Upcoming IPOs by StoxBox

Just a tap away!

The time has come for you to enjoy easy access to IPOs. Our platform is built to offer you superior, fair, and completely free access. The best part? Our team of experienced analysts closely examine IPO offerings, identifying those with strong growth potential and determining which IPOs you should invest in.

IPOs, Just a tap away!

The time has come for you to enjoy easy access to IPOs. Our platform is built to offer you superior, fair, and completely free access. The best part? Our team of experienced analysts closely examine IPO offerings, identifying those with strong growth potential and determining which IPOs you should invest in.

Upcoming / Ongoing IPO’s

| Company name | Date | Price Range | Min.Qty | View |

|---|

Past IPO's

| Company name | Date | Price Range | Min.Qty | View |

|---|

Want to know whether the

next IPO will be a hit or a miss?

Signup now to find out!

| Investors in India eagerly await the latest news on upcoming IPOs, as these initial public offerings present enticing investment opportunities. To stay informed about the most recent IPOs, one can rely on Stoxbox IPO List 2023. It provides comprehensive details, including the issue price and allotment status, enabling investors to make well-informed decisions. Stoxbox understands the significance of having access to accurate and up-to-date information when it comes to investing in IPOs. With the convenience of online platforms, investors can easily track and analyze the latest IPOs, making it easier than ever to participate in these offerings. By staying updated on the IPO list through Stoxbox, investors can identify the IPOs that seem most promising and align with their investment goals. With careful consideration and a reliable source of information like Stoxbox, investors can make informed choices regarding IPO investments and potentially reap significant rewards. |

What is an IPO?

An Initial Public Offering (IPO) marks a pivotal moment for a private company as it transitions into a publicly traded entity. This process involves offering shares of the company to the public for the first time, thereby allowing it to raise substantial capital from a broad base of investors. The funds garnered through an IPO can be utilized for various strategic objectives, such as expanding business operations, paying down existing debts, or investing in new projects and technologies.

When a company opts to go public, it typically enlists the expertise of investment banks to facilitate the IPO process. Understanding What is IPO is crucial for grasping the role these banks play. These investment banks, often referred to as underwriters, play a crucial role in setting the initial price of the shares and determining the quantity to be offered. They conduct extensive due diligence to ensure that the company meets regulatory requirements and is attractive to potential investors. This includes preparing a detailed prospectus that outlines the company’s financial health, business model, and growth prospects, providing transparency to potential investors.

The pricing of the shares is a critical step. It involves a careful assessment of the company’s valuation, market conditions, and investor demand. The underwriters help strike a balance to ensure the shares are priced attractively enough to generate interest among investors while maximizing the capital raised for the company. Once the shares are priced, the company embarks on a roadshow, presenting its investment case to institutional investors to build momentum ahead of the public listing.

Finally, on the day of the IPO, the shares are offered to the public, and the company begins trading on the stock exchange. This event not only raises capital but also enhances the company’s visibility and credibility in the market, potentially attracting further investments and fostering long-term growth.

Understanding IPO Watch

IPO watch platforms are invaluable resources for investors looking to stay informed about the latest happenings in the IPO market. These platforms provide real-time updates and comprehensive information on Upcoming IPO, including IPO listings, the latest IPO GMP (Grey Market Premium), and other critical details. Here’s a detailed look at how IPO watch platforms can help investors:

Real-Time Updates

Real-time updates on IPOs: IPO watch platforms offer continuous updates about new IPOs and upcoming IPOs, ensuring investors are always aware of the latest opportunities. For instance, if you’re tracking an upcoming IPO in India, these platforms will provide detailed information about the company, expected listing dates, and financial health.

Upcoming IPOs and Listings

Information on upcoming IPOs and listings: Investors can view a comprehensive IPO list featuring all the upcoming IPOs for 2024, including upcoming SME IPOs. This helps investors plan their investments by reviewing the companies that will soon be going public. The IPO listing date and other key dates are also provided, allowing investors to time their applications effectively.

Grey Market Premium (GMP)

Tracking IPO GMP: One of the critical features of IPO watch platforms is the live tracking of IPO GMP. The GMP of upcoming IPOs gives investors an insight into market sentiment and potential listing gains. By monitoring the live IPO GMP and latest IPO GMP, investors can gauge the demand and expected performance of a new IPO before it officially lists.

IPO Dashboard

Comprehensive IPO dashboard: An IPO dashboard consolidates all relevant information in one place. This includes the latest news, IPO details, and performance of recent IPOs. It also highlights new IPO listings today and new upcoming IPOs, providing a snapshot of the current IPO market landscape.

Market Sentiment and Analysis

Insights into market sentiment: By offering insights into market sentiment through GMP and other indicators, IPO watch platforms help investors make informed decisions. This is particularly useful for evaluating the latest IPO in India and assessing whether it aligns with their investment strategy.

By leveraging the comprehensive information provided by IPO watch platforms, investors can stay ahead of the curve and make well-informed investment decisions in the dynamic IPO market. Whether you’re interested in the latest IPO list, the best upcoming IPO, or the new IPO listing today, these platforms offer the tools and information necessary to navigate the IPO landscape effectively.

Types of IPOs

Main Board IPO

A Main Board IPO refers to the process of a larger company offering its shares to the public for the first time on primary stock exchanges like the Bombay Stock Exchange (BSE) or the National Stock Exchange (NSE) in India. This type of Initial Public Offering (IPO) is typically associated with companies that have substantial market capitalizations and are well-established in their industries.

Characteristics of Main Board IPOs

- Substantial Market Capitalization: Companies undergoing a Main Board IPO usually have significant market capitalizations. These are often industry leaders with robust financial health and established business models.

- Regulatory Compliance: These companies must comply with stringent regulatory requirements set by SEBI (Securities and Exchange Board of India). This includes detailed disclosures in the IPO Prospectus, which provides vital IPO details to potential investors.

- Investor Base: Main Board IPOs attract a broad range of investors, including institutional investors, mutual funds, and retail investors. This diverse investor base helps in achieving a more stable and successful IPO launch.

- GMP Insights: The Grey Market Premium (GMP) for upcoming IPOs can provide insights into investor sentiment. Tracking the live IPO GMP through platforms like IPO watch and IPO dashboard helps investors gauge the potential performance of new IPOs.

SME IPO

SME IPOs (Small and Medium Enterprises Initial Public Offerings) are tailored for small and medium-sized companies looking to raise capital by offering their shares to the public. These companies list their shares on specialized platforms like the BSE SME or NSE Emerge. SME IPOs provide a significant opportunity for smaller companies to access public funds while offering new investment avenues to investors.

Characteristics of SME IPOs

- Target Market: SME IPOs are specifically designed for smaller enterprises that may not meet the stringent criteria required for Main Board IPOs. These platforms provide a more accessible route for SMEs to go public.

- Regulatory Requirements: Although SME IPOs have lighter regulatory requirements compared to Main Board IPOs, they still adhere to strict guidelines set by SEBI. Companies must provide detailed disclosures in their IPO Prospectus, which includes financial health, risks, and business prospects.

- Investor Interest: SME IPOs attract a diverse group of investors, including retail investors looking for high-growth opportunities. Tracking IPO watch platforms and live IPO GMP can provide insights into market sentiment and potential performance of upcoming SME IPOs.

- Growth Potential: Investing in SME IPOs can be highly rewarding, as these companies often have substantial growth potential. The upcoming IPOs list on platforms like BSE SME or NSE Emerge often highlights high-potential companies

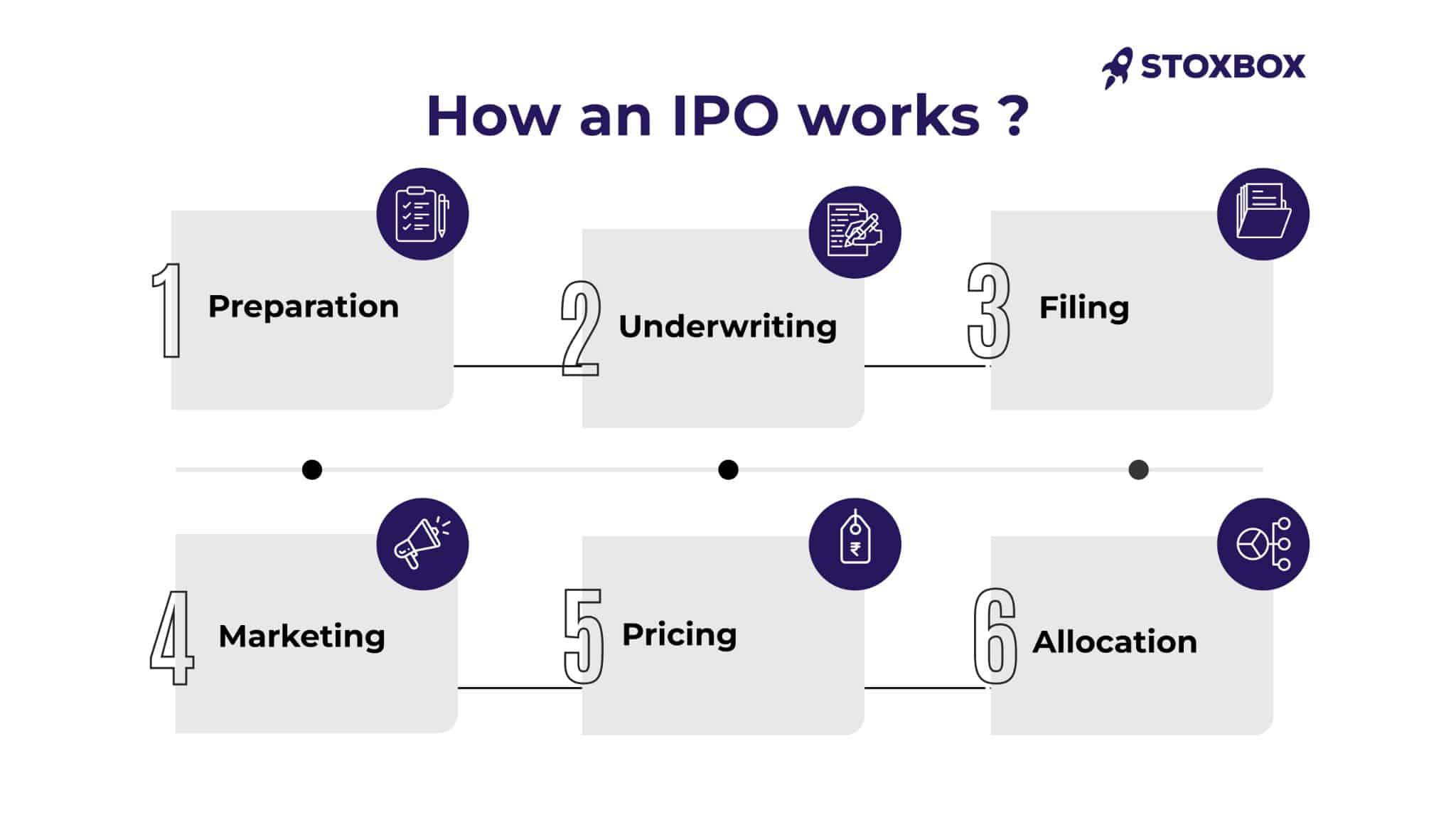

How an IPO Works?

Preparation

In the preparation phase, the company gets its financial statements and business model ready for thorough scrutiny. This involves auditing financial records, structuring the business plan, and ensuring compliance with regulatory requirements. This stage is crucial as it lays the foundation for the IPO process. Investors interested in upcoming IPOs often start their research at this point by looking at the company’s historical performance and future growth prospects.

Underwriting

Once the company is prepared, it hires investment banks to underwrite the IPO. Underwriters play a pivotal role in the IPO process; they assess the company’s value and help set the initial share price. Underwriters also provide essential guidance on market conditions and investor appetite. For instance, if you are tracking an upcoming IPO 2024, the underwriting phase is where the initial groundwork for the IPO pricing and strategy is laid out. Investment banks may also purchase shares from the company and sell them to the public, ensuring the company raises the intended capital.

Filing

The company files a prospectus with regulatory authorities, detailing its financial health, risks, business model, and future prospects. In India, this is done with the Securities and Exchange Board of India (SEBI). The prospectus provides potential investors with all the necessary information to make an informed decision. For those keen on IPO watch, this document is vital as it offers in-depth insights into the company’s operations and financial status. The prospectus must be transparent and comprehensive, as it forms the basis of investor trust and interest.

Marketing

Marketing the IPO is a critical step where the company and its underwriters engage in roadshows and presentations to attract potential investors. This phase involves meeting institutional investors, mutual funds, and retail investors to generate interest and build a strong investor base. During this period, the concept of “live IPO GMP” or Grey Market Premium becomes relevant, as it indicates the market’s perception of the IPO’s value before the actual listing. Positive sentiment in the grey market can significantly boost investor confidence and demand.

Pricing

The final price of the shares is set based on investor demand and prevailing market conditions. This is known as the book-building process, where investors bid for shares at various price points within a specified range. The price at which the majority of bids are placed becomes the final IPO price. Keeping an eye on the latest IPO GMP can provide insights into how the market is valuing the shares compared to the offering price. A higher GMP indicates strong demand and potential for price appreciation post-listing.

Allocation

In the allocation phase, shares are distributed to investors. If the IPO is oversubscribed, shares may be allocated on a pro-rata basis or through a lottery system. This phase concludes with the company’s shares being officially listed on the stock exchange, making it a public entity. The “IPO listing date” is a significant milestone as it marks the first day the shares are available for public trading. Monitoring the IPO dashboard on this day can provide real-time updates on share performance and investor sentiment.

Investing in IPOs offers several benefits to investors looking to diversify their portfolios and potentially achieve high returns. Here are some key advantages:

Potential for High Returns

IPOs can provide significant returns if the company performs well post-listing. Many investors are drawn to IPOs because of the potential for substantial gains. When a company goes public, it often attracts a lot of attention, which can drive up the share price. For instance, looking at recent IPOs and the live IPO GMP (Grey Market Premium) can provide insights into investor sentiment and the expected performance of an upcoming IPO.

Early Access

Investors get the opportunity to invest in companies before they become widely traded. Participating in an IPO allows investors to buy shares at the offering price, which can be lower than the price at which the shares will trade once they are listed on the stock exchange. This early access can be particularly advantageous if the company is expected to perform well. Keeping an eye on the upcoming IPO list and the IPO dashboard helps investors stay updated on the latest IPO news and opportunities.

Growth Opportunities

Investing in IPOs allows investors to support and benefit from the growth of emerging companies. Many IPOs involve companies in their growth phase, providing an opportunity for investors to participate in their expansion and success. For instance, new IPOs in sectors like technology, healthcare, and consumer goods often present lucrative opportunities for growth. Monitoring the latest IPOs and the IPO watch platforms for upcoming IPOs in India can help investors identify the best upcoming IPOs to invest in.

Diversification

IPOs provide a way to diversify investment portfolios. By investing in a mix of established and new companies through IPOs, investors can spread their risk across different sectors and industries. This diversification can help in mitigating risks and enhancing returns. Checking the upcoming IPO list and the new IPO GMP can give investors a sense of which sectors are currently trending and offer diversification benefits.

Transparency and Information

Companies going public are required to disclose detailed information in their IPO Prospectus. This document provides comprehensive details about the company’s financial health, business model, risks, and future prospects. This transparency helps investors make informed decisions. Keeping track of IPO news and the IPO process in India ensures that investors have all the necessary information to evaluate the investment.

Access to Promising Companies

IPOs often include companies with strong growth potential that are not yet available to the public. Investing in these companies early can lead to substantial long-term gains. By regularly checking the IPO dashboard and the upcoming IPO list, investors can identify new opportunities and stay ahead of market trends.

Benefits of IPOs for Companies

Raising capital through IPOs allows companies to expand their operations, pay off debt, and invest in new projects. This growth, in turn, benefits investors who have a stake in the company’s success. The Benefits of IPO include providing a company with the necessary funds to fuel expansion and innovation. Monitoring upcoming IPO 2024 and the latest IPO in India can help investors spot companies that are poised for growth and expansion.

Investing in Initial Public Offerings (IPOs) can be an exciting opportunity, but it also comes with several risks that investors should be aware of. Here’s an in-depth look at the potential pitfalls and how to navigate them, using relevant keywords to provide a comprehensive understanding.

Market Volatility

IPOs can be volatile, and prices may fluctuate significantly. When a company first goes public, the share price can experience substantial swings due to market speculation, investor sentiment, and broader economic conditions. This volatility can be particularly pronounced on the IPO listing date and in the days following the launch.

For example, recent IPOs in India have shown considerable volatility, which can impact both short-term and long-term investors. Monitoring the live IPO GMP (Grey Market Premium) can provide insights into the expected performance but does not eliminate the inherent risk of price fluctuations.

Limited Information

Investors may not have access to comprehensive information about the company. Unlike established public companies, IPOs involve businesses that are new to the public market, often with limited publicly available financial history. The IPO Prospectus provides essential details, but it may not cover all aspects comprehensively.

For investors keeping an eye on upcoming IPOs in India, it’s crucial to delve deep into the IPO details provided in the prospectus and other regulatory filings. Utilizing IPO watch platforms can help gather additional information, but investors should be cautious and seek as much detail as possible about the company’s business model, competitive landscape, and growth prospects.

Lock-In Periods

Some IPOs have lock-in periods preventing early investors from selling their shares immediately after the IPO. These lock-in periods, which can last from 90 days to several months, are designed to prevent a flood of shares from hitting the market all at once, which can depress the stock price. However, it also means that early investors may not be able to liquidate their shares even if the stock price drops post-listing.

For instance, new IPOs often come with lock-in periods that restrict when insiders and early investors can sell their shares, adding another layer of risk. Investors should be aware of the lock-in details and be prepared for potential price drops once the lock-in period expires.

Other Risks and Considerations

- Overvaluation: Some IPOs may be overvalued at the time of listing due to high investor demand. It’s essential to compare the IPO price with the company’s financials and industry benchmarks to avoid overpaying for shares.

- Changing Market Conditions: Economic downturns or market corrections can negatively impact IPO performance. Keeping track of IPO news and the latest IPO list can help investors stay informed about broader market trends and conditions.

- Performance of Recent IPOs: Analysing the performance of recent IPOs can provide insights into current market sentiment and potential risks. Reviewing the latest IPO GMP and upcoming IPO GMP can help investors gauge market expectations and adjust their strategies accordingly.

- Upcoming SME IPOs: Smaller companies, often listed under SME IPOs, can be riskier due to their limited market presence and financial instability. While they offer growth potential, they also come with higher volatility and uncertainty.

Mitigation Strategies

To mitigate these risks, investors should conduct thorough research and due diligence. Here are some steps to consider:

- Research the Company: Thoroughly read the IPO Prospectus and understand the company’s business model, financial health, competitive landscape, and growth strategy. This information is crucial for evaluating the investment’s potential.

- Monitor Market Sentiment: Use IPO watch platforms and live IPO GMP updates to stay informed about market sentiment towards the IPO. This can provide insights into potential price movements and investor interest.

- Diversify Your Portfolio: Avoid putting all your funds into a single IPO. Diversifying across different sectors and asset classes can help spread risk and reduce the impact of a single investment’s poor performance.

- Evaluate the Management Team: The experience and track record of the company’s management team can significantly impact its success. Ensure that the team has a strong background and a clear vision for the company’s growth.

- Understand the Industry: Be aware of the industry’s growth prospects and challenges. For example, upcoming IPOs in the tech sector may have different risk profiles compared to those in traditional industries like manufacturing or consumer goods.

- Keep an Eye on Key Metrics: Look at key financial metrics such as revenue growth, profitability, and debt levels. These indicators can provide a clearer picture of the company’s financial health and future prospects.

While IPOs present exciting opportunities for investors to participate in the growth of new companies, they also come with significant risks. By conducting thorough research, staying informed through IPO watch platforms, and understanding the specifics of each IPO, investors can make more informed decisions and mitigate potential risks. Keeping an eye on upcoming IPOs in India, live IPO GMP, and market trends will help investors navigate the dynamic landscape of IPO investments effectively.

How to Evaluate an Upcoming IPO?

When considering an investment in an upcoming IPO, it’s essential to thoroughly evaluate several factors to make an informed decision. Here’s a detailed guide to help you assess the potential of an IPO:

Company Financials

Review the company’s financial health, revenue growth, and profitability. Start by examining the financial statements provided in the IPO Prospectus. Key metrics to look for include:

- Revenue Growth: Consistent revenue growth indicates a company’s ability to expand its business and attract customers. Compare the company’s revenue growth over the past few years to understand its growth trajectory.

- Profitability: Analyse the company’s profit margins, including gross margin, operating margin, and net margin. A profitable company with healthy margins is generally more stable and sustainable.

- Debt Levels: Check the company’s debt-to-equity ratio to assess its leverage. High debt levels can be risky, especially if the company’s earnings are not sufficient to cover interest payments.

For instance, upcoming IPOs in India like those listed on the IPO watch platforms provide detailed financial summaries that can help investors understand the company’s financial health.

Market Position

Assess the company’s competitive position and market share. Understanding the company’s position within its industry is crucial.

Consider the following

- Competitive Advantage: Determine what sets the company apart from its competitors. This could be unique technology, strong brand recognition, or a significant market share.

- Market Share: Evaluate the company’s market share and its ability to maintain or grow this share. Companies with a leading market position are often better positioned to withstand market fluctuations.

- Customer Base: Look at the diversity and loyalty of the company’s customer base. A wide and loyal customer base can provide a stable revenue stream.

The IPO dashboard often provides insights into the competitive landscape, helping investors gauge the company’s position relative to its peers.

Management Team

Evaluate the experience and track record of the company’s leadership. The management team plays a critical role in the company’s success.

Consider the following:

- Experience: Assess the management team’s experience in the industry and their track record of success. Experienced leaders are more likely to navigate the company through challenges effectively.

- Vision and Strategy: Understand the management’s vision for the company and their strategic plans for growth. This information is usually detailed in the IPO Prospectus.

- Reputation: Research the reputation of the management team and any previous ventures they have been involved in. A strong, reputable management team can instil confidence in investors.

Monitoring IPO news and updates about the management team can provide additional insights into their capabilities and plans.

Industry Trends

Consider the growth prospects of the industry in which the company operates. The broader industry context can significantly impact the company’s growth potential. Factors to consider include:

- Industry Growth: Evaluate the overall growth potential of the industry. Industries that are expanding rapidly can provide a favourable environment for the company to grow.

- Regulatory Environment: Understand any regulatory challenges or changes that could impact the industry. For example, upcoming IPOs in the healthcare sector might be affected by changes in healthcare regulations.

- Market Demand: Assess the demand for the company’s products or services. High demand can drive revenue growth and market share expansion.

For the latest IPO in India, checking the live IPO GMP and upcoming IPO list can give insights into investor sentiment and market expectations.

Additional Considerations

- IPO Pricing: Evaluate the pricing of the IPO shares. Overpriced shares can limit upside potential, while under-priced shares can offer significant returns. The GMP of upcoming IPOs can provide an indication of market pricing.

- Lock-in Periods: Be aware of any lock-in periods that prevent early investors from selling their shares immediately after the IPO. This can affect the stock’s liquidity and price stability post-listing.

- Underwriting and Institutional Interest: The quality of the underwriters and the level of institutional interest can provide additional confidence in the IPO. Reputable underwriters and strong institutional demand often signal a high-quality IPO.

Important Points to consider

- Research the Company: Read the IPO Prospectus and other available documents to understand the company’s business model, financials, and growth prospects.

- Check IPO Listings: Use platforms like the IPO dashboard to stay updated on the latest IPOs and their GMP.

- Evaluate Market Sentiment: Monitor live IPO GMP and upcoming IPO news to gauge market sentiment and demand.

- Apply for IPO: Follow the IPO application process through your brokerage account or directly via the stock exchanges.

Monitor Post-Listing Performance: Keep an eye on the stock’s performance post-listing and be prepared for volatility.

By carefully evaluating these factors and staying informed through resources like IPO watch platforms and IPO news, investors can make well-informed decisions about participating in upcoming IPOs.

Performance of IPOs in India (Last 6 Months)

| Top Performers | |||

|---|---|---|---|

| IPO Name | IPO Price (INR) | Listing Gains (%) | Current Gains (%) |

| Tata Technologies | 500 | 162.6 | 118 |

| Motisons Jewellers | 55 | 88.27 | 243.73 |

| IREDA | 32 | 87.5 | 506.72 |

| Netweb Technologies | 500 | 82.08 | 335 |

| DOMS Industries | 790 | 67.85 | 133.54 |

| Cyient DLM | 265 | 58.72 | 148.74 |

| EMS Limited | 211 | 32.65 | 121.33 |

| JSW Infra | 119 | 32.18 | 138.32 |

| Moderate Performers | |||

|---|---|---|---|

| IPO Name | IPO Price (INR) | Listing Gains (%) | Current Gains (%) |

| Vishnu Prakash Punglia | 99 | 47.17 | 77.27 |

| Jupiter Life Line Hospitals | 735 | 46.36 | 57.14 |

| INOX India | 660 | 42.42 | 91.08 |

| IKIO Lighting | 285 | 41.7 | -4.68 |

| Sah Polymers | 65 | 37.31 | 45.23 |

| Flair Writing | 304 | 48.32 | -0.66 |

| Lower Performers | |||

|---|---|---|---|

| IPO Name | IPO Price (INR) | Listing Gains (%) | Current Gains (%) |

| Aeroflex Industries | 108 | 51.16 | 28.06 |

| Plaza Wires | 54 | 55.93 | 65.74 |

| SBFC Finance | 57 | 61.75 | 45.35 |

| Gandhar Oil | 169 | 78.34 | 23.08 |

| IdeaForge | 672 | 92.7 | 3.57 |

Steps to Invest in an IPO

Investing in an Initial Public Offering (IPO) can be an exciting opportunity to become part of a company’s growth journey. Here’s a detailed guide to help you navigate the process:

Open a Demat Account

A Demat account is necessary to hold shares electronically. This is the first and most crucial step. Without a Demat account, you cannot apply for or hold shares. Most banks and financial institutions offer Demat account services, and it can often be linked to your existing bank account for seamless transactions.

- How to Open a Demat Account: Choose a brokerage firm or bank that offers Demat services. Fill out the application form, provide necessary documents (identity proof, address proof, and PAN card), and complete the KYC process.

- Choosing the Right Broker: Compare brokerage firms based on their services, brokerage charges, and user reviews to select the best option for your needs.

Select an IPO

Choose the IPO you wish to invest in by reviewing the IPO list and upcoming IPOs. This involves researching and selecting a company that matches your investment goals.

- Review IPO List and Upcoming IPOs: Keep an eye on platforms that provide information on upcoming IPOs in India. Resources like IPO watch and IPO dashboard give you a comprehensive list of upcoming IPOs, including details like upcoming IPO GMP (Grey Market Premium), listing dates, and company information.

- Analyse IPO Prospectus: The IPO Prospectus contains detailed information about the company’s financial health, business model, and future plans. Understanding this document is crucial for making informed decisions.

Apply for Shares

Fill out the IPO application form through your brokerage platform. This step involves officially applying to purchase shares in the IPO.

- Online Application: Most brokerage firms provide an online application process. Log in to your Demat account, navigate to the IPO section, and select the IPO you wish to apply for. Fill in the necessary details and submit your application.

- UPI Mandate: If you’re applying through the UPI (Unified Payments Interface), you’ll receive a mandate request on your UPI app, which you need to approve for the application to be processed.

Fund Your Account

Ensure your account has sufficient funds to cover your application. The amount required depends on the number of shares you wish to apply for and the price range of the IPO.

- Funding the Account: Transfer the required funds into your linked bank account or directly into your brokerage account. Ensure you have a margin of extra funds to cover any discrepancies.

Wait for Allocation

Shares will be allocated based on demand. If oversubscribed, you may receive fewer shares than requested.

- Allocation Process: The allocation is usually done on a lottery basis in case of oversubscription. You will receive a confirmation email or message from the depository (NSDL/CDSL) once the shares are allocated.

- Refund Process: If you don’t receive the full number of shares you applied for, the excess funds will be refunded to your account.

Monitor the IPO Dashboard

Use an IPO dashboard to track the status of your application and the listing date.

- IPO Dashboard: This tool helps you keep track of your application status, share allocation, and the IPO listing date. It provides real-time updates and important IPO news.

- Post-Listing Strategy: Decide whether to hold or sell the shares based on the company’s performance and market conditions. Monitoring the live IPO GMP and latest IPO GMP can give you an idea of the market sentiment and potential post-listing performance.

Additional Tips

Stay Informed: Regularly check IPO news and updates. Websites and financial news portals often have sections dedicated to the latest IPO in India and the upcoming IPO 2024 list.

- Evaluate Multiple IPOs: Don’t put all your funds into one IPO. Diversify by investing in multiple upcoming IPOs to spread risk.

- Understand the Risks: Be aware that investing in IPOs comes with risks, such as market volatility and limited information. Make informed decisions by researching thoroughly.

Conclusion

Investing in IPOs can offer significant opportunities for investors looking to diversify their portfolios and participate in the growth of emerging companies. By getting in on the ground floor, investors have the potential to reap substantial returns if the company performs well post-listing. Understanding the IPO process is crucial for making informed investment decisions. This includes knowing how companies prepare for an IPO, how shares are priced and allocated, and what factors drive the success of an IPO.

Evaluating upcoming IPOs involves thorough research and analysis. Investors should review the company’s financial health, market position, growth potential, and the credibility of its management team. It’s also essential to understand the industry trends and how the company fits within the broader market landscape. Using resources like IPO watch platforms can be invaluable. These platforms provide real-time updates on upcoming IPOs, Grey Market Premiums (GMP), and market sentiment, helping investors stay informed about the latest opportunities and trends.

However, investing in IPOs also comes with risks. Market volatility can lead to significant price fluctuations, and limited information about the company can increase uncertainty. To mitigate these risks, it’s important to conduct due diligence and be cautious about the hype that often surrounds IPOs. By following these guidelines and staying informed through reliable sources, investors can navigate the IPO landscape effectively. This strategic approach allows them to capitalize on new opportunities while managing potential downsides, ultimately contributing to a more robust and diversified investment portfolio.

Frequently Asked Questions

Can I sell my shares immediately after the IPO listing?

Yes, you can sell your shares immediately after the IPO listing, assuming you were allocated shares during the IPO. Once the company’s shares start trading on the stock exchange, you are free to sell them just like any other publicly traded stock. However, it’s important to consider the potential for short-term price volatility immediately following the IPO. Monitoring platforms like IPO watch can help you keep track of the latest IPO GMP and listing day performance to make informed decisions.

Why do some IPOs get oversubscribed?

IPOs get oversubscribed when the demand for shares exceeds the number of shares offered by the company. This often happens with upcoming IPOs that generate significant investor interest due to factors like strong company fundamentals, market positioning, growth potential, or favourable market conditions. High-profile IPO news and positive GMP of upcoming IPOs can also drive oversubscription. Investors use tools like the IPO dashboard to gauge demand and make decisions.

What is the lock-up period in an IPO, and why is it important?

The lock-up period is a predetermined period (typically 90 to 180 days) post-IPO during which insiders, such as company executives, employees, and early investors, are restricted from selling their shares. This period is crucial because it helps stabilize the stock price by preventing a flood of shares into the market immediately after the IPO listing date. Once the lock-up period expires, there can be increased volatility if a large number of shares are sold. Monitoring platforms like IPO watch can provide updates on when lock-up periods expire.

How can I determine if a stock is a good long-term investment?

To determine if a stock is a good long-term investment, consider several factors:

- Company Financials: Review the company’s financial statements, revenue growth, profitability, and cash flow.

- Market Position: Assess the company’s competitive position and market share within its industry.

- Management Team: Evaluate the experience and track record of the company’s leadership.

- Industry Trends: Consider the growth prospects of the industry in which the company operates.

- Valuation: Compare the company’s valuation metrics (e.g., P/E ratio) to its peers.

- Growth Potential: Look for companies with strong potential for future growth and innovation.

Are there any tax implications of investing in IPOs?

Yes, there are tax implications when investing in IPOs. In India, the profits from selling IPO shares are subject to capital gains tax. If you sell the shares within one year of the IPO listing date, the gains are considered short-term capital gains and are taxed at 15%. If you hold the shares for more than one year, the gains are considered long-term capital gains and are taxed at 10% for gains exceeding Rs. 1 lakh. It’s essential to consult with a tax advisor to understand the specific implications based on your investment.

How can retail investors ensure they get a fair allocation in an IPO?

Retail investors can increase their chances of getting a fair allocation in an IPO by:

- Applying through multiple accounts: Ensure the accounts belong to different PAN holders to avoid rejection.

- Applying early: Submit your application as soon as the IPO opens to avoid last-minute issues.

- Using the ASBA (Application Supported by Blocked Amount) process: This method ensures that your application is valid and funds are available.

- Staying informed: Regularly check upcoming IPO lists, IPO watch platforms, and IPO news for details on application dates and guidelines.

Can foreign investors participate in domestic IPOs?

Yes, foreign investors can participate in domestic IPOs in India. Foreign Institutional Investors (FIIs) and Non-Resident Indians (NRIs) can apply for shares in an IPO, subject to certain regulatory requirements and guidelines. They need to have a PAN card and a Demat account in India. It’s essential for foreign investors to stay updated with IPO details and upcoming IPOs through platforms like IPO watch to ensure they comply with all necessary regulations.

By staying informed through reliable sources and platforms like IPO watch, investors can navigate the IPO landscape effectively, capitalize on new opportunities, and manage the associated risks.