You know you

should Invest

We know it

should be Simple

You know you

should Invest

We know it

should be Simple

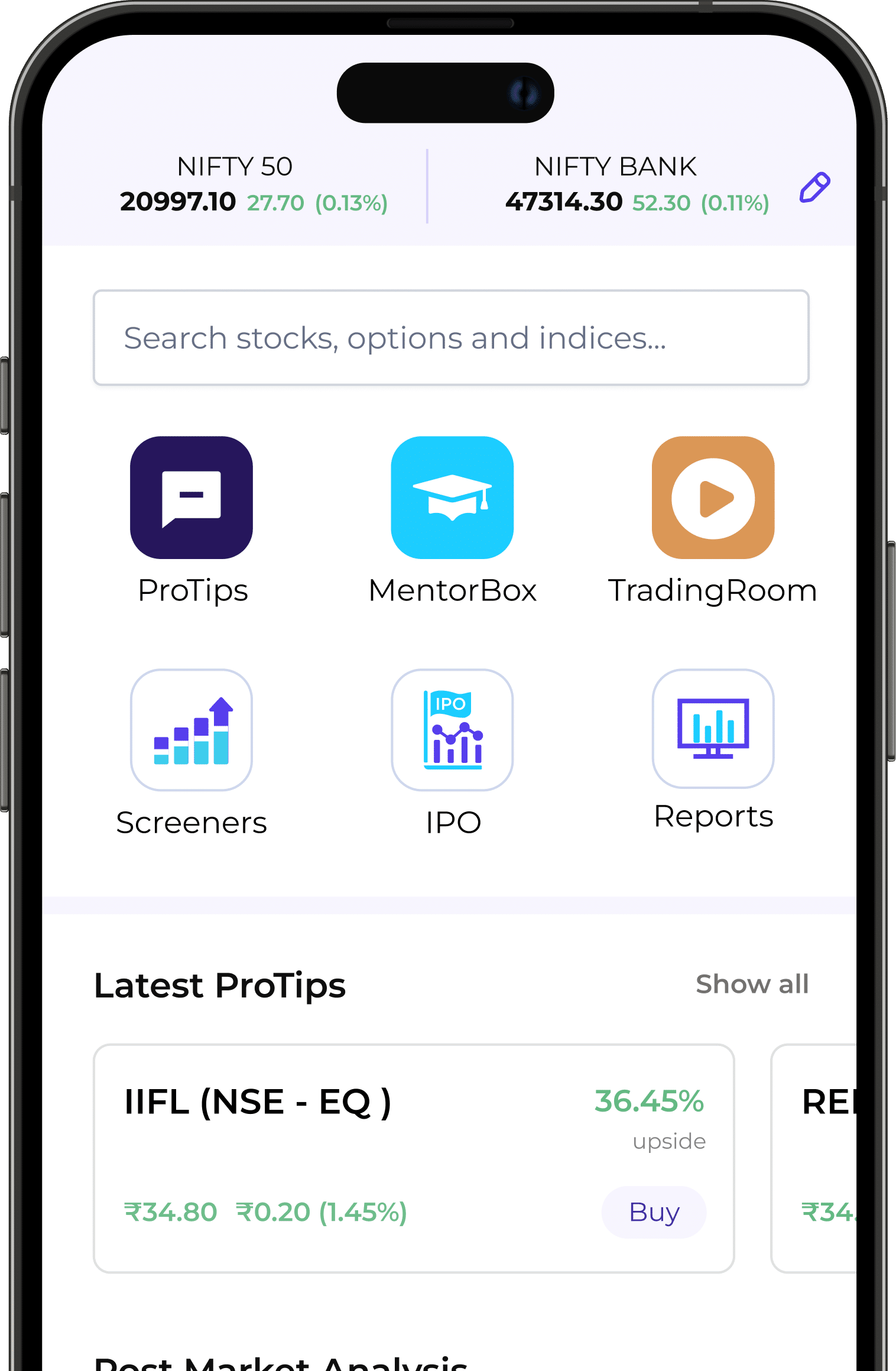

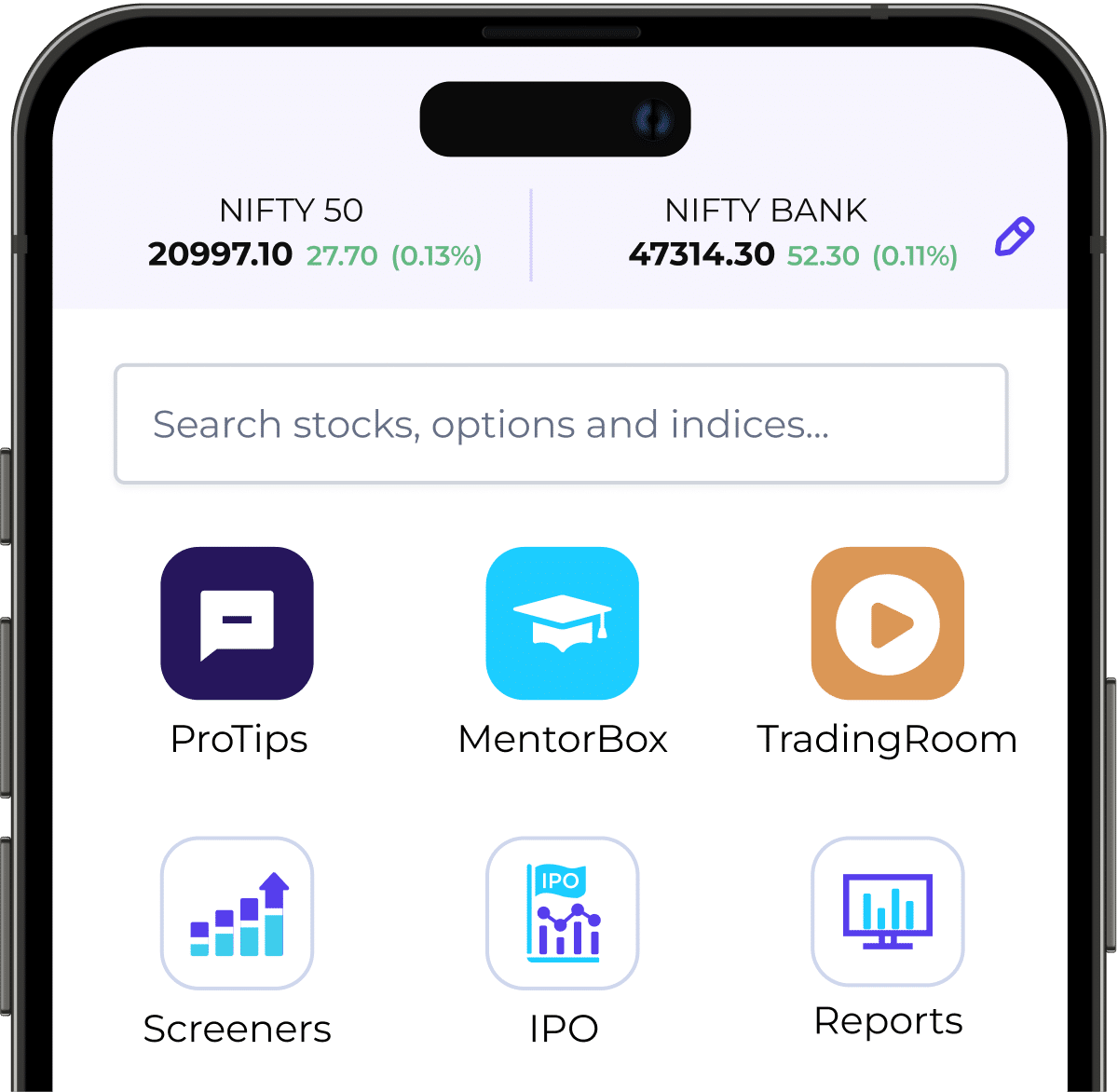

Why StoxBox?

Value Broker

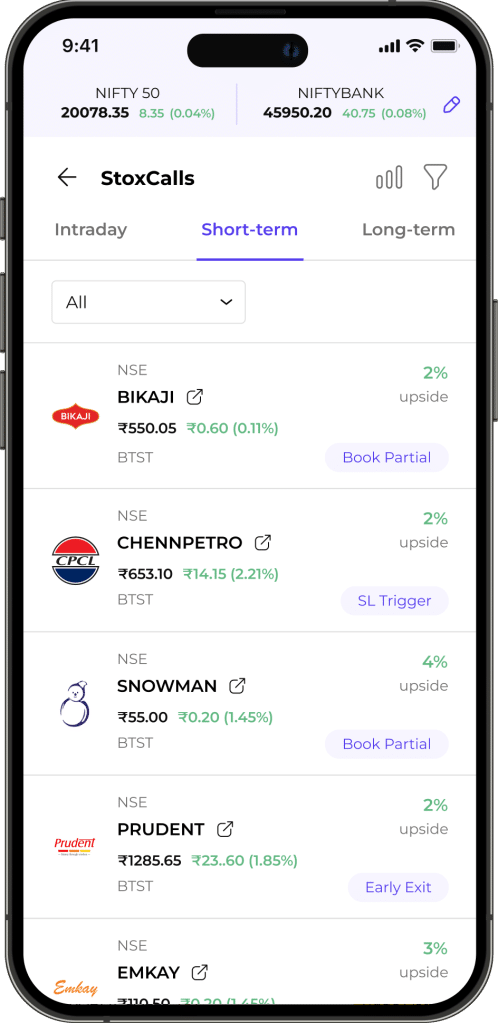

StoxCalls

Our flagship product StoxCalls, provides buy-sell-exit trading recommendations and option strategies across all asset classes. Enjoy zero-brokerage by subscribing to StoxCalls, an unbiased, high performing, timely buy-sell-exit recommendations.

Learn and Succeed

StoxCalls = Success

All trades may not end in profits, but traders can.

-

We are not discount brokers, we are Value Brokers, who believe in providing unlimited value to our customers and help them succeed in trading and investing.

-

We do not charge brokerage when you subscribe to StoxCalls. This means, our buy-sell-exit recommendations, are fully unbiased and do not push transactions.

-

We do not give buy-sell-exit recommendations when there is no opportunity. We also give early exit signals when the markets turn against us.

StoxCalls products:

-

Intraday Tips

-

Intraday Option Calls

-

Long-Term Stocks

-

Positional and Expiry Strategies

-

Option Strategies

StoxCalls Past Performance:

2,725

Total Tips

1,652

Book profit

1,073

Stop Loss Hit

Cumulative Returns:

See the TradeLog and detailed performance of StoxCalls here.

Did we get you excited

We have more such resources baking.

Beginners, Learners and Traders,

All of them love StoxBox!

“I am an algo trader and working with StoxBox in using their OpenAPI product. Brokerage is free and API is extremely easy to use. I regularly attend the Live TradingRoom conducted by Mr. Nikhil”

Susannah D’souz

HouseWife

“I have attended free webinars by Mr. Nikhil. I also watch his post-market view and pre-market view regularly on YouTube. I opened an account with StoxBox 3 months ago and traded at just Rs 10 brokerage. I have not used Stoxcalls yet.”

Aakash Anand

Professor

“I am a user of ODIN Diet and traded with multiple brokers. I opened my account with StoxBox within a few minutes and am using ODIN Diet with a lesser price and higher value.”

Nikhil Naik

Content Creator

“Initially I thought, StoxBox is another new discount broker in the market when I saw the brokerage rate on their site as Rs 10 per order. But I really love their promise and sincere attempts to help customers succeed in trading through Stoxcalls, Live Trading Room and MentorBox courses. I have subscribed to the yearly plan of Stoxcalls and the calls are good.”

Ranjeet Sawant

Software Engineer

“I love StoxBox for its StoxCalls service, where the exit calls are given instantly. I am new to stock markets, and I have been using research from many brokers. I never used to get timely exit calls and lost money even in trades that were once profitable.”

Akshay Chaudhary

Executive

“StoxCalls and MentorBox are an amazing combination. I am a professional trader and still I have joined the Options Course just to learn 101 strategies that StoxBox is teaching. I pay zero Brokerage. StoxBox is way different in helping its customers, good work and all the best StoxBox.”

Amit Singh

Manager

“TradingRoom, Vamsi Sir and Nikhil Sir are excellent. StoxBox teaches me how to use charts, StoxCalls, Trading Software and more everyday. I have joined the TradingRoom by paying Rs 35,000 and it is really worth it to learn from experts who are online/live with us during the markets. I also use recordings when I miss any live session.”

Rajesh Mehta

Trader

“I regularly use StoxCalls Option Strategies, my success rate is above 90% till date since last 1 year. Returns are not exorbitant, but I make consistent returns every month. Thanks StoxBox.”

Palash Oberoi

Business Owner

Beginners, Learners and Traders,

All of them love StoxBox!

“I regularly use StoxCalls Option Strategies, my success rate is above 90% till date since last 1 year. Returns are not exorbitant, but I make consistent returns every month. Thanks StoxBox.”

Palash Oberoi

Business Owner

“TradingRoom, Vamsi Sir and Nikhil Sir are excellent. StoxBox teaches me how to use charts, StoxCalls, Trading Software and more everyday. I have joined the TradingRoom by paying Rs 35,000 and it is really worth it to learn from experts who are online/live with us during the markets. I also use recordings when I miss any live session.”

Rajesh Mehta

Trader

“StoxCalls and MentorBox are an amazing combination. I am a professional trader and still I have joined the Options Course just to learn 101 strategies that StoxBox is teaching. I pay zero Brokerage. StoxBox is way different in helping its customers, good work and all the best StoxBox.”

Amit Singh

Manager

“I love StoxBox for its StoxCalls service, where the exit calls are given instantly. I am new to stock markets, and I have been using research from many brokers. I never used to get timely exit calls and lost money even in trades that were once profitable.”

Akshay Chaudhary

Executive

“I am a user of ODIN Diet and traded with multiple brokers. I opened my account with StoxBox within a few minutes and am using ODIN Diet with a lesser price and higher value.”

Nikhil Naik

Content Creator

“I have attended free webinars by Mr. Nikhil. I also watch his post-market view and pre-market view regularly on YouTube. I opened an account with StoxBox 3 months ago and traded at just Rs 10 brokerage. I have not used Stoxcalls yet.”

Aakash Anand

Professor

“I am an algo trader and working with StoxBox in using their OpenAPI product. Brokerage is free and API is extremely easy to use. I regularly attend the Live TradingRoom conducted by Mr. Nikhil”

Susannah D’souz

HouseWife

Made for Option Traders

Naked, covered or strategies. Learn and use options to succeed.

Options Program

We understand the needs of professional traders. All our MentorBox students become active traders in 6 months of training and live mentoring.

Strategies

Our StoxCalls Option Strategies, Naked Option Calls, Special Subscription Price and friction-less trading platform suit perfectly to both small and large professional traders.

OptionBox

Our OptionBox* platform gives option chain, OI analysis, strategy builder and more for FREE for StoxCalls subscribers.

Learn and Become a PRO

with Marketopedia

90% of traders lose money in the market. Welcome to the 10%.

Free Learning

Our Products

| Products | Buy-Sell-Exit Recommendations | MentorBox | Software |

|---|---|---|---|

| Equity | StoxCalls - Monthly and Yearly (Flagship) | Free Webinars | ProductsMobile App |

| F&O | IPO Note | MarketoPedia | PowerTrader |

| Commodities | Result Updates | Aero-Web | |

| Currency | Stock Research | ODIN Diet | |

| Mutual Funds | Algo | ||

| IPO | StoxBox API | ||

| NCDs | |||

| Screeners |

Awards & Recognition

At StoxBox Our Trophy Shelf Shines Bright! From innovation to excellence, our awards and recognitions speak volumes.

StoxBox wins Best BFSI Company of the year for developing and delivering multiple products in a record time and Zero attrition.

StoxBox wins Best Innovation of the Year for conceptualising the value broking business model.

StoxBox wins the Product of the Year award for its revolutionary product, StoxCalls.

StoxBox wins Best DIGITAL Innovation award for launching India's first ever AI-Powered WhatsApp Trader.

Get Surprised - No hidden fees!

StoxCalls subscribers pay Zero Brokerage.

All others - pay Rs 10 per executed order.

Click here to see statutory and operation charges.

| Looking for the best trading app that offers zero brokerage*? Stoxbox should be your top choice. With its advanced research tools and comprehensive market analysis, it provides accurate recommendations for successful trading. Stoxbox stands out as the first value broker, delivering quality services without any hidden costs. Whether you’re a beginner or an experienced trader, Stoxbox offers StoxCalls and valuable stock recommendations to enhance your investment portfolio. Moreover, it provides detailed option trading strategies that can help you maximize your profits and manage risk effectively. With Stoxbox, you have access to a reliable platform that combines cutting-edge technology with expert insights to empower your trading journey. |