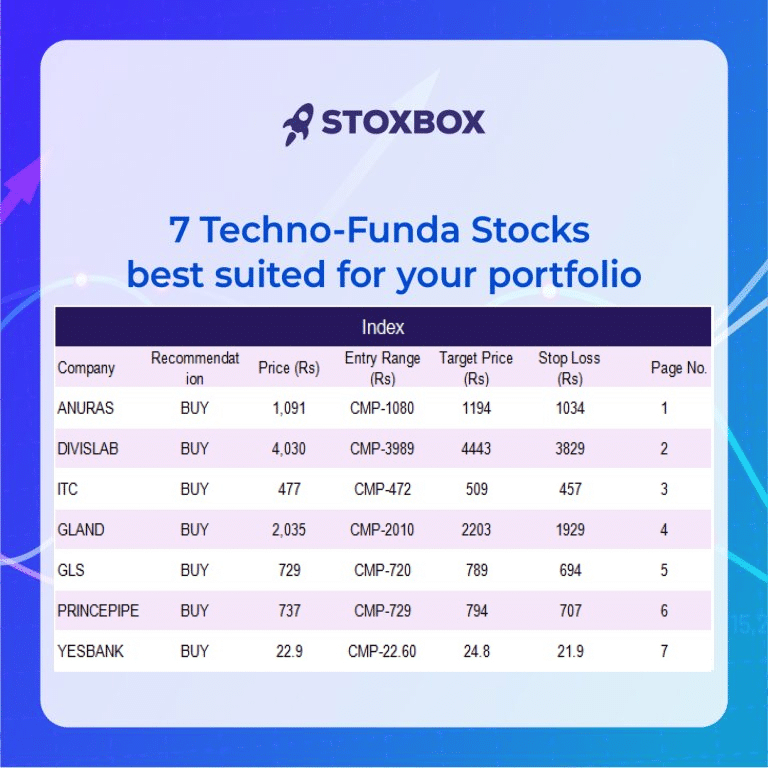

7 techno funda for January 2024

Anupam Rasayan Ltd. – Buy

Strong order book led by multiple Letters of Intent

Anupam has signed deals worth Rs. 8,000 crores, including new contracts with a Japanese company for Rs. 5,500 crores, to supply innovative life-science ingredients and polymer intermediates. These deals are set to bring in about Rs. 1,000 crores in revenue over the next 3-4 years, giving the company a solid financial outlook. Anupam expects a 20% growth, maintaining good profit margins, and is also discussing other high-value product deals globally.

Tanfac acquisition to aid backward integration and expand product portfolio

They bought a 26% stake in Tanfac, enhancing their capabilities in fluorine-based products. They plan to expand their product range, including 14 new fluorination molecules, and increase production capacity, which positions Anupam as a leading supplier in Asia and supports their growth strategy.

Divi’s Laboratories Ltd. – Buy

Focus on new opportunities in custom synthesis and generic products

Divis Laboratories is actively pursuing new business areas, particularly in custom synthesis and generic pharmaceuticals. Their strategy includes branching into specialty chemicals and creating complex molecules tailored for specific clients. This approach could lead to new markets and revenue streams. Additionally, Divis is looking to grow its generic drug portfolio by entering different therapeutic areas and developing generic versions of popular branded drugs. Although the generics market is currently facing pricing challenges and inventory issues, the company is optimistic about future improvements. They anticipate a double-digit revenue increase, driven by a range of projects in contrast media and generic active pharmaceutical ingredients (APIs), especially as patents on key drugs are set to expire in the coming years.

GLP-1 represents a significant growth opportunity

Another significant growth area for Divis Laboratories is in peptides, especially Glucagon-like peptide-1 (GLP-1) products. The company has made considerable advancements in peptides and aims to become a key supplier. The opportunity in peptides is substantial, as there are few companies capable of producing these complex building blocks outside of China. Divis sees potential in both supplying these building blocks and further value addition through forward integration into dipeptides, tripeptides, and longer peptide chains. Despite entering the market later than some competitors, Divis is positioning itself to be a leading supplier of GLP-1 drug building blocks, expecting strong growth from FY2025 onwards.

ITC Ltd. – Buy

Outperformance by non-cigarette business and positive outlook

The non-cigarette sector of the company has been performing exceptionally well, with significant growth in revenue and profit over the past five years. Looking ahead, the company aims to continue this trend by focusing on upscale products and expanding distribution. Efforts in cost-saving and improving the product mix are expected to enhance profitability. The company also anticipates a boost in rural demand over the next year as inflation pressures ease.

Profitable volume growth via market share gains in the cigarette business

In the cigarette business, the company is focusing on gaining a larger market share and increasing profitability. It aims to capture a part of the illicit cigarette market, which is substantial, through innovative product launches and strengthening its portfolio. These new products, along with strategies like premiumization and ongoing innovation, are key to competing effectively in the legal cigarette market and reducing the impact of illegal trade.

Gland Pharma Ltd. – Buy

Strong visibility on the business trajectory

Gland Pharma is optimistic about its future, having introduced 34 new products in the US market, including nine completely new ones. The company aims to expand its product launches in the US and sees potential in the oncology sector. Its core markets and operations in India are also performing well. The company is focused on improving its operations and cutting costs to increase profits. The future looks bright for Gland Pharma with plans for new products, wider portfolio, and market expansion.

Focus on integrating Cenexi and driving synergistic benefits

Regarding its European expansion, Gland Pharma has acquired Cenexi for its CDMO operations, improving its presence in Europe. This acquisition has already contributed to the company’s finances. Gland Pharma is looking forward to benefiting from the synergies from Cenexi, like accessing new technologies and markets, and is optimistic about improving profit margins in the future.

Glenmark Life Sciences Ltd. – Buy

Steady pace of new launches to aid financial growth

Glenmark Life Sciences is growing its portfolio with new APIs, including some for chronic treatments. They’ve added three new products recently and have a pipeline of 12 high-potential APIs, three of which are already validated. The company plans to develop 8-10 APIs every year and expand its CDMO projects. They’re also aiming to grow by introducing existing products into new markets.

Expansion plans on track with strong growth visibility in H2FY24

The company’s expansion plans are on track, with a new API plant in Dahej and an integration plant in Ankleshwar underway. The Dahej plant, focusing on oncology products, is partly operational, and the Ankleshwar plant should be ready by FY25. Glenmark expects strong growth in the second half of FY24 due to high demand and ongoing projects.

Prince Pipes and Fittings Ltd. – Buy

Diversification into bathware segment and technological advancements fuel growth prospects

Prince Pipes has diversified its offerings by launching PE-FIT Aqua HDPE Piping Systems and entering the bathware sector with premium faucets and sanitaryware. This expansion is expected to enhance the brand and contribute significantly to the company’s growth. The management is also optimistic about achieving double-digit growth in pipe volumes due to stable raw material costs and demand in agriculture, plumbing, and infrastructure.

Robust expansion plans and strategic initiatives to drive sustainable growth

The company is actively pursuing growth through expansion plans and strategic initiatives. It aims to double its FY24 revenue from the water storage tank business and plans to open a new facility in Bihar by FY25, which will cater to the North-Eastern market. Furthermore, Prince Pipes is focusing on increasing production capacity and tapping into the bathware market through distribution, branding, and acquisitions. Despite a temporary dip in returns, the company is confident about future improvements, supported by favourable business conditions and polymer prices.

YES Bank Ltd. – Buy

Strong business growth drives profitability and NIMs

Yes Bank has seen a healthy loan growth, despite a decrease in corporate loans, thanks to its focus on retail and SME sectors. This strategy, along with a significant increase in deposits and improvements in its CASA ratio, is expected to lead to higher net interest margins. The bank’s non-interest income is also likely to grow, contributing to its profitability in the future.

Significant improvement in asset quality

The bank’s asset quality has improved significantly, largely due to selling off non-performing assets and reducing corporate loans. This has led to a sharp decline in gross and net non-performing asset levels. Yes Bank has also made extra provisions for stressed assets, cleaning up its balance sheet and setting the stage for further improvements in asset quality.

You might also Like.

CCL Products (India) Ltd. – Q2FY25 Result Update

Table of Contents Sector Outlook: Positive Trade Now Strong financial...

JB Chemicals & Pharmaceuticals Ltd. – Q2FY25 Result Update

Table of Contents Sector Outlook: Positive Trade Now Domestic formulation...