Introduction

If you are about to retire or just beginning your investment journey, there is a plan for you. Portfolio diversification is a popular strategy for generating high returns. However, you must first consider your budget, financial goals, and risk appetite. Beginners may even consider the services of companies offering portfolio management in India. Let’s begin by understanding what portfolio management means.

What Is Portfolio Management?

The age, budget, income, risk appetite, and financial goals of every investor are unique. An investment plan that is suitable for one investor may not be suitable for another. Hence, portfolio management is necessary in order to match an investor’s financial goals to his risks.

Portfolio management involves creating the best investment plan for an individual, taking into account all their needs. By best investment plan, we mean, a plan that has the least risk and can earn maximum returns on investment. Alternatively, we can say returns on portfolio management and risk go hand in hand.

When designing portfolio management for young investors, one of the popular options is thematic investing. This portfolio management option mostly attracts investors who are passionate about emerging technologies such as clean energy and electric vehicles. You can invest in any upcoming trend or innovative sector in any part of the world where you believe it will result in strong growth in the future. The market today has a large number of thematic funds to choose from. You just need to choose a theme or idea that appeals to you. It also provides better diversification than the sector funds as it holds stocks of companies belonging to varied sectors.

For devising portfolio management for beginners, you can consult companies like StoxBox. Moreover, they assign a portfolio manager who plans an investment strategy for you. You can even decide the degree of involvement you want from the portfolio managers.

Now, two approaches can be taken when designing portfolio management for retail investors—active and passive.

- Active portfolio management

This approach to portfolio management involves monitoring a client’s investment portfolio regularly by the portfolio manager. The goal is to outperform the overall market or index. This strategy involves the implementation of a lot of forecasting techniques, tools, ratios for constructing the best asset allocation strategy. The objective is to move capital away from underperforming stocks. Therefore, the investor’s portfolio positions are continuously bought, sold, and held. This is why a knowledgeable portfolio manager, with experience, is imperative to this strategy.

Example: Equity mutual funds are one of the best examples to participate in active portfolio management.

- Passive portfolio management

This portfolio management strategy does not pay attention to daily market fluctuations, unlike active portfolio management. Most of the time, portfolio managers are asked to hold fixed stock portfolios for long periods of time. The goal is to mimic market returns. This strategy believes that market prices reflect all you need to know and hence no need to spend time researching individual stocks. All this makes investing comparatively easier to understand, rendering the services of portfolio managers futile.

Example: Investing in exchange-traded funds, unit investment trust, pension funds in mutual funds are an option if you prefer passive portfolio management.

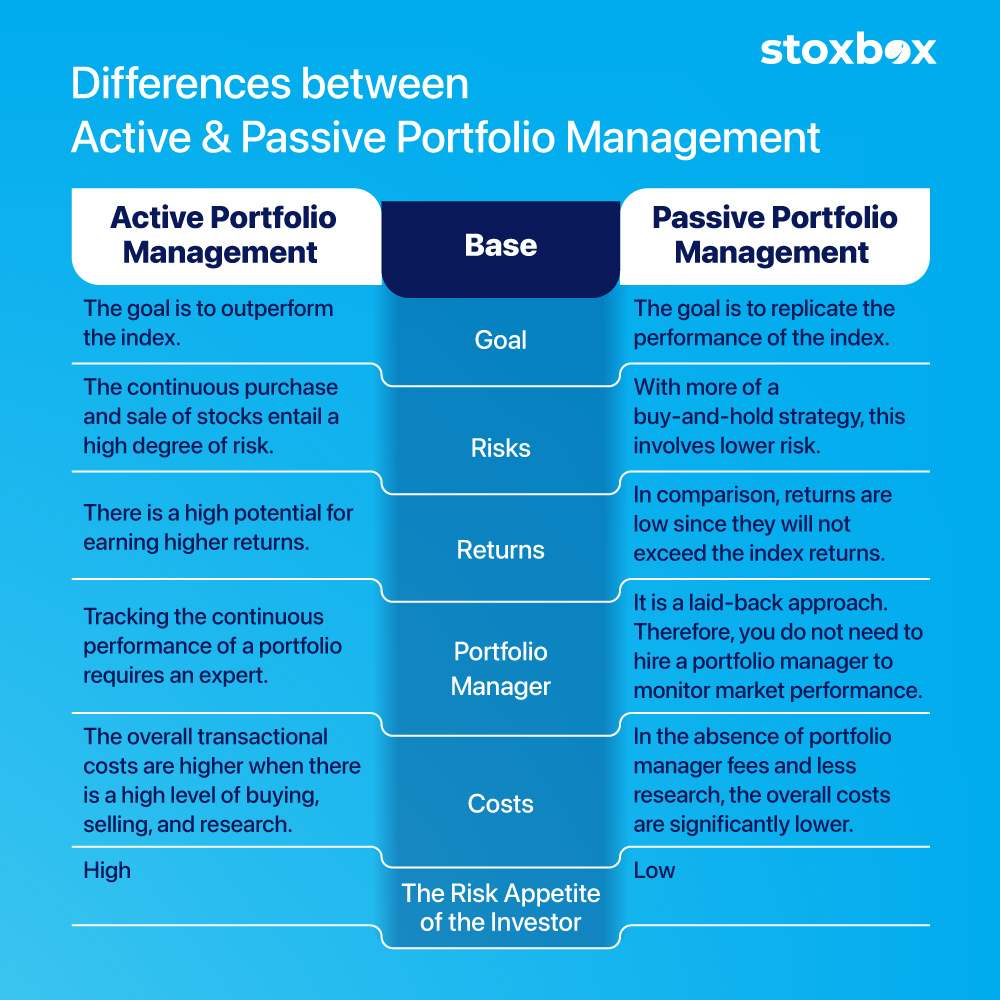

Let’s take a closer look at the differences between these two.

Sr no. | Basis | Active portfolio management | Passive portfolio management |

1 | Goal | The goal is to outperform the index. | The goal is to replicate the performance of the index. |

2 | Risk | The continuous purchase and sale of stocks entail a high degree of risk. | With more of a buy-and-hold strategy, this involves lower risk. |

3 | Returns | There is a high potential for earning higher returns. | In comparison, returns are low since they will not exceed the index returns. |

4 | Portfolio manager | Tracking the continuous performance of a portfolio requires an expert | It is a laid-back approach. Therefore, you do not need to hire a portfolio manager to monitor market performance. |

5 | Costs | The overall transactional costs are higher when there is a high level of buying, selling, and research. | In the absence of portfolio manager fees and less research, the overall costs are significantly lower. |

6 | The risk appetite of the investor | High | Low |

7 | Taxes | The investor will have to pay higher capital gains taxes on transactions. | This strategy is more tax efficient. |

Which Is Better for New Investors: Active or Passive Portfolio Management?

It is important to consider a variety of factors when choosing a portfolio management strategy. Portfolio management, whether active or passive, have their pros and cons. In the end, it all depends on what you are looking for. As a new investor, ask yourself the following questions and then determine what strategy will work the best for you:

- What is your investment objective? What kind of returns do you expect from your investment? If you are looking for less volatility and safer returns, passive portfolio management is likely to be the best choice.

- Are you investing spare funds or a part of your savings? Can you afford to lose money on your investment? If yes, then you can opt for active portfolio management.

- Are you aware of different costs related to transactions, research, portfolio manager fees, and expense ratios for active portfolio management?

- Is it okay for your portfolio manager to make investment decisions on your behalf?

- Do you have a passion for future technologies? Is that something you want in your portfolio? If so, then thematic investing is a good option for you.

By answering the questions and learning the difference between the two, you will be able to determine what portfolio management strategy will be best for you. You can even blend the two strategies to invest in a more optimum mix to earn high returns. For instance, investing in small-cap companies with an active approach and investing in new and unfamiliar markets with a passive approach. However, if you are just starting, it is always better to take guidance from an expert.

Final Thoughts

After reading the above article, we hope you have a fair idea about the different strategies of portfolio management. Regardless of your investment approach, discipline is the key if you want to get long-term returns. To further clarify matters, you can also consult a firm like StoxBox, which offers portfolio management services. You can even download their portfolio management app for both Google and Apple devices.

You might also Like.

HDFC Bank – Q4FY24 Result Update

Margin pressure continues Sector Outlook: Positive Buy Now In Q4FY24,...