Thematic Funds: The Next Best Thing in Investing?

Are you looking to diversify your investment portfolio? Thematic funds can solve your problem! These are ready-made quality portfolios that focus on thematic investing. This article covers all you need to know about thematic funds in detail.

What is a Thematic Fund?

Have you visited a theme park? The most popular Bollywood theme park, wholly dedicated to the Indian film industry, is in Dubai. Similarly, thematic funds are mutual funds that invest in stocks relating to a specific industry. As per SEBI, these funds have to invest a minimum of 80% of their total assets in equity stocks.

A thematic fund can focus on the energy industry. Different companies produce different forms of energy such as thermal, renewable, and nuclear. The thematic fund invests in all these sectors relating to the energy industry. This investment strategy helps to diversify your portfolio.

ESG Funds

There is an increasing thrust on environmental, social, and governance factors. The companies that follow all the rules laid out by the government on the above three parameters are said to be ESG-compliant (environmental, social, and governance). These companies run on an environment-friendly and sustainable policy. Hence, they are less likely to be penalized or shut down for dishonoring the law.

There is a growing demand for these stocks and hence, ESG funds are the emerging thematic funds. These funds analyze the companies that are ESG-compliant and invest in them.

Are Thematic Funds the Same As ETFs?

Exchange-traded funds (ETFs) are funds that invest based on an index. ETFs can follow the market indices or even specific indices like gold. The objective of an ETF is to invest in sync with the index. This helps in replicating the index returns. These funds make portfolio changes only when the index makes a change.

Thematic funds are mutual funds that invest in all sectors relevant to a specific industry. These funds are free to make changes to their portfolios whenever the prospects for their stocks change. There are thematic fund ETFs that follow the investments of the thematic funds. This makes them relatively risky than regular ETFs as thematic funds focus on the central theme of investment, but there are chances of earning higher returns as well.

What Investors Are Saying About the Thematic Fund Market and Its Future?

Thematic funds in India are an emerging area for investors. However, their popularity is rising as some industries regularly outperform the stock market due to favorable circumstances and greater opportunities.

So, what has the growth been so far? As per Economic Times, the top 10 thematic funds in India have provided a consistent annual return between 12% and 28%. This is much higher as compared to the stock markets.

Information technology is a classic industry that has outperformed all the sectors internationally over the last two decades. The growing influence of computers and the emerging market for fast-speed internet has propelled this industry toward skyrocketing profits. Another report by Economic Times features the top 5 technology thematic funds in India having an annual return between 30% and 41%.

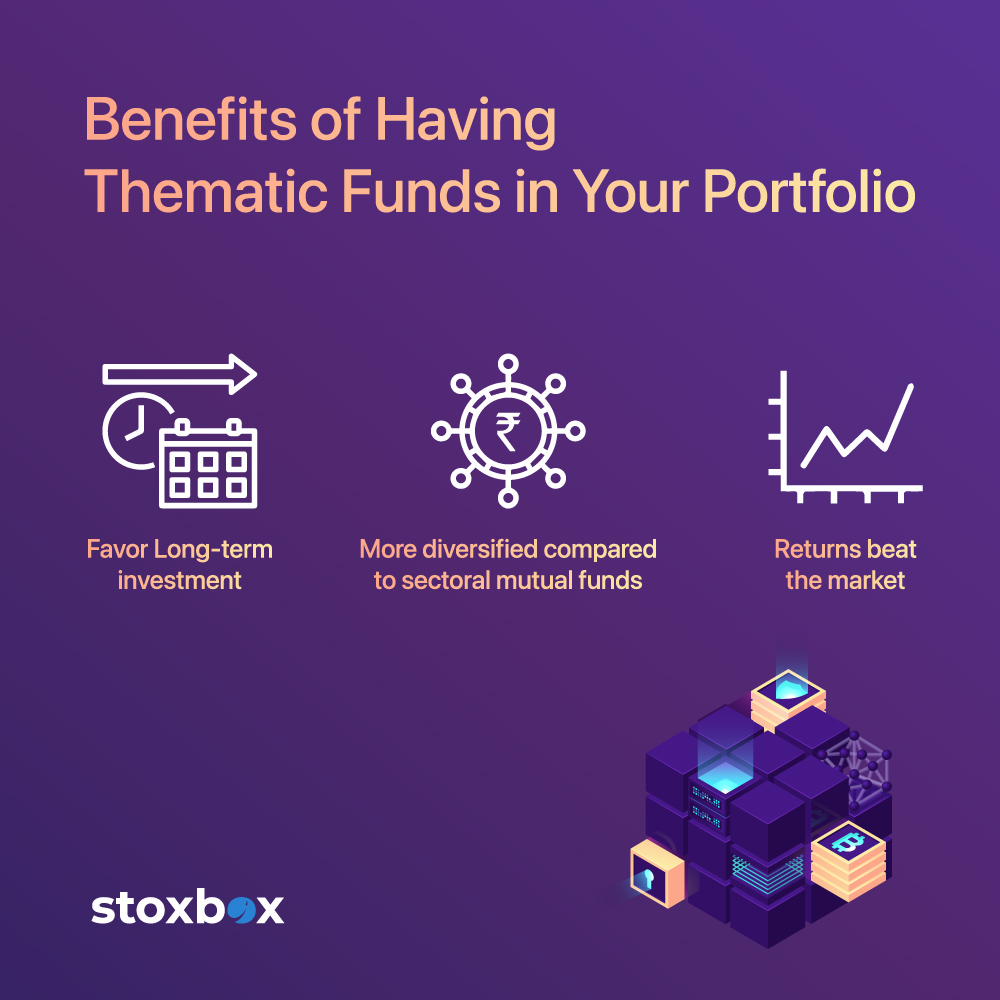

Benefits of Having Thematic Funds in Your Portfolio

There are many benefits of having a thematic fund in your portfolio. Let’s discuss them in detail.

- Favor Long-term investment

- Most retail investors make long-term investments as trading requires elaborate knowledge of the market trends and aggressive trading skills.

- Investing in thematic funds gives leverage to the investors. These funds are only for long-term investments.

- Once you identify the industry that is going to outperform, you can invest in the thematic fund of that industry.

- Thereafter the fund manager tends to the investments and the modifications required from time to time.

- You can grow your wealth by investing in these funds for a long-term period.

- More diversified compared to sectoral mutual funds

- Sectoral funds focus on a specific sector, for example, the cement sector. Sectoral funds fail to recognize the role and influence of other linked sectors.

- Now, there are many sectors linked to the cement sector such as the steel and construction sectors.

- Thematic funds acknowledge this and invest in the whole infrastructure industry. This includes all the sectors such as cement, steel, and construction.

- These are all interlinked and hence, there are chances of higher returns and lesser risks.

- Returns beat the market

- The return on investment of the thematic funds has consistently outperformed the market.

- The government policies, socio-economic conditions, and consumer behavior can help you identify the industries that will flourish.

- For example, during COVID-19 lockdowns, it was evident that the medical and pharma industries stood to gain the most.

- The IT industry outperformed as people spent more time on social media for entertainment during the widespread lockdowns.

- Online marketplaces became more popular. The emergence of OTT platforms as online entertainment alternates is another story.

- Conversely, the tourism and hospitality industry has seen a major blow.

- The transportation and aviation industries have also seen negative results.

Is the Future of Investing Sustainable?

The increasing volatility in the markets and the fast-changing circumstances have led to lopsided growth. Some industries tend to grow at a higher pace compared to others. Is it possible to grow your investments sustainably amid aggressive investors?

Yes! It is possible. ESG and industry funds cater to this exact need. ESG funds feature only those companies that take care of the overall sustainability of the organization. These companies recognize the fact that their actions must not harm the environment or society.

Thematic funds are going to be at the core of investors’ portfolios. Your investment objectives define the type of fund you want to select. Easy simple thematic stoxbox equity investing features ready-made quality portfolios called thematic boxes. You can explore these boxes and get the benefits of thematic investing.

Should You Invest?

You must have heard that your money loses its value when it is kept idle. This is because of the inflation prevalent in the economy. As inflation increases, the value of your money decreases. A bank fixed deposit (FD) typically depicts the minimum return you need to earn to grow your money.

Investing in thematic funds can help you earn 5–7 times the FD returns. Now, this is called growing your wealth. Hence, investing helps you build a passive income source along with your main earnings. BP Wealth can help you attain your investment goals and create wealth. You can visit the investment website. You can also access their services through mobile apps on Google Playstore and App Store.

Frequently Asked Questions

Are thematic funds suitable for short-term investments?

Thematic funds are generally better suited for long-term investments, as the performance of themes often takes time to materialize and may involve higher short-term volatility.

Can thematic funds help diversify my portfolio?

Yes, thematic funds can diversify your portfolio by providing exposure to specific sectors or trends that may not be covered by broad-based equity or debt funds.

How are returns from thematic funds affected by market conditions?

Thematic fund performance is directly linked to the success of the underlying theme, which may be influenced by market trends, regulatory changes, and global developments.

Are thematic funds a good choice for first-time investors?

First-time investors should approach thematic funds cautiously due to their focused nature and higher risk. Consulting with a financial advisor is recommended to align with your investment goals.

How are thematic funds different from sectoral or diversified mutual funds?

While thematic funds and sectoral funds both focus on specific areas, thematic funds cast a wider net by targeting a broad trend (e.g., digital transformation) rather than a single sector (e.g., IT). In contrast, diversified mutual funds spread investments across various sectors to minimize risk. Thematic funds often carry higher risk due to their concentrated exposure but can offer significant returns if the theme performs well.

Are thematic funds riskier than other types of mutual funds?

Yes, thematic funds are generally riskier due to their concentrated exposure to specific themes. They lack the broad diversification of traditional mutual funds, making them more vulnerable to market fluctuations or setbacks in the chosen theme. Investors should assess their risk tolerance before investing.

You might also Like.

ETF vs Mutual Fund: Which Investment Option Suits You Best?

Understand the difference between ETF Vs Mutual Funds Table of...