Impact of US Dollar on Indian Economy

The US economy is one of the sturdiest economies, making the US dollar one of the world’s strongest currencies. The US dollar is a global currency; it is accepted all over the world for international trade. It is also considered a safe investment by many. Moreover, the dollar is also held by countries in their central reserves as their monetary policy. As per the data issued by the IMF (International Monetary Fund), at the end of the last quarter of 2019, the US dollar accounts for about 60% of the foreign exchange reserves in the central banks of most countries. Moreover, about 90% of forex trading and 40% of the aggregate debt of the world is issued in Dollars. (Source: https://www.thebalance.com/world-currency-3305931).

Impact of US Dollar on Indian Economy

The US Dollar Index measures the dollar’s value against six of the world’s biggest currencies: British Pound, Japanese Yen, Swedish Krona, Canadian Dollar, US Dollar, and the Swiss Franc. If the index is high, the dollar is performing well, while a low index indicates a weak Dollar. Though the Indian Rupee does not feature on the index, when the dollar’s index changes compared to other currencies, it impacts the Indian economy.

Any rise or fall in the price of the dollar has far-reaching impacts on the economies of other countries, including India. If we talk about the Indian economy, the Dollar price movements deeply impact different segments of the economy, collectively impacting the economy as a whole. Let’s learn how the dollar impacts the Indian economy in detail.

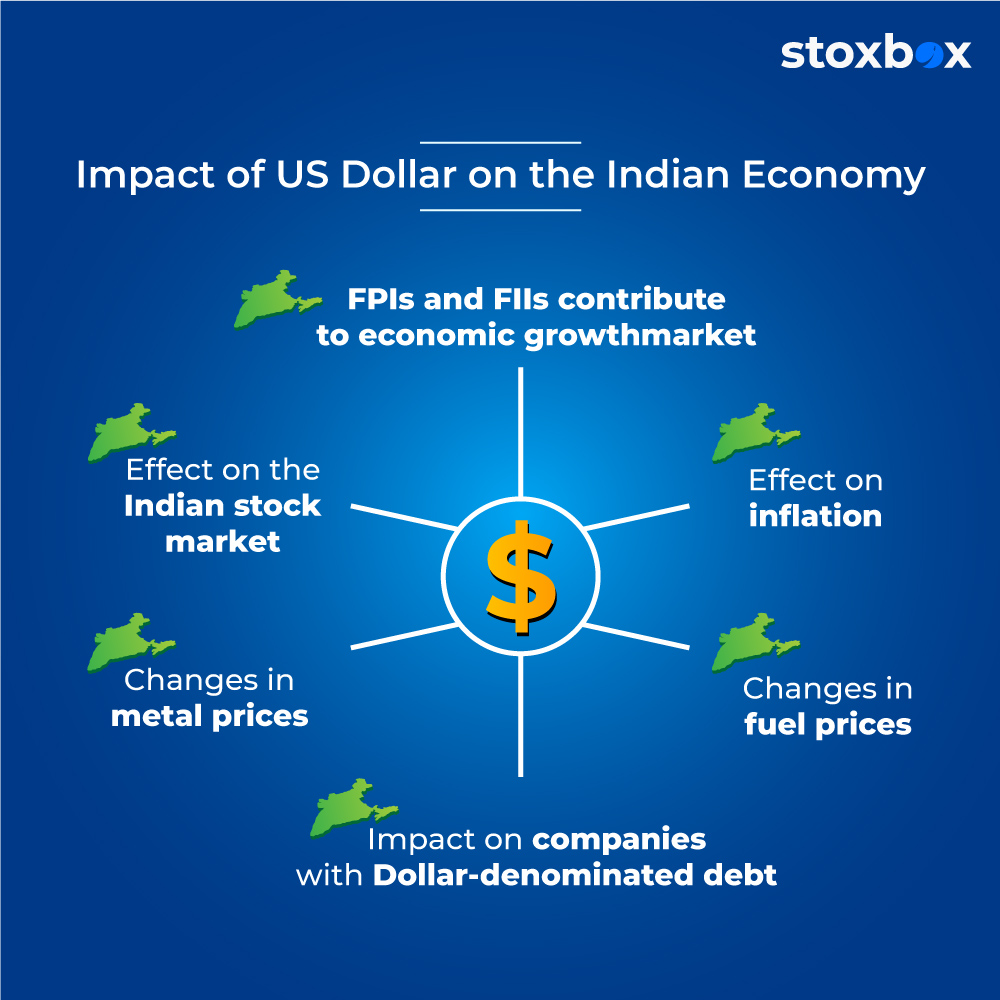

Impact of US Dollar on the Indian Economy

If the US Dollar’s value rises or falls, here’s how it impacts the Indian economy:

- Effect on the Indian stock market

If the index falls, the dollar weakens, and the INR appreciates. As such, foreign investors get the opportunity to reap higher returns on their investments in India. This leads to an inflow of Foreign Institutional Investment (FII) and/or Foreign Portfolio Investment (FPI). Due to the inflow of FIIs and/or FPIs, there is a buying pressure in the stock market, and the Indian stock market booms and becomes bullish.

- FPIs and FIIs contribute to economic growth

With a falling Dollar index, foreign investors find India a lucrative investment avenue to earn higher returns on their investments. As such, FPIs/FIIs flow into the Indian economy and contribute to economic growth. The flow of capital to companies from their international joint venture partners goes up as FPIs and FIIs increase. This allows companies to grow and expand themselves. Exports also increase, leading to a favorable Balance of Payments position for the country.

- Changes in metal prices

It has been historically observed that gold prices move inversely with the price of the dollar. So, if the Dollar index increases and the dollar appreciates, the price of gold would fall and vice-versa. This price movement of gold impacts the demand and supply of gold and, as such, impacts the Indian economy.

- Changes in fuel prices

Fuel and oil commodities are traded in Dollars. India is the largest importer of crude oil, and any change in the Dollar index affects crude oil prices and thus the Indian economy. If the Dollar index rises, crude oil and other commodities become costlier. This increases the import cost and creates a deficit in India’s current account. Moreover, it also affects the profitability of oil companies, oil importers, and oil refineries. The opposite holds if the Dollar index falls. The trade deficit reduces, and oil companies become more profitable.

- Effect on inflation

The Dollar index also impacts the inflationary trend in India. An increase in the Dollar index makes the dollar strong and depreciates the value of the INR. A weakened rupee makes imports costlier and impacts India Inc.’s profitability due to increased production costs. Increased costs lead to inflation, and the prices of goods and services rise, much to the detriment of consumers. Thus, the overall GDP (Gross Domestic Product) is impacted and suffers a slowdown when the dollar strengthens.

On the other hand, for companies engaged in exports, an increasing Dollar index is favorable because they can earn a higher revenue in terms of the US Dollar. Companies in the IT sector and pharmaceutical companies that primarily export their goods and services become more profitable when the Dollar index increases and vice-versa.

- Impact on companies with Dollar-denominated debt

Many companies have borrowed Dollar-denominated debt for their cost-effectiveness. Such companies are directly impacted if the dollar rises. A strong Dollar proves costly to companies having Dollar-denominated debt as they have to shell out more in INR to repay their debt. This, therefore, impacts the profitability of such companies negatively and might lead to a financial crunch or even insolvency.

The US Dollar, therefore, impacts all the aspects of the Indian economy considerably. You must understand this impact since it impacts you, too, the consumer. The dollar’s impact on the stock market will affect your investments. Moreover, as the dollar impacts inflationary trends too, it would impact your monthly budget as well as consumption habits.

If you want to invest in the stock market, you need to look out for a weakening Dollar index as it would lead to a surge in the stock market and give attractive returns on your invested money. Stoxbox is a lucrative investment option in India that can help you time the market. It offers you a readymade portfolio of assets, including stocks, chosen through technical and fundamental analysis of the capital markets. Stoxbox would allow you to enjoy the benefit of diversification by investing in different types of investments. This would give you attractive returns while minimizing the risks. So, if you are looking for where to invest money, Stoxbox is a good choice.

So, understand the dollar’s impact to make wise investment decisions when choosing the right 2021 investments in India.

You might also Like.

A Primer on Investments in Share Market

A Primer on Investments in Share Market When Ankit’s father...